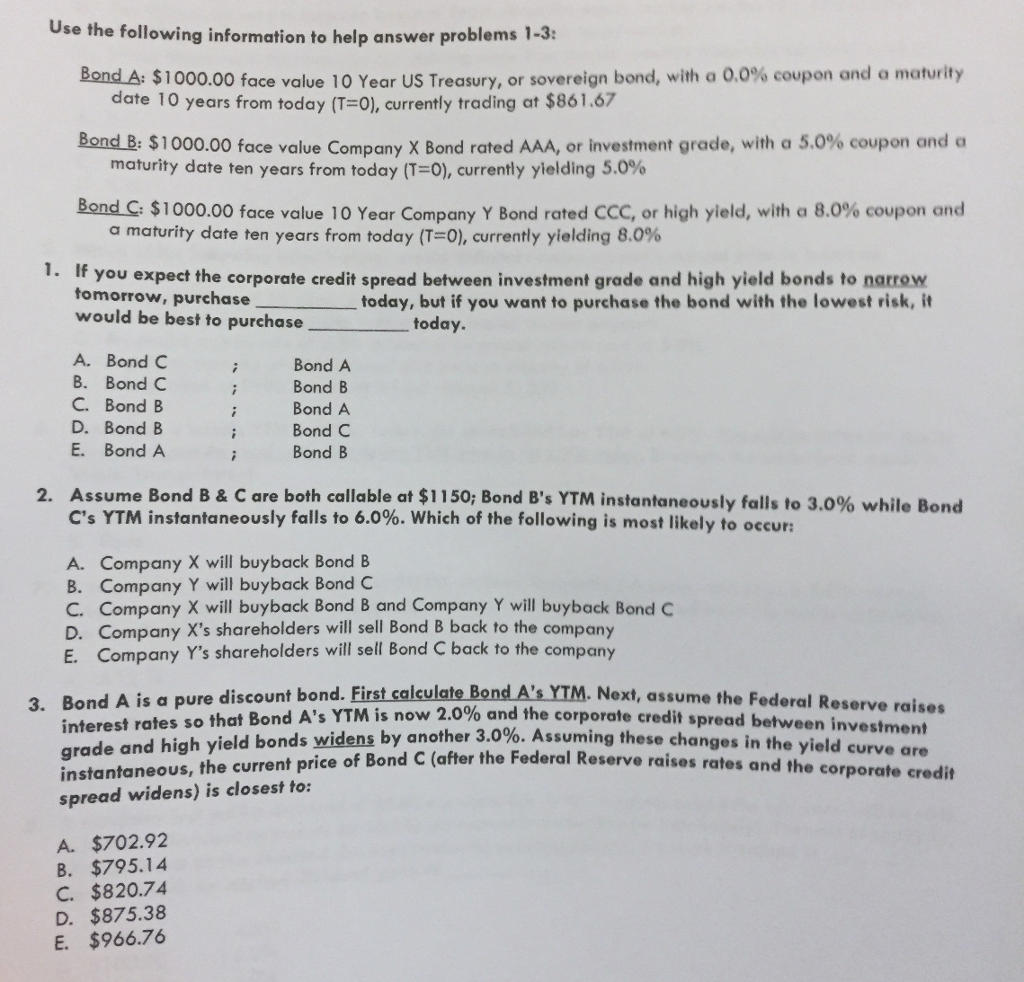

Question: Use the following information to help answer problems 1-3 Bond A: $1000.00 face value 10 Year US Treasury, or sovereign bond, with a 0.0% coupon

Use the following information to help answer problems 1-3 Bond A: $1000.00 face value 10 Year US Treasury, or sovereign bond, with a 0.0% coupon and a maturity Bond B: $1000.00 face value Company X Bond rated AAA, or investment grade, with a 5.0% coupon and a Bond G $1000.00 face value 10 Year Company Y Bond rated CCC, or high yield, with a 8.0% coupon and date 10 years from today (T-0), currently trading at $861.67 rmaturity date ten years from today (1-0), currently yielding 5.0% a maturity date ten years from today (T-0), currently yielding 8.0% 1. If you expect the corporate credit spread between investment grade and high yield bonds to natrow tomorrow, purchase today, but if you want to purchase the bond with the lowest risk, it would be best to purchase today. A. Bond C B. BondC C. Bond B D. Bond B E. Bond A Bond A Bond B Bond A : Bond C Bond B Assume Bond B & C are both callable at $1150; Bond B's YTM instantaneously falls to 3.0% while Bond C's YTM instantaneously falls to 6.0%, which of the following is most likely to occur 2. A. Company X will buyback Bond B B. Company Y will buyback Bond C C. Company X will buyback Bond B and Company Y will buyback Bond C D. Company X's shareholders will sell Bond B back to the company E. Company Y's shareholders will sell Bond C back to the company Bond A's YTM. Next, assume the Federal Reserve raises 3. Bond A is a pure discount bond. First calculate terest rates so that Bond A's YTM i snow 2.0% and the corporate credit spread between investment in grade and high yield bonds widens b instantaneous, the current price of Bon spread widens) is closest to: y another 3.0%. Assuming these changes in the yield curve are d C (after the Federal Reserve raises rates and the corporate credit A. $702.92 B. $795.14 C. $820.74 D. $875.38 E. $966.76

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts