Question: Use the 5 Factor ROE Model Excel workbook provided in Module 1, lesson 2.3 to calculate the ROE and Operation Profit Margin. If... Net Income

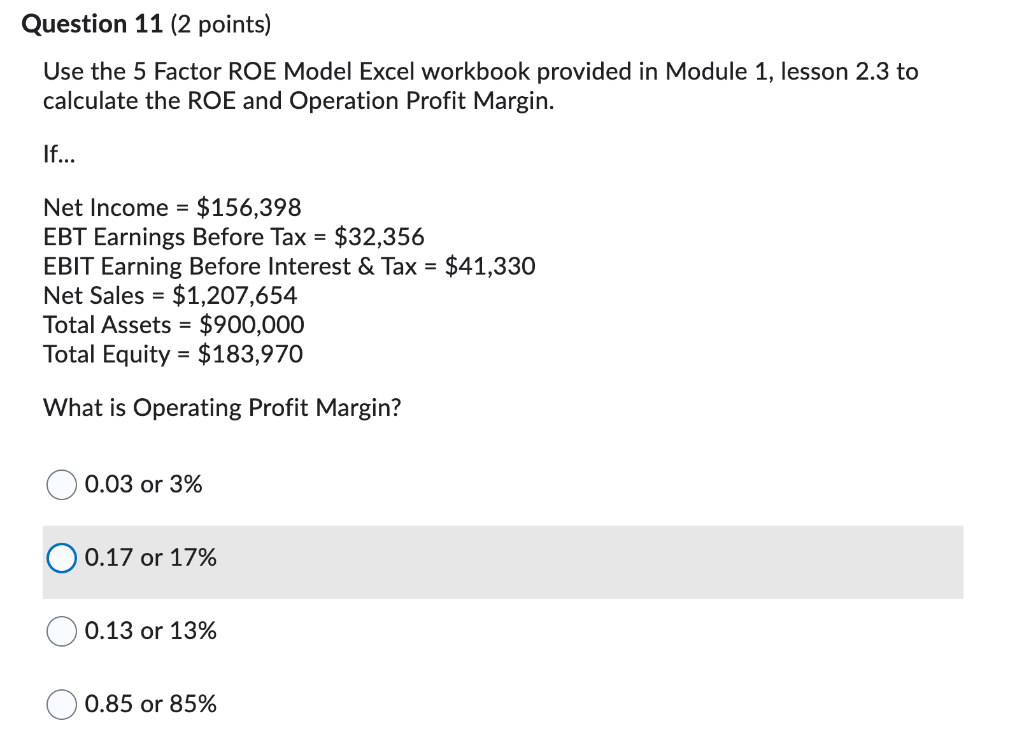

Use the 5 Factor ROE Model Excel workbook provided in Module 1, lesson 2.3 to calculate the ROE and Operation Profit Margin.

If...

Net Income = $156,398 EBT Earnings Before Tax = $32,356 EBIT Earning Before Interest & Tax = $41,330 Net Sales = $1,207,654 Total Assets = $900,000 Total Equity = $183,970

What is Operating Profit Margin?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts