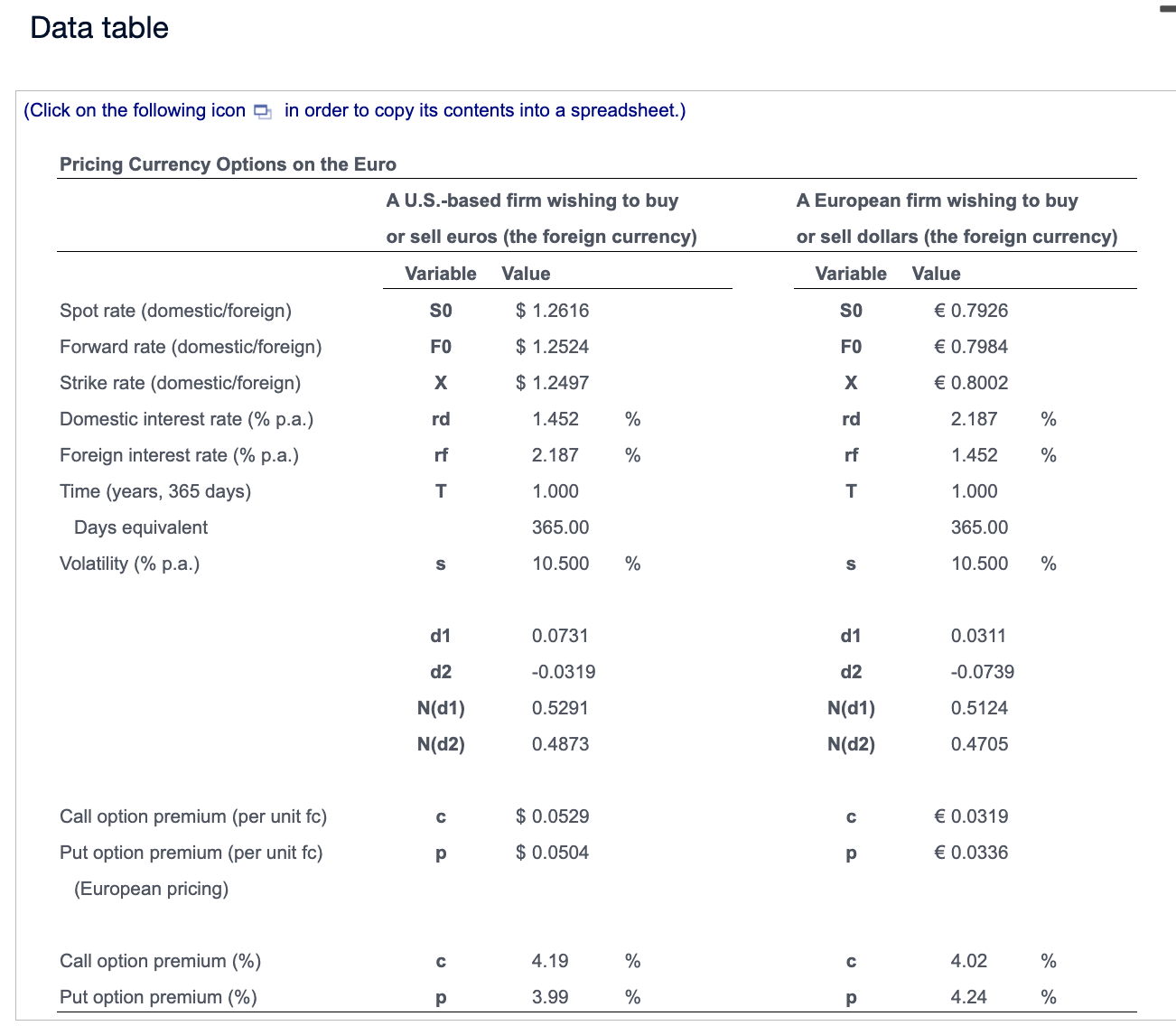

Question: U.S. Dollar-Euro. The table, a , indicates that a 1-year call option on euros at a strike rate of $1 .2497 = 1.00 will cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts