Question: use any example that can be relevant to explain each question ?. Calculate the value of the firm using the Discounted Equity Cash Flow method.

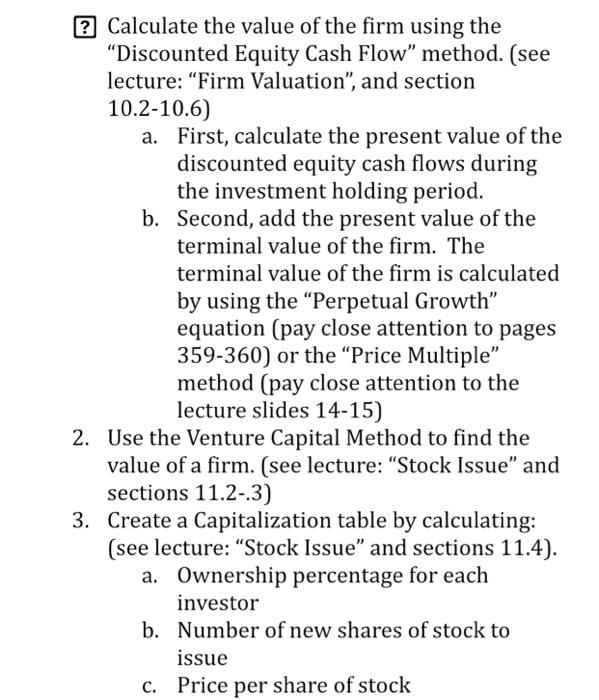

?. Calculate the value of the firm using the "Discounted Equity Cash Flow" method. (see lecture: "Firm Valuation", and section 10.2-10.6) a. First, calculate the present value of the discounted equity cash flows during the investment holding period. b. Second, add the present value of the terminal value of the firm. The terminal value of the firm is calculated by using the "Perpetual Growth" equation (pay close attention to pages 359-360) or the "Price Multiple" method (pay close attention to the lecture slides 14-15) 2. Use the Venture Capital Method to find the value of a firm. (see lecture: "Stock Issue" and sections 11.2-.3) 3. Create a Capitalization table by calculating: (see lecture: "Stock Issue" and sections 11.4). a. Ownership percentage for each investor b. Number of new shares of stock to issue c. Price per share of stock ?. Calculate the value of the firm using the "Discounted Equity Cash Flow" method. (see lecture: "Firm Valuation", and section 10.2-10.6) a. First, calculate the present value of the discounted equity cash flows during the investment holding period. b. Second, add the present value of the terminal value of the firm. The terminal value of the firm is calculated by using the "Perpetual Growth" equation (pay close attention to pages 359-360) or the "Price Multiple" method (pay close attention to the lecture slides 14-15) 2. Use the Venture Capital Method to find the value of a firm. (see lecture: "Stock Issue" and sections 11.2-.3) 3. Create a Capitalization table by calculating: (see lecture: "Stock Issue" and sections 11.4). a. Ownership percentage for each investor b. Number of new shares of stock to issue c. Price per share of stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts