Question: Under certain conditions, wages lower than the minimum wage may be paid to some employees. 1. Tipped employees. 2. A training wage allows employers to

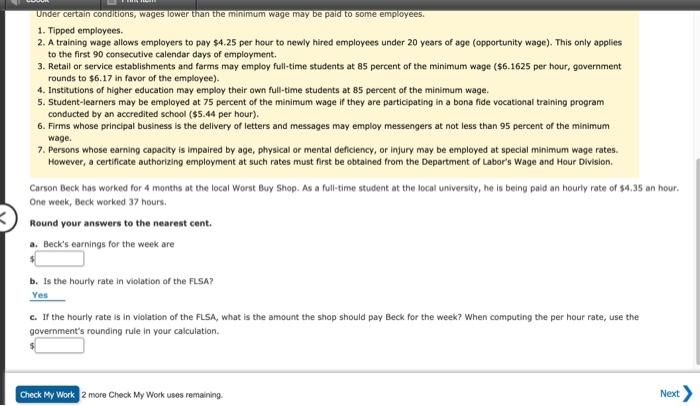

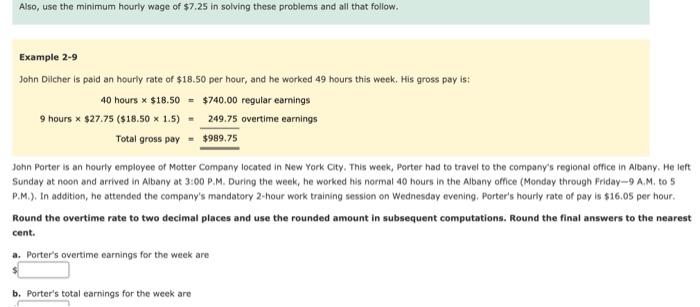

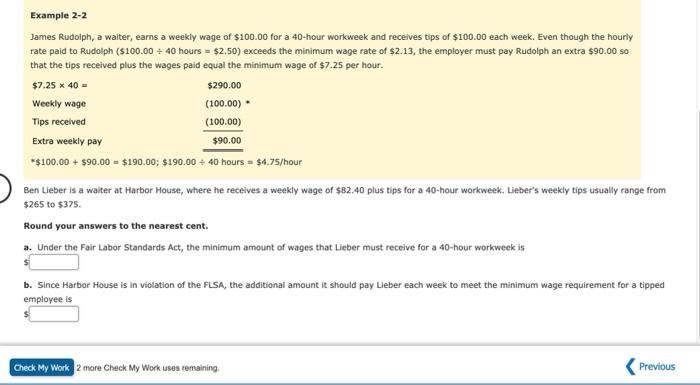

Under certain conditions, wages lower than the minimum wage may be paid to some employees. 1. Tipped employees. 2. A training wage allows employers to pay $4.25 per hour to newly hired employees under 20 years of age (opportunity wage). This only applies to the first 90 consecutive calendar days of employment. 3. Retail or service establishments and farms may employ full-time students at 85 percent of the minimum wage ($6.1625 per hour, government rounds to $6.17 in favor of the employee). 4. Institutions of higher education may employ their own full-time students at 85 percent of the minimum wage. 5. Student-learners may be employed at 75 percent of the minimum wage if they are participating in a bona fide vocational training program conducted by an accredited school ($5.44 per hour). 6. Firms whose principal business is the delivery of letters and messages may employ messengers at not less than 95 percent of the minimum wage. 7. Persons whose earning capacity is impaired by age, physical or mental deficiency, or injury may be employed at special minimum wage rates. However, a certificate authorizing employment at such rates must first be obtained from the Department of Labor's Wage and Hour Division Carson Beck has worked for 6 months at the local Worst Buy Shop. As a full-time student at the local university, he is being paid an hourly rate of $4.35 an hour. One week, Beck worked 37 hours. Round your answers to the nearest cent. a. Beck's earnings for the week are b. Is the hourly rate in violation of the FLSA? Yes c. If the hourly rate is in violation of the FLSA, what is the amount the shop should pay Beck for the week? When computing the per hour rate, use the government's rounding rule in your calculation Check My Work 2 more Check My Work uses remaining Next Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow. Example 2-9 John Dilicher is paid an hourly rate of $18.50 per hour, and he worked 49 hours this week. His gross pay is: 40 hours * $18.50 = $740.00 regular earnings 9 hours $27.75 ($18.50 * 1.5) - 249.75 overtime earnings Total gross pay - $989.75 John Porter is an hourly employee of Motter Company located in New York City. This week, Porter had to travel to the company's regional office in Albany. He left Sunday at noon and arrived in Albany at 3:00 P.M. During the week, he worked his normal 40 hours in the Albany office (Monday through Friday 9 AM to 5 P.M.). In addition, he attended the company's mandatory 2 hour work training session on Wednesday evening, Porter's hourly rate of pay is $16.05 per hour. Round the overtime rate to two decimal places and use the rounded amount in subsequent computations. Round the final answers to the nearest cent. a. Porter's overtime earnings for the week are b. Porter's total earnings for the week are Example 2-2 James Rudolph, a waiter, earns a weekly wage of $100.00 for a 40-hour workweek and receives tips of $100.00 each week. Even though the hourly rate paid to Rudolph ($100.00 - 40 hours = $2.50) exceeds the minimum wage rate of $2.13, the employer must pay Rudolph an extra $90.00 so that the tips received plus the wages paid equal the minimum wage of $7.25 per hour. $7.25 x 40 - $290.00 Weekly wage (100.00) Tips received (100.00) Extra weekly pay $90.00 *$100.00 + $90.00 = $190.00; $190.00 - 40 hours = $4.75/hour Ben Lieber is a walter at Harbor House, where he receives a weekly wage of $82.40 plus tips for a 40-hour workweek. Lieber's weekly tips usually range from $265 to $375. Round your answers to the nearest cent. a. Under the Fair Labor Standards Act, the minimum amount of wages that Lieber must receive for a 40-hour workweek is b. Since Harbor House is in violation of the FLSA, the additional amount it should pay Lieber each week to meet the minimum wage requirement for a tipped employee is Check My Work 2 more Check My Work uses remaining, Previous