Question: Use the following information to help answer problems 1-3 Bond A: $1000.00 face value 10 Year US Treasury, or sovereign bond, with a 0.0% coupon

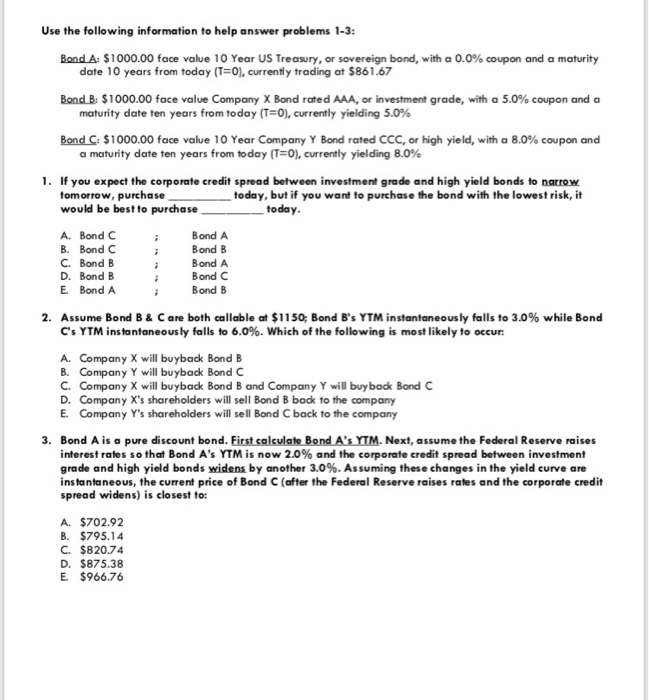

Use the following information to help answer problems 1-3 Bond A: $1000.00 face value 10 Year US Treasury, or sovereign bond, with a 0.0% coupon and a maturity date 10 years from today (T=O), currently trading at $861.67 BandB: $1000.00 face value Company X Bond rated AAA, or investment grade, with a 5.0% coupon and a maturity date ten years from today ( 0), currently yielding 5.0% BondC $1000.00 face value 10 Year Company Y Bond rated CCC, or high yield, with a 8.0% coupon and a maturity date ten years from today (T=0), currently yielding 8.0% 1. If you expect the corporate credit spread between investment grade and high yield bonds to narrow today, but if you want to purchase the bond with the lowest risk, it tomorrow, purchase would be best to purchase today A. Bond C B. Bond C C. Bond B D. Bond B E. Bond A Bond A Bond B Bond A Bond C Bond B 2. Assume Bond B & C are both callable at $1150; Bond B's YTM instantaneously falls to 3.0% while Bond C's YTM instantaneously falls to 6.0%, which of the following is most likely to occur: A. Company X will buyback Bond B B. Company Y will buyback Bond C C. Company X will buyback Bond B and Company Y will buyback Bond C D. Company X's shareholders will sell Bond B back to the company E. Company Y's shareholders will sell Bond C back to the company 3. Bond A is a pure discount bond. First calculate Bond A's YTM. discount Bond A's YTM Next, assume the Feder al Reserve raises interest rates so that Bond A's YTM is now 2.0% and the corporate credit spread between investment grade and high yield bonds yndens by another 3.0%. Assuming these changes in the yield curve are instantaneous, the curren price of Bond C (after the Federal Reserve raises rates and the corporate credit spread widens) is closest to: A. $702.92 B. $795.14 C. $820.74 D. $875.38 E $966.76

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts