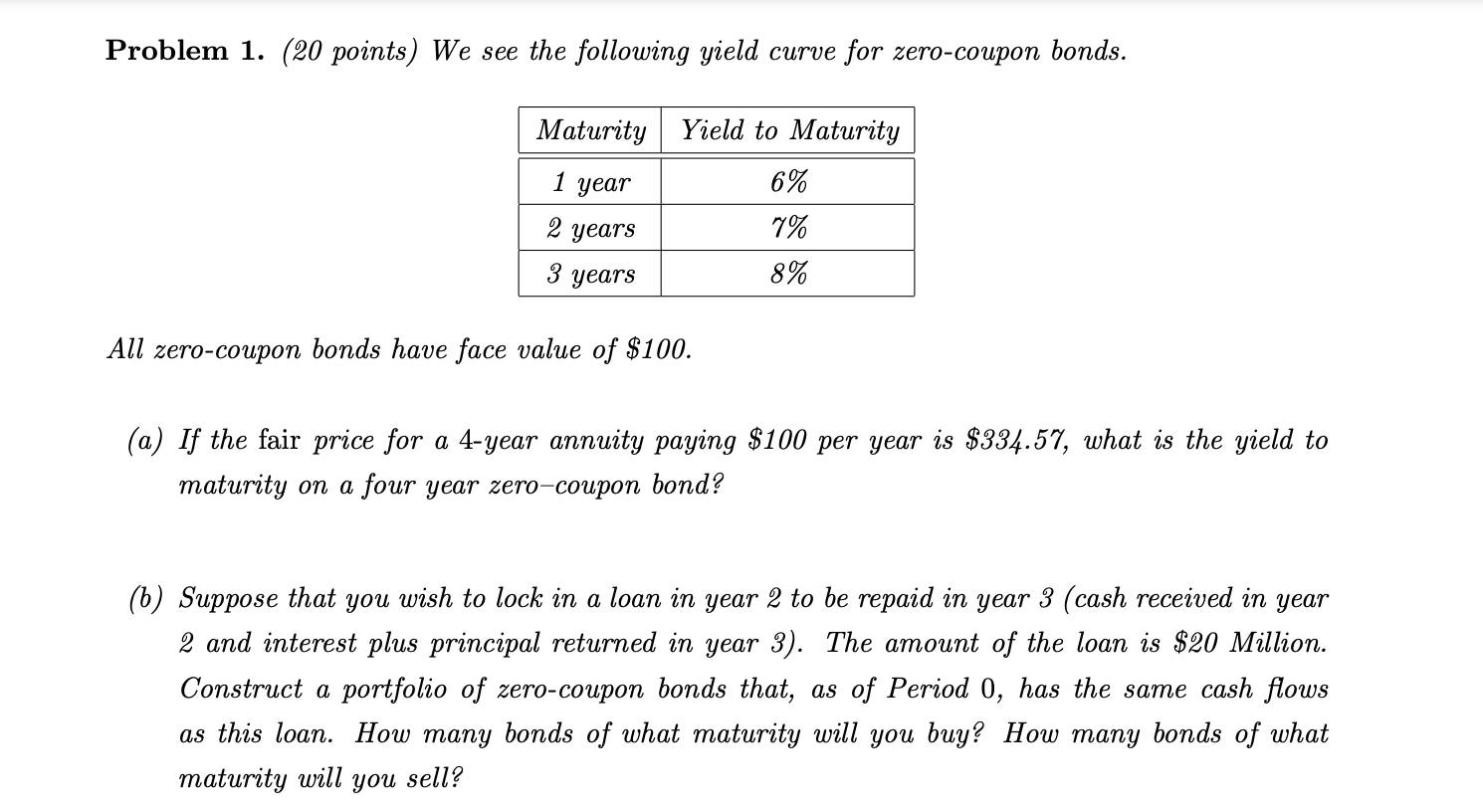

Question: undefined Problem 1. (20 points) We see the following yield curve for zero-coupon bonds. Maturity Yield to Maturity 1 year 6% 7% 8% 2 years

undefined

undefined

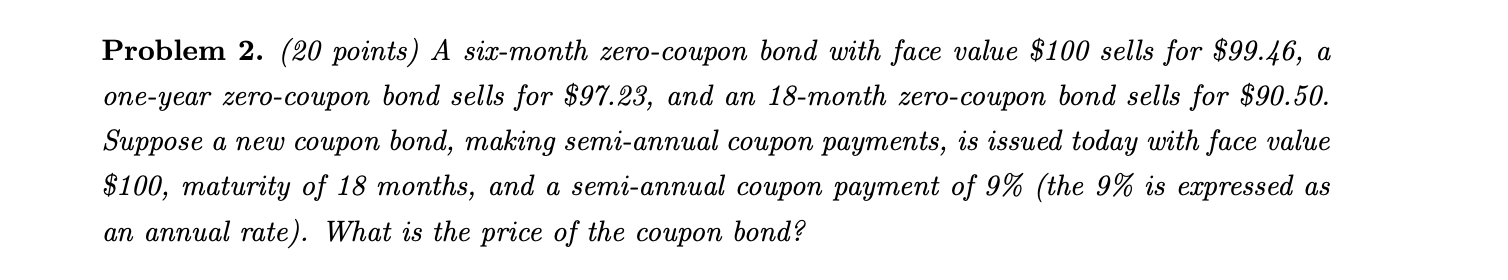

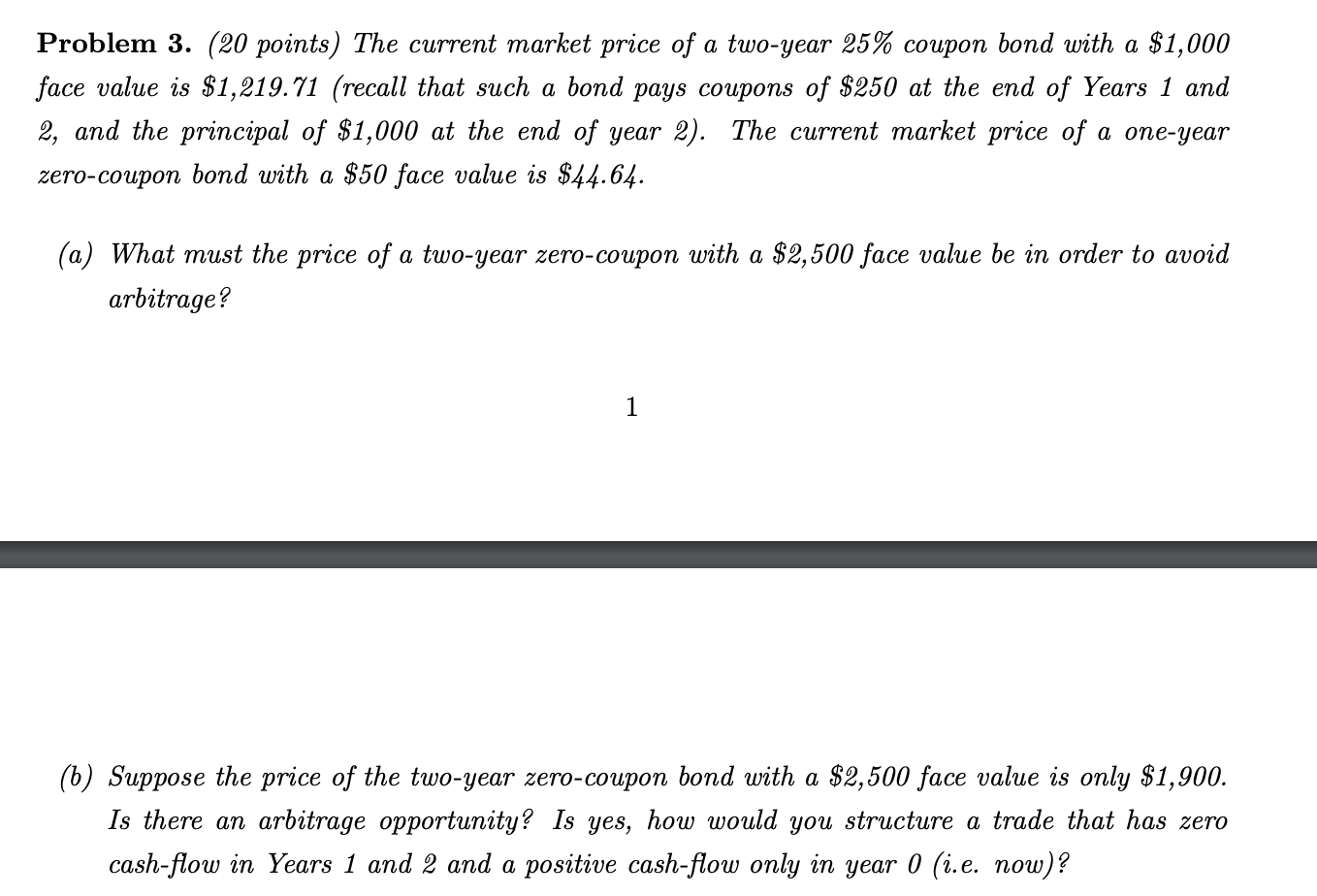

Problem 1. (20 points) We see the following yield curve for zero-coupon bonds. Maturity Yield to Maturity 1 year 6% 7% 8% 2 years 3 years All zero-coupon bonds have face value of $100. (a) If the fair price for a 4-year annuity paying $100 per year is $334.57, what is the yield to maturity on a four year zero-coupon bond? (6) Suppose that you wish to lock in a loan in year 2 to be repaid in year 3 (cash received in year 2 and interest plus principal returned in year 3). The amount of the loan is $20 Million. Construct a portfolio of zero-coupon bonds that, as of Period 0, has the same cash flows as this loan. How many bonds of what maturity will you buy? How many bonds of what maturity will you sell? Problem 2. (20 points) A six-month zero-coupon bond with face value $100 sells for $99.46, a one-year zero-coupon bond sells for $97.23, and an 18-month zero-coupon bond sells for $90.50. Suppose a new coupon bond, making semi-annual coupon payments, is issued today with face value $100, maturity of 18 months, and a semi-annual coupon payment of 9% (the 9% is expressed as an annual rate). What is the price of the coupon bond? Problem 3. (20 points) The current market price of a two-year 25% coupon bond with a $1,000 face value is $1,219.71 (recall that such a bond pays coupons of $250 at the end of Years 1 and 2, and the principal of $1,000 at the end of year 2). The current market price of a one-year zero-coupon bond with a $50 face value is $44.64. (a) What must the price of a two-year zero-coupon with a $2,500 face value be in order to avoid arbitrage? 1 (6) Suppose the price of the two-year zero-coupon bond with a $2,500 face value is only $1,900. Is there an arbitrage opportunity? Is yes, how would you structure a trade that has zero cash-flow in Years 1 and 2 and a positive cash-flow only in year 0 (i.e. now)? Problem 1. (20 points) We see the following yield curve for zero-coupon bonds. Maturity Yield to Maturity 1 year 6% 7% 8% 2 years 3 years All zero-coupon bonds have face value of $100. (a) If the fair price for a 4-year annuity paying $100 per year is $334.57, what is the yield to maturity on a four year zero-coupon bond? (6) Suppose that you wish to lock in a loan in year 2 to be repaid in year 3 (cash received in year 2 and interest plus principal returned in year 3). The amount of the loan is $20 Million. Construct a portfolio of zero-coupon bonds that, as of Period 0, has the same cash flows as this loan. How many bonds of what maturity will you buy? How many bonds of what maturity will you sell? Problem 2. (20 points) A six-month zero-coupon bond with face value $100 sells for $99.46, a one-year zero-coupon bond sells for $97.23, and an 18-month zero-coupon bond sells for $90.50. Suppose a new coupon bond, making semi-annual coupon payments, is issued today with face value $100, maturity of 18 months, and a semi-annual coupon payment of 9% (the 9% is expressed as an annual rate). What is the price of the coupon bond? Problem 3. (20 points) The current market price of a two-year 25% coupon bond with a $1,000 face value is $1,219.71 (recall that such a bond pays coupons of $250 at the end of Years 1 and 2, and the principal of $1,000 at the end of year 2). The current market price of a one-year zero-coupon bond with a $50 face value is $44.64. (a) What must the price of a two-year zero-coupon with a $2,500 face value be in order to avoid arbitrage? 1 (6) Suppose the price of the two-year zero-coupon bond with a $2,500 face value is only $1,900. Is there an arbitrage opportunity? Is yes, how would you structure a trade that has zero cash-flow in Years 1 and 2 and a positive cash-flow only in year 0 (i.e. now)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts