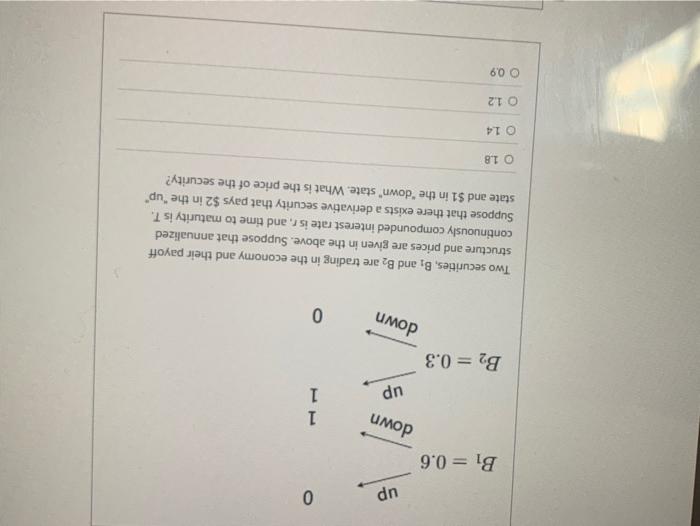

Question: up 0 B1 = 0.6 down 1 1 up B2 = 0.3 down 0 Two securities, B, and B2 are trading in the economy and

up 0 B1 = 0.6 down 1 1 up B2 = 0.3 down 0 Two securities, B, and B2 are trading in the economy and their payoff structure and prices are given in the above. Suppose that annualized continuously compounded interest rate isr, and time to maturity is T. Suppose that there exists a derivative security that pays $2 in the "up state and $1 in the "down" state. What is the price of the security? O 1.8 O 1.4 O 1.2 O 0.9 up 0 B1 = 0.6 down 1 1 up B2 = 0.3 down 0 Two securities, B, and B2 are trading in the economy and their payoff structure and prices are given in the above. Suppose that annualized continuously compounded interest rate isr, and time to maturity is T. Suppose that there exists a derivative security that pays $2 in the "up state and $1 in the "down" state. What is the price of the security? O 1.8 O 1.4 O 1.2 O 0.9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts