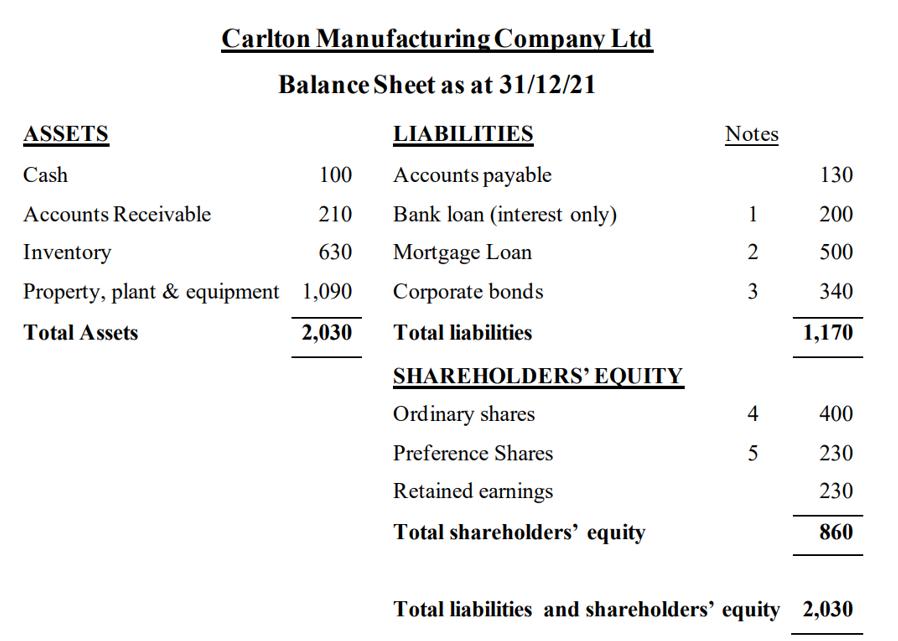

Question: use the below balance sheet and notes for the below questions. 1. The interest rate on the bank loan is 8.4% p.a. 2. The interest

use the below balance sheet and notes for the below questions.

1. The interest rate on the bank loan is 8.4% p.a.

2. The interest rate on the mortgage loan is 5.3% p.a.

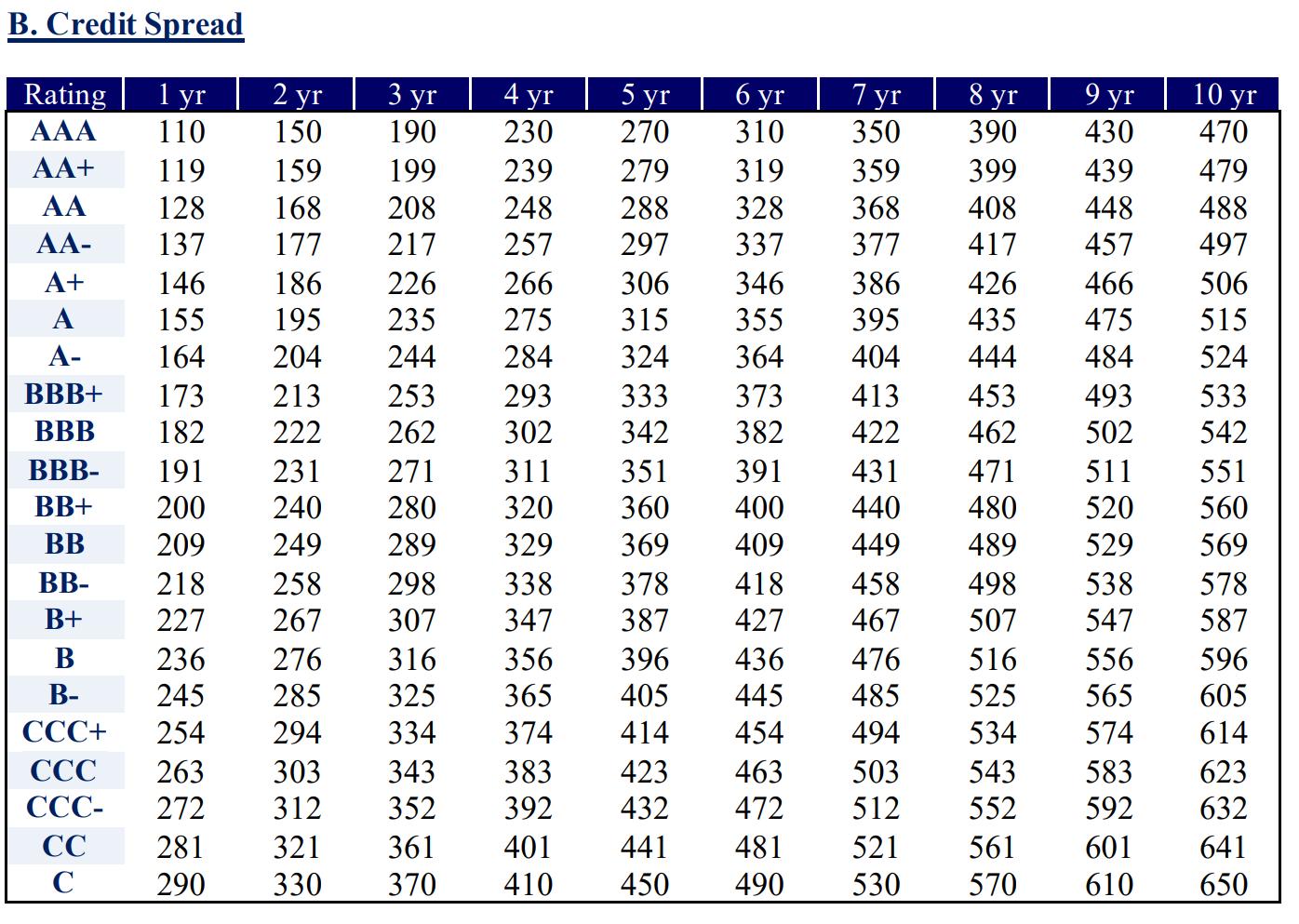

3. The corporate bonds have a credit rating of A+ and have 3 years to maturity. They make quarterly coupon payments at a coupon rate of 6% p.a.

4. The ordinary shares are shown on the balance sheet at their book value of $1 per share. They have a beta of 1.6. They are expected to pay a dividend of $0.07 next year. The dividend is expected to grow at a rate of 9% p.a. for the following 3 years, and after that it will grow at a constant rate of 2% p.a. in perpetuity.

5. The preference shares have a par value of $1 each and are shown on the Balance Sheet at their par value. They pay a constant dividend of $0.10 and they are currently trading for $1.05.

6. The risk premium for the ordinary shares is 9.6%.

7. The corporate tax rate is 30%. The 3-year risk-free rate is 0.03%. The 10-year risk-free rate is 1.17%

Part 1:

a) Calculate the before-tax cost of bank loans, mortgage loans, and corporate bonds

b) Calculate the (market) value of bank loans, mortgage loans, and corporate bonds

c) Calculate the cost of ordinary shares and preference shares

d) Calculate the market prices of ordinary shares and preference shares

e) Calculate the market value of ordinary shares and preference shares

f) Calculate the company’s WACC

Carlton Manufacturing Company Ltd Balance Sheet as at 31/12/21 LIABILITIES Accounts payable Bank loan (interest only) Mortgage Loan Corporate bonds Total liabilities SHAREHOLDERS' EQUITY Ordinary shares Preference Shares Retained earnings Total shareholders' equity ASSETS Cash 100 Accounts Receivable 210 Inventory 630 Property, plant & equipment 1,090 Total Assets 2,030 Notes 1 2 3 4 5 130 200 500 340 1,170 400 230 230 860 Total liabilities and shareholders' equity 2,030

Step by Step Solution

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts