Question: URGENT The inverse demand function for silver necklaces is given by the equation p=200 - 59, where g is the number of necklaces that are

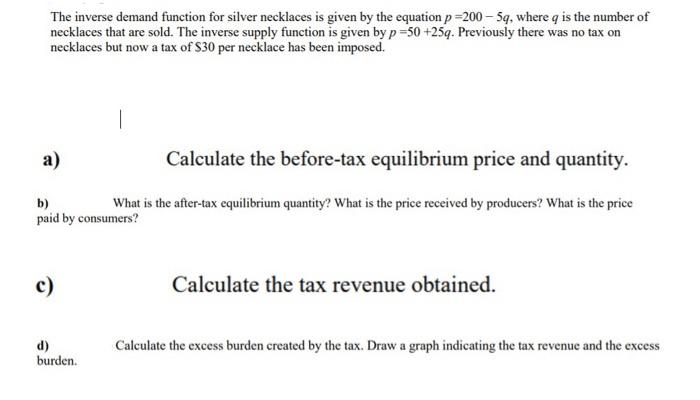

The inverse demand function for silver necklaces is given by the equation p=200 - 59, where g is the number of necklaces that are sold. The inverse supply function is given by p =50 +25q. Previously there was no tax on necklaces but now a tax of S30 per necklace has been imposed. a) Calculate the before-tax equilibrium price and quantity. b) What is the after-tax equilibrium quantity? What is the price received by producers? What is the price paid by consumers? c) Calculate the tax revenue obtained. d) burden. Calculate the excess burden created by the tax. Draw a graph indicating the tax revenue and the excess The inverse demand function for silver necklaces is given by the equation p=200 - 59, where g is the number of necklaces that are sold. The inverse supply function is given by p =50 +25q. Previously there was no tax on necklaces but now a tax of S30 per necklace has been imposed. a) Calculate the before-tax equilibrium price and quantity. b) What is the after-tax equilibrium quantity? What is the price received by producers? What is the price paid by consumers? c) Calculate the tax revenue obtained. d) burden. Calculate the excess burden created by the tax. Draw a graph indicating the tax revenue and the excess

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts