Question: Use Excel to replicate the effective interest method schedules in Illustration 14.6 (Schedule of Bond Discount Amortization) ILLUSTRATION 14.6 Bond Discount Amortization Schedule Underlying Concepts

- Use Excel to replicate the effective interest method schedules in Illustration 14.6 (Schedule of Bond Discount Amortization)

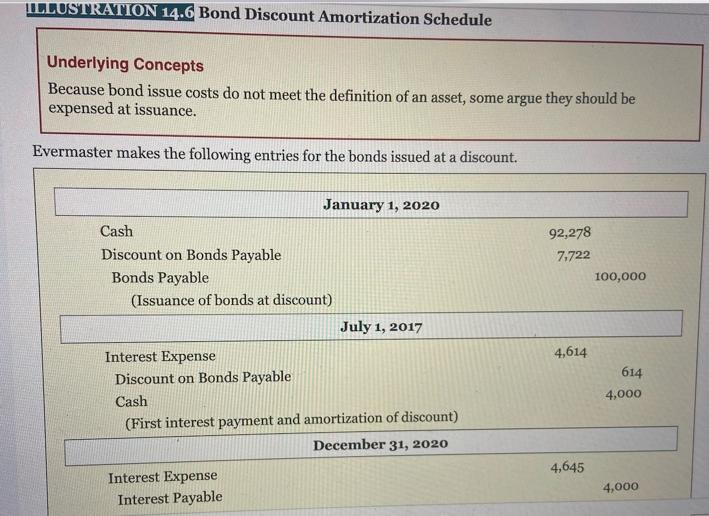

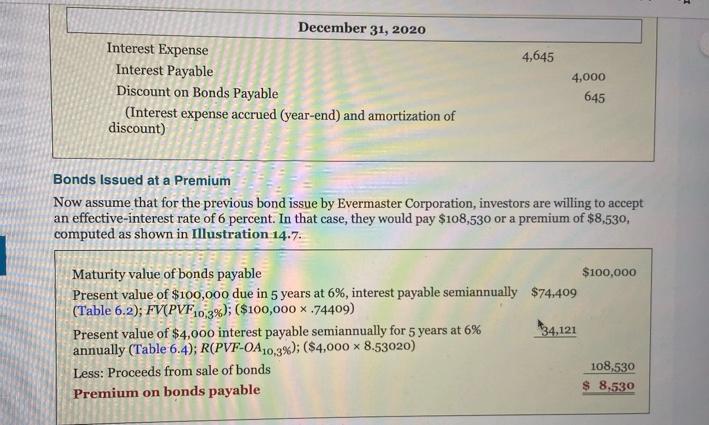

ILLUSTRATION 14.6 Bond Discount Amortization Schedule Underlying Concepts Because bond issue costs do not meet the definition of an asset, some argue they should be expensed at issuance. Evermaster makes the following entries for the bonds issued at a discount. January 1, 2020 Cash Discount on Bonds Payable Bonds Payable (Issuance of bonds at discount) July 1, 2017 92,278 7.722 100,000 4,614 614 4,000 Interest Expense Discount on Bonds Payable Cash (First interest payment and amortization of discount) December 31, 2020 4,645 Interest Expense Interest Payable 4,000 1 4,645 December 31, 2020 Interest Expense Interest Payable Discount on Bonds Payable (Interest expense accrued (year-end) and amortization of discount) 4,000 645 Bonds Issued at a Premium Now assume that for the previous bond issue by Evermaster Corporation, investors are willing to accept an effective-interest rate of 6 percent. In that case, they would pay $108,530 or a premium of $8,530, computed as shown in Illustration 14.7. Maturity value of bonds payable $100,000 Present value of $100,000 due in 5 years at 6%, interest payable semiannually $74,409 (Table 6.2); FV(PVF10,3%); ($100,000 x 74409) Present value of $4,000 interest payable semiannually for 5 years at 6% 134.121 annually (Table 6.4); R(PVF-OA10,3%); ($4,000 x 8.53020) Less: Proceeds from sale of bonds 108,530 Premium on bonds payable $ 8.530

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts