Question: Use the accompanying data table regarding retirement funds. a. Construct a table that tabulates type, market cap, and rating. b. What conclusions can you reach

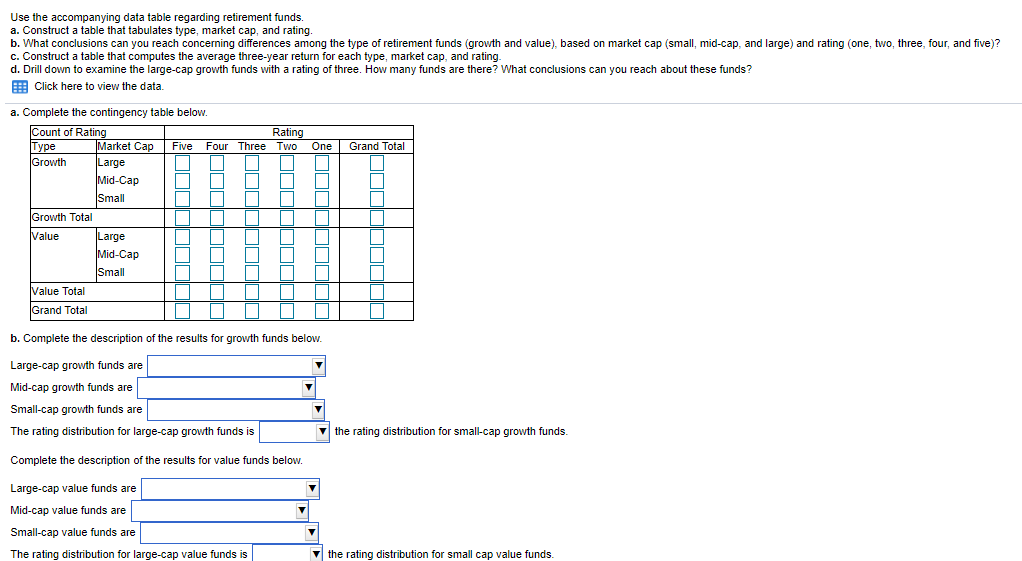

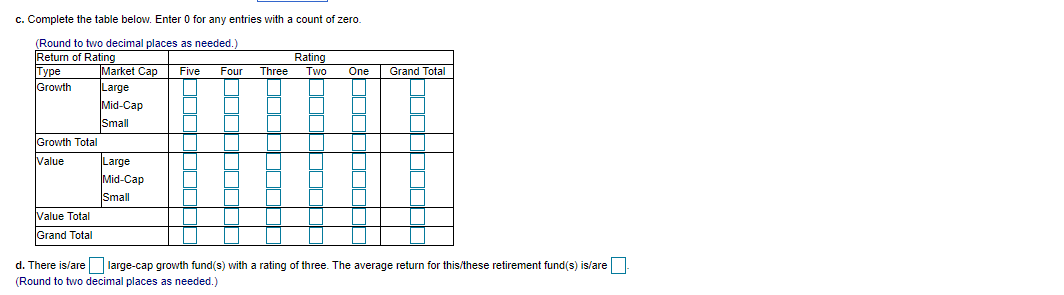

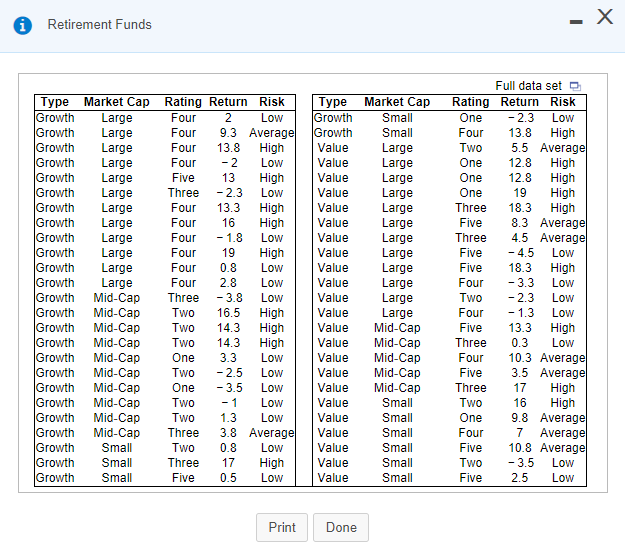

Use the accompanying data table regarding retirement funds. a. Construct a table that tabulates type, market cap, and rating. b. What conclusions can you reach concerning differences among the type of retirement funds (growth and value), based on market cap (small, mid-cap, and large) and rating one, two, three, four, and five)? c. Construct a table that computes the average three-year return for each type, market cap, and rating. d. Drill down to examine the large-cap growth funds with a rating of three. How many funds are there? What conclusions can you reach about these funds? Click here to view the data One Grand Total a. Complete the contingency table below. Count of Rating Rating Type Market Cap Five Four Three Two Growth Large Mid-Cap Small Growth Total Value Large Mid-Cap Small Value Total Grand Total b. Complete the description of the results for growth funds below. Large-cap growth funds are Mid-cap growth funds are Small-cap growth funds are The rating distribution for large-cap growth funds is the rating distribution for small-cap growth funds Complete the description of the results for value funds below. Large-cap value funds are Mid-cap value funds are V Small-cap value funds are The rating distribution for large-cap value funds is v the rating distribution for small cap value funds. c. Complete the table below. Enter 0 for any entries with a count of zero Rating Three Two One Grand Total (Round to two decimal places as needed.) Return of Rating Type Market Cap Five Four Growth Large Mid-Cap Small Growth Total Large Mid-Cap Small Value Total Grand Total value d. There is/are large-cap growth fund(s) with a rating of three. The average return for this/these retirement fund(s) is/are (Round to two decimal places as needed.) - X Retirement Funds Type Market Cap Rating Return Risk Growth Large Four 2 Low Growth Large Four 9.3 Average Growth Large Four 13.8 High Growth Large Four -2 Low Growth Large Five 13 High Growth Large Three -2.3 Low Growth Large Four 13.3 High Growth Large Four 16 High Growth Large Four - 1.8 Low Growth Large Four 19 High Growth Large Four 0.8 Low Growth Large Four 2.8 Low Growth Mid-Cap Three -3.8 Low Growth Mid-Cap Two 16.5 High Growth Mid-Cap Two 14.3 High Growth Mid-Cap Two 14.3 High Growth Mid-Cap One 3.3 Low Growth Mid-Cap TWO -2.5 Low Growth Mid-Cap One - 3.5 Low Growth Mid-Cap Two Low Growth Mid-Cap Two 1.3 Low Growth Mid-Cap Three 3.8 Average Growth Small TWO 0.8 Low Growth Small Three 17 High Growth Small Five 0.5 Low Type Growth Growth Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Market Cap Small Small Large Large Large Large Large Large Large Large Large Large Large Large Mid-Cap Mid-Cap Mid-Cap Mid-Cap Mid-Cap Small Small Small Small Small Small Full data set Rating Return Risk One -2.3 Low Four 13.8 High Two 5.5 Average One 12.8 High One 12.8 High One 19 High Three 18.3 High Five 8.3 Average Three 4.5 Average Five -4.5 Low Five 18.3 High Four -3.3 Low Two -2.3 Four -1.3 Low Five 13.3 High Three 0.3 Low Four 10.3 Average Five 3.5 Average Three 17 High TWO 16 High One 9.8 Average Four 7 Average Five 10.8 Average Two - 3.5 Low Five 2.5 Low Low -1 Print Done Use the accompanying data table regarding retirement funds. a. Construct a table that tabulates type, market cap, and rating. b. What conclusions can you reach concerning differences among the type of retirement funds (growth and value), based on market cap (small, mid-cap, and large) and rating one, two, three, four, and five)? c. Construct a table that computes the average three-year return for each type, market cap, and rating. d. Drill down to examine the large-cap growth funds with a rating of three. How many funds are there? What conclusions can you reach about these funds? Click here to view the data One Grand Total a. Complete the contingency table below. Count of Rating Rating Type Market Cap Five Four Three Two Growth Large Mid-Cap Small Growth Total Value Large Mid-Cap Small Value Total Grand Total b. Complete the description of the results for growth funds below. Large-cap growth funds are Mid-cap growth funds are Small-cap growth funds are The rating distribution for large-cap growth funds is the rating distribution for small-cap growth funds Complete the description of the results for value funds below. Large-cap value funds are Mid-cap value funds are V Small-cap value funds are The rating distribution for large-cap value funds is v the rating distribution for small cap value funds. c. Complete the table below. Enter 0 for any entries with a count of zero Rating Three Two One Grand Total (Round to two decimal places as needed.) Return of Rating Type Market Cap Five Four Growth Large Mid-Cap Small Growth Total Large Mid-Cap Small Value Total Grand Total value d. There is/are large-cap growth fund(s) with a rating of three. The average return for this/these retirement fund(s) is/are (Round to two decimal places as needed.) - X Retirement Funds Type Market Cap Rating Return Risk Growth Large Four 2 Low Growth Large Four 9.3 Average Growth Large Four 13.8 High Growth Large Four -2 Low Growth Large Five 13 High Growth Large Three -2.3 Low Growth Large Four 13.3 High Growth Large Four 16 High Growth Large Four - 1.8 Low Growth Large Four 19 High Growth Large Four 0.8 Low Growth Large Four 2.8 Low Growth Mid-Cap Three -3.8 Low Growth Mid-Cap Two 16.5 High Growth Mid-Cap Two 14.3 High Growth Mid-Cap Two 14.3 High Growth Mid-Cap One 3.3 Low Growth Mid-Cap TWO -2.5 Low Growth Mid-Cap One - 3.5 Low Growth Mid-Cap Two Low Growth Mid-Cap Two 1.3 Low Growth Mid-Cap Three 3.8 Average Growth Small TWO 0.8 Low Growth Small Three 17 High Growth Small Five 0.5 Low Type Growth Growth Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Value Market Cap Small Small Large Large Large Large Large Large Large Large Large Large Large Large Mid-Cap Mid-Cap Mid-Cap Mid-Cap Mid-Cap Small Small Small Small Small Small Full data set Rating Return Risk One -2.3 Low Four 13.8 High Two 5.5 Average One 12.8 High One 12.8 High One 19 High Three 18.3 High Five 8.3 Average Three 4.5 Average Five -4.5 Low Five 18.3 High Four -3.3 Low Two -2.3 Four -1.3 Low Five 13.3 High Three 0.3 Low Four 10.3 Average Five 3.5 Average Three 17 High TWO 16 High One 9.8 Average Four 7 Average Five 10.8 Average Two - 3.5 Low Five 2.5 Low Low -1 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts