Question: Use the following information on a mortgage-backed security for Problems 6-10. You are examining a mortgage-backed security with the following features: - $500 million in

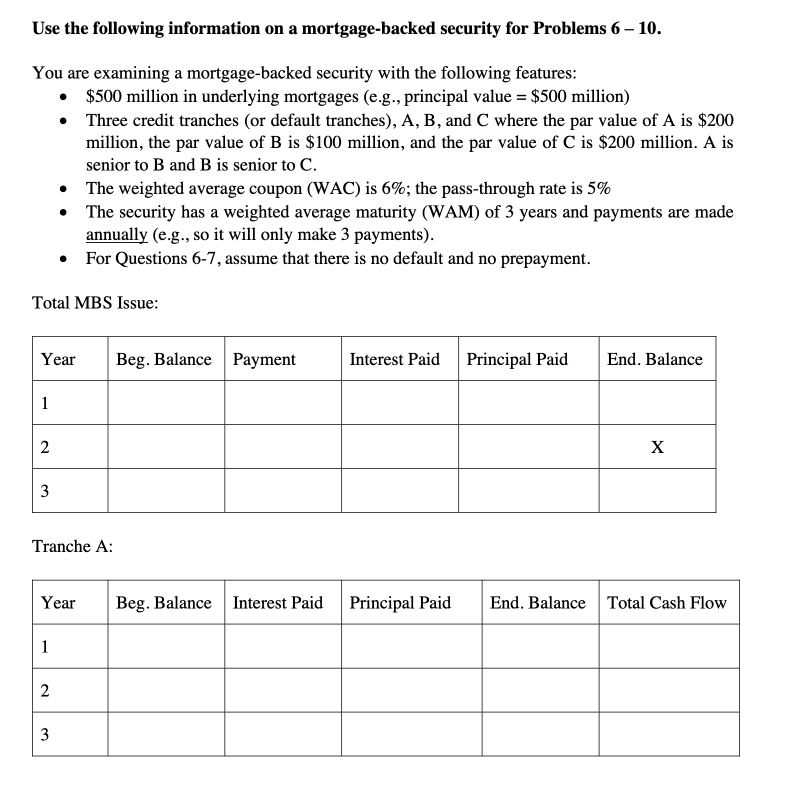

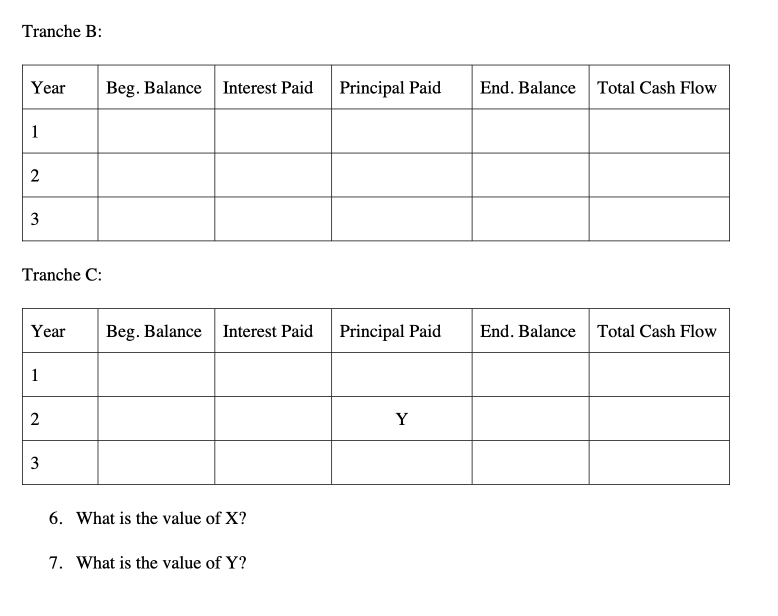

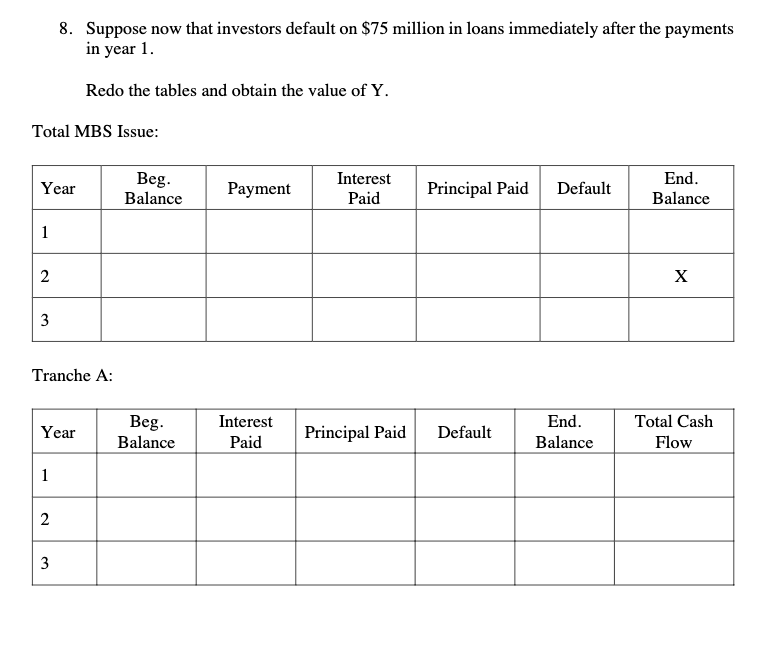

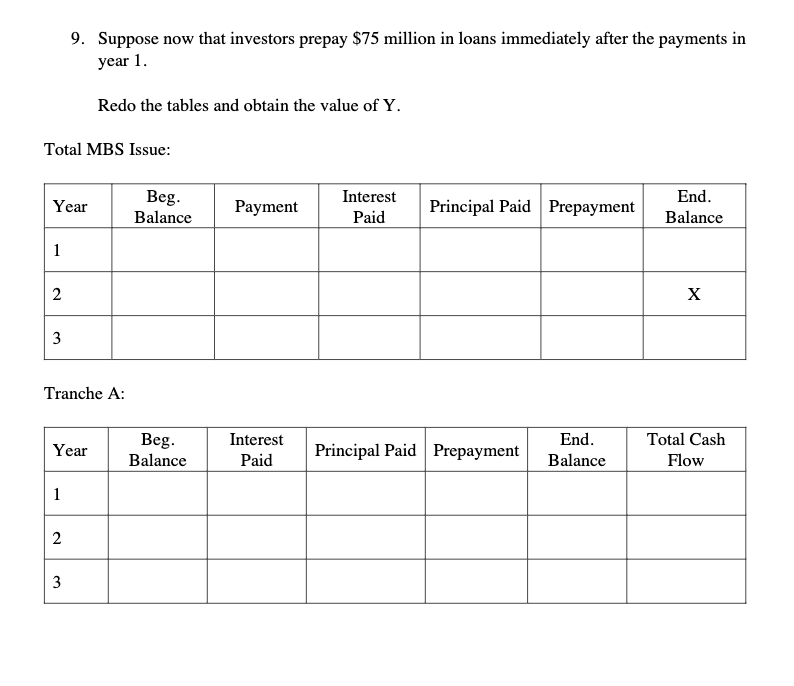

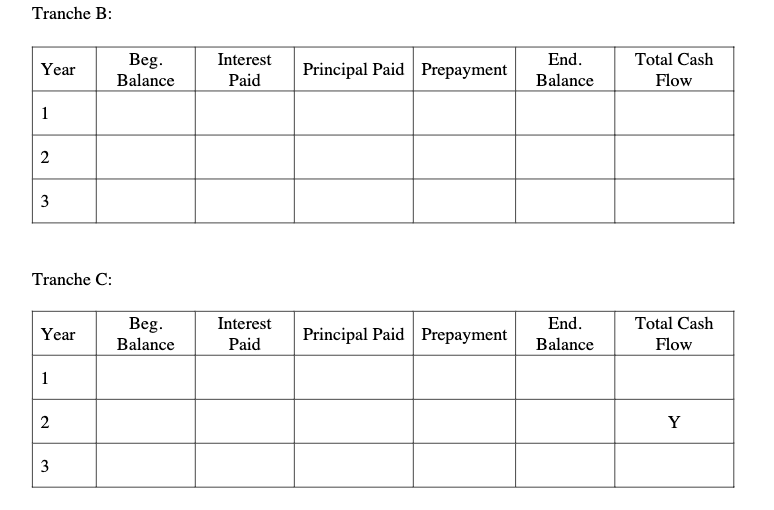

Use the following information on a mortgage-backed security for Problems 6-10. You are examining a mortgage-backed security with the following features: - $500 million in underlying mortgages (e.g., principal value =$500 million) - Three credit tranches (or default tranches), A, B, and C where the par value of A is $200 million, the par value of B is $100 million, and the par value of C is $200 million. A is senior to B and B is senior to C. - The weighted average coupon (WAC) is 6%; the pass-through rate is 5% - The security has a weighted average maturity (WAM) of 3 years and payments are made annually (e.g., so it will only make 3 payments). - For Questions 6-7, assume that there is no default and no prepayment. Total MBS Issue: Tranche A: Tranche B: Tranche C: 6. What is the value of X ? 7. What is the value of Y ? 8. Suppose now that investors default on $75 million in loans immediately after the payments in year 1 . Redo the tables and obtain the value of Y. Total MBS Issue: Tranche A: Tranche B: Tranche C: 9. Suppose now that investors prepay $75 million in loans immediately after the payments in year 1. Redo the tables and obtain the value of Y. Total MBS Issue: Tranche A: Tranche B: Tranche C: Use the following information on a mortgage-backed security for Problems 6-10. You are examining a mortgage-backed security with the following features: - $500 million in underlying mortgages (e.g., principal value =$500 million) - Three credit tranches (or default tranches), A, B, and C where the par value of A is $200 million, the par value of B is $100 million, and the par value of C is $200 million. A is senior to B and B is senior to C. - The weighted average coupon (WAC) is 6%; the pass-through rate is 5% - The security has a weighted average maturity (WAM) of 3 years and payments are made annually (e.g., so it will only make 3 payments). - For Questions 6-7, assume that there is no default and no prepayment. Total MBS Issue: Tranche A: Tranche B: Tranche C: 6. What is the value of X ? 7. What is the value of Y ? 8. Suppose now that investors default on $75 million in loans immediately after the payments in year 1 . Redo the tables and obtain the value of Y. Total MBS Issue: Tranche A: Tranche B: Tranche C: 9. Suppose now that investors prepay $75 million in loans immediately after the payments in year 1. Redo the tables and obtain the value of Y. Total MBS Issue: Tranche A: Tranche B: Tranche C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts