Question: Use Excel: Consider a bond with 2 years to maturity, Face (Par) Value =$1,000,10% annual coupon rate, semi-annual coupon payments and YTM =3% per 6

Use Excel:

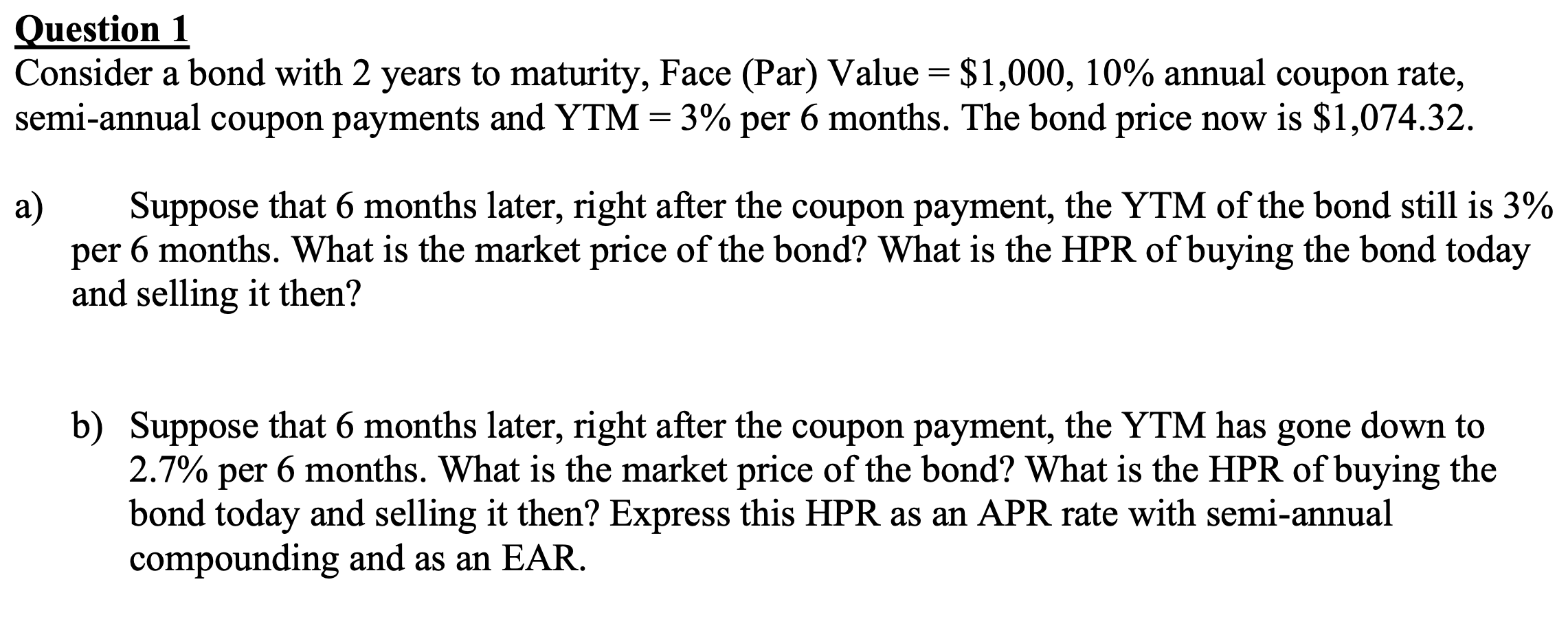

Consider a bond with 2 years to maturity, Face (Par) Value =$1,000,10% annual coupon rate, semi-annual coupon payments and YTM =3% per 6 months. The bond price now is $1,074.32. a) Suppose that 6 months later, right after the coupon payment, the YTM of the bond still is 3% per 6 months. What is the market price of the bond? What is the HPR of buying the bond today and selling it then? b) Suppose that 6 months later, right after the coupon payment, the YTM has gone down to 2.7% per 6 months. What is the market price of the bond? What is the HPR of buying the bond today and selling it then? Express this HPR as an APR rate with semi-annual compounding and as an EAR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts