Question: US based Discover financial services (DFS) is planning to enter fast growing Australian credit card market with its own card offerings. As a first step,

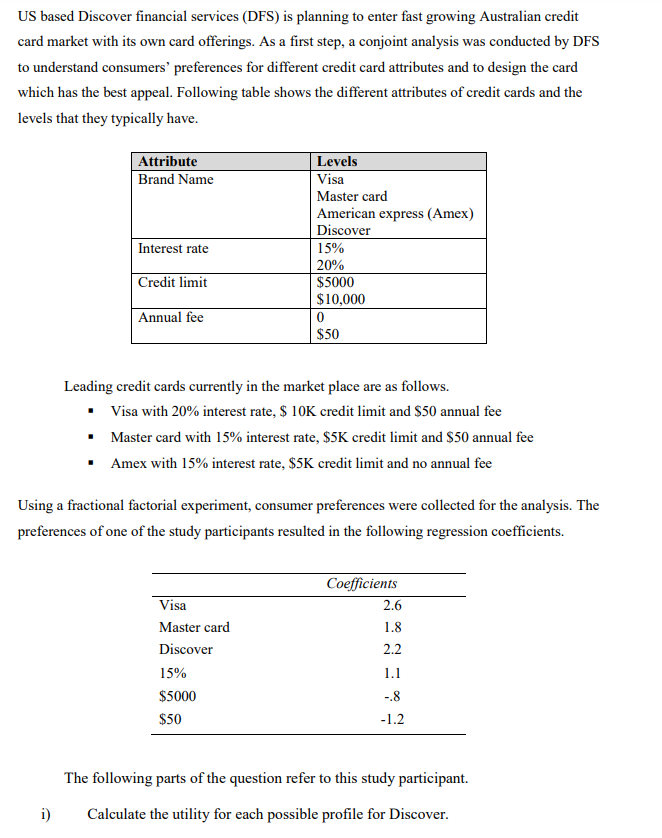

US based Discover financial services (DFS) is planning to enter fast growing Australian credit card market with its own card offerings. As a first step, a conjoint analysis was conducted by DFS to understand consumers' preferences for different credit card attributes and to design the card which has the best appeal. Following table shows the different attributes of credit cards and the levels that they typically have. Attribute Levels Brand Name Visa Master card American express (Amex) Discover Interest rate 15% 20% Credit limit $5000 $10,000 Annual fee 0 $50 Leading credit cards currently in the market place are as follows. Visa with 20% interest rate, $ 10K credit limit and $50 annual fee Master card with 15% interest rate, $5K credit limit and $50 annual fee Amex with 15% interest rate, $5K credit limit and no annual fee Using a fractional factorial experiment, consumer preferences were collected for the analysis. The preferences of one of the study participants resulted in the following regression coefficients. Coefficients Vise 2.6 Master card 1.8 Discover 2.2 15% 1.1 $5000 -.8 $50 1.2 The following parts of the question refer to this study participant. i) Calculate the utility for each possible profile for Discover

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts