Question: Use the following information on a mortgage-backed security for Problems 6 - 10 . You are examining a mortgage -backed security with the following features

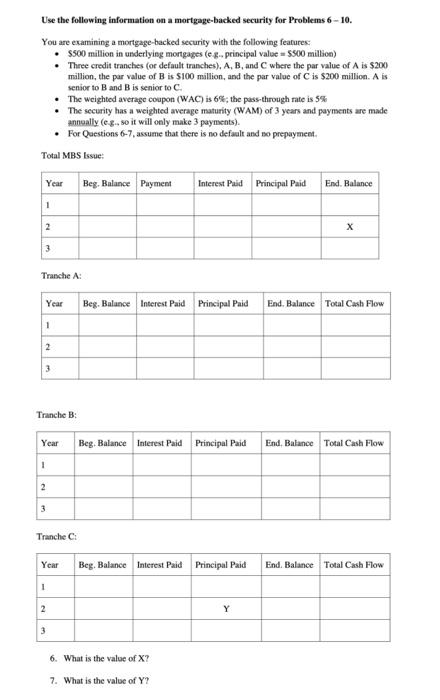

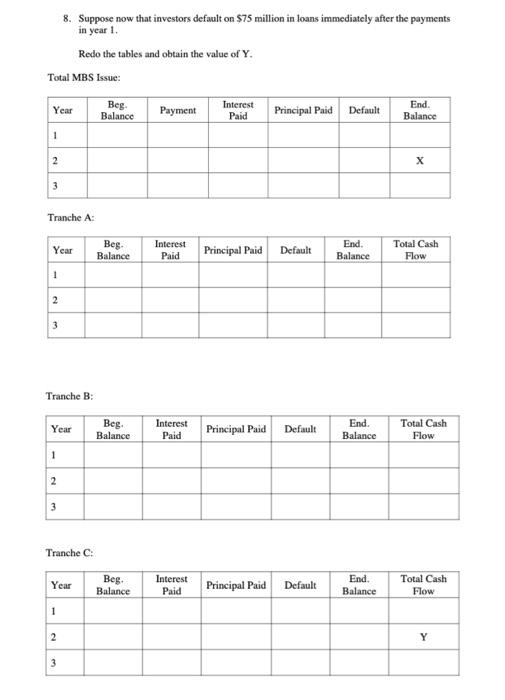

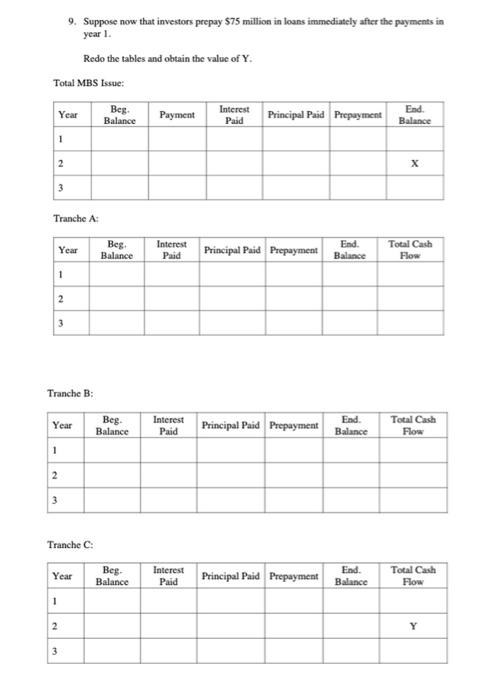

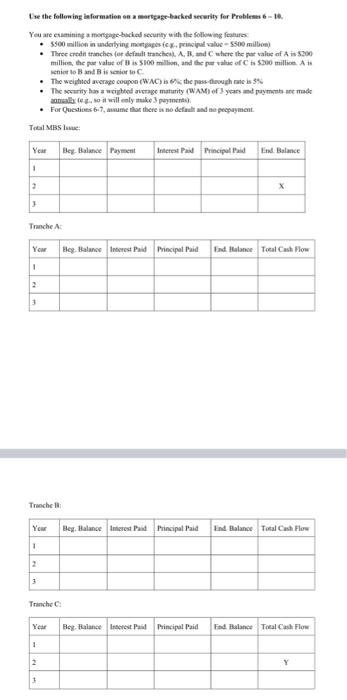

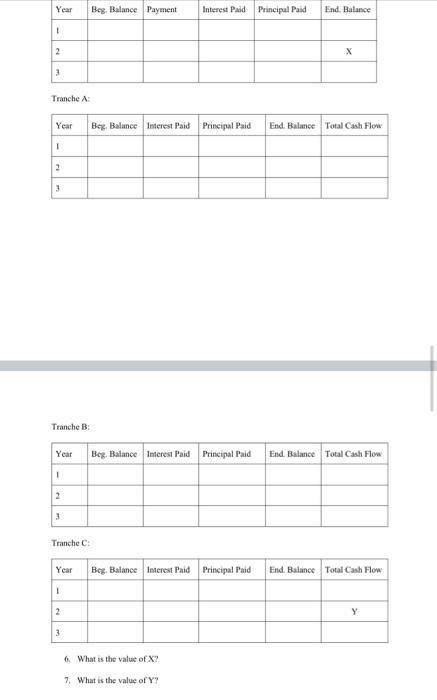

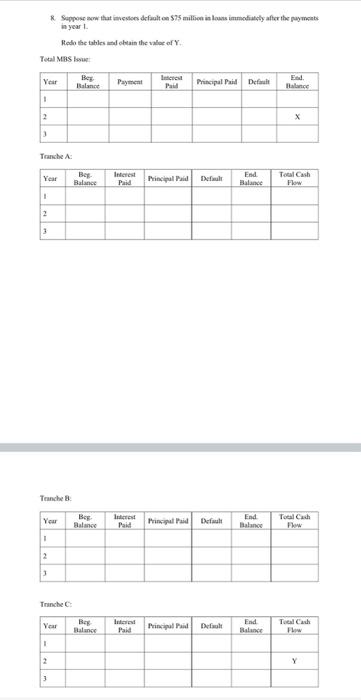

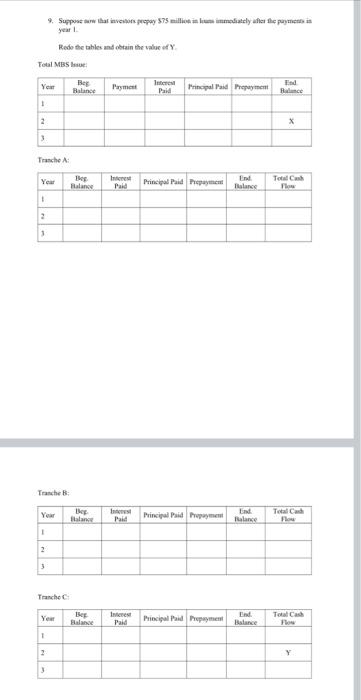

Use the following information on a mortgage-backed security for Problems 610. You are examining a mortgage-backed security with the following features: - $500 million in underlying mortgages (e.z- principal value = 5500 million) - Three credit tranches (or default tranches), A, B, and C wbere the par value of A is $200 million, the par value of B is $100 million, and the par value of C is $200 million. A is senior to B and B is senior to C. - The weightod average coupon (WAC) is 6%; the pass-through rate is 5% - The security has a weighted average maturity (WAM) of 3 years and payments are made annoally (e.g-s so it will only make 3 payments). - For Questions 6-7, assume that there is no defalt and bo prepayment. Total MBS Issue: Tranche A: Tranche B: Tranche C: 6. What is the value of X ? 7. What is the value of Y ? 8. Suppose now that investors default on $75 million in loans immediately after the payments in year 1. Redo the tables and obtain the value of Y. Total MBS Issue: Tranche A: Tranche B: Tranche C : 9. Suppose now that investors prepay $75 million in loans immediately after the puyments in year 1. Redo the tables and obtain the value of Y. Total MBS Lssue: Tranche A: Tranche B: Tranche C: Whe the folloning leformation en a mortrage-backed senwrity for Problest 6=10. Yeu are evaminits a morthage-buched sccurity with the following feahures milioes, the pou value of H is 5100 millon, and the pue value of C is 5300 millioe A is seniee to B and B is semior lo C * The weiphiod averape coopon (W:MC) is 6h- the pase thouph rate is 54 - The sccrity has a acighbod atrage maturity (W AMf of 1 ycars mad paymenta are made * For Questioes bu? 7 , anume tlen there sk no definilh asd ao pocpuyment. Toeal MBS lsnue: Tranche A: Tranche 11 Tranche C. Tranche A Tranche B: Tranche C: 6. What is the value of X ? 7. What is the value of Y ? R. Suppose arw that incesion defalt on $75 millien in louss intodiutly after the puymeinbs in year 1 . Feos the tahles mat owain the wace of Y. Total Mas hove: Tranche A Tranche 8 Trinche C : year 1. Redo the tahles and obtain the value of Y Toul MBs lave: Trasche A: Tranche B : Tranche C : Use the following information on a mortgage-backed security for Problems 610. You are examining a mortgage-backed security with the following features: - $500 million in underlying mortgages (e.z- principal value = 5500 million) - Three credit tranches (or default tranches), A, B, and C wbere the par value of A is $200 million, the par value of B is $100 million, and the par value of C is $200 million. A is senior to B and B is senior to C. - The weightod average coupon (WAC) is 6%; the pass-through rate is 5% - The security has a weighted average maturity (WAM) of 3 years and payments are made annoally (e.g-s so it will only make 3 payments). - For Questions 6-7, assume that there is no defalt and bo prepayment. Total MBS Issue: Tranche A: Tranche B: Tranche C: 6. What is the value of X ? 7. What is the value of Y ? 8. Suppose now that investors default on $75 million in loans immediately after the payments in year 1. Redo the tables and obtain the value of Y. Total MBS Issue: Tranche A: Tranche B: Tranche C : 9. Suppose now that investors prepay $75 million in loans immediately after the puyments in year 1. Redo the tables and obtain the value of Y. Total MBS Lssue: Tranche A: Tranche B: Tranche C: Whe the folloning leformation en a mortrage-backed senwrity for Problest 6=10. Yeu are evaminits a morthage-buched sccurity with the following feahures milioes, the pou value of H is 5100 millon, and the pue value of C is 5300 millioe A is seniee to B and B is semior lo C * The weiphiod averape coopon (W:MC) is 6h- the pase thouph rate is 54 - The sccrity has a acighbod atrage maturity (W AMf of 1 ycars mad paymenta are made * For Questioes bu? 7 , anume tlen there sk no definilh asd ao pocpuyment. Toeal MBS lsnue: Tranche A: Tranche 11 Tranche C. Tranche A Tranche B: Tranche C: 6. What is the value of X ? 7. What is the value of Y ? R. Suppose arw that incesion defalt on $75 millien in louss intodiutly after the puymeinbs in year 1 . Feos the tahles mat owain the wace of Y. Total Mas hove: Tranche A Tranche 8 Trinche C : year 1. Redo the tahles and obtain the value of Y Toul MBs lave: Trasche A: Tranche B : Tranche C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts