Question: Use the information below to help answer Questions 6-9: Bond A: $10,000 face value 10 Year US Treasury, or sovereign bond, with a 0.0% coupon

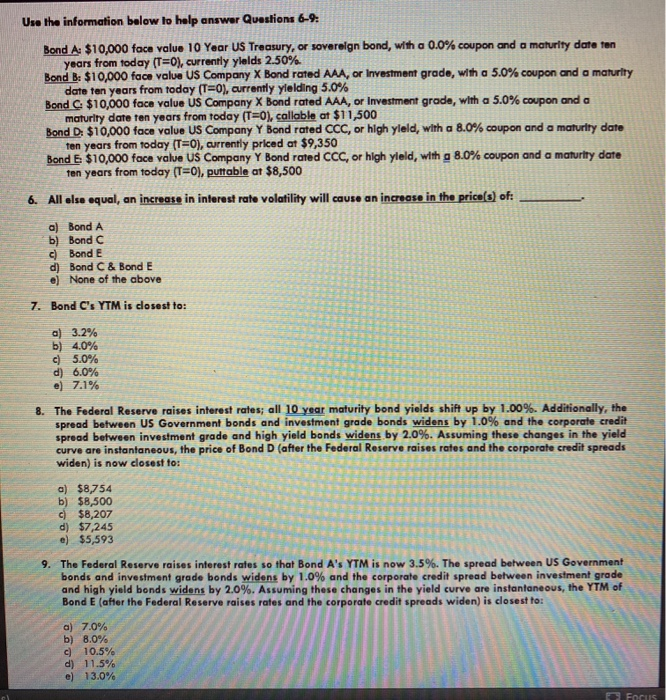

Use the information below to help answer Questions 6-9: Bond A: $10,000 face value 10 Year US Treasury, or sovereign bond, with a 0.0% coupon and a maturity date ten years from today (T=0), currently ylalds 2.50% Bond B: $10,000 face value US Company X Bond rated AAA, or Investment grade, with a 5.0% coupon and a maturity date ten years from today (T=0), currently yielding 5.0% Bond $10,000 face value US Company X Bond rated AAA, or Investment grade, with a 5.0% coupon and a maturity date ten years from today (T=0), callable at $11,500 Bond D: $10,000 face value US Company Y Bond rated CCC, or high yleld, with a 8.0% coupon and a maturity date Ten years from today (T=0), currently priced at $9,350 Bond E $10,000 face value US Company Y Bond rated CCC, or high yield, with a 8.0% coupon and a maturity date fen years from today (T=0), puttable at $8,500 All else equal, an increase in interest rate volatility will cause an increase in the price(s) of: a) Bond A b) Bond C c) Bond E d) Bond C & Bond E e) None of the above 7. Bond C's YTM is closest to: a) 3.2% b) 4.0% c) 5.0% d) 6.0% e) 7.1% The Federal Reserve raises interest rates, all 10 year maturity bond yields shift up by 1.00%. Additionally, the spread between US Government bonds and investment grade bonds widens by 1.0% and the corporate credit spread between investment grade and high yield bonds widens by 2.0%. Assuming these changes in the yield curve are instantaneous, the price of Bond D (after the Federal Reserve raises rates and the corporate credit spreads widen) is now closest to: a) $8754 b) $8,500 $8,207 d) $7,245 e) $5,593 9. The Federal Reserve raises interest rates so that Bond A's YTM is now 3.5%. The spread between US Government bonds and investment grade bonds widens by 1.0% and the corporate credit spread between investment grade and high yield bonds widens by 2.0%. Assuming these changes in the yield curve are instantaneous, the YTM of Bond E (after the Federal Reserve raises rates and the corporate credit spreads widen) is closest to: a) 7.0% b) 8.0% c 10.5% d) 11.5% e) 13.0% Use the information below to help answer Questions 6-9: Bond A: $10,000 face value 10 Year US Treasury, or sovereign bond, with a 0.0% coupon and a maturity date ten years from today (T=0), currently ylalds 2.50% Bond B: $10,000 face value US Company X Bond rated AAA, or Investment grade, with a 5.0% coupon and a maturity date ten years from today (T=0), currently yielding 5.0% Bond $10,000 face value US Company X Bond rated AAA, or Investment grade, with a 5.0% coupon and a maturity date ten years from today (T=0), callable at $11,500 Bond D: $10,000 face value US Company Y Bond rated CCC, or high yleld, with a 8.0% coupon and a maturity date Ten years from today (T=0), currently priced at $9,350 Bond E $10,000 face value US Company Y Bond rated CCC, or high yield, with a 8.0% coupon and a maturity date fen years from today (T=0), puttable at $8,500 All else equal, an increase in interest rate volatility will cause an increase in the price(s) of: a) Bond A b) Bond C c) Bond E d) Bond C & Bond E e) None of the above 7. Bond C's YTM is closest to: a) 3.2% b) 4.0% c) 5.0% d) 6.0% e) 7.1% The Federal Reserve raises interest rates, all 10 year maturity bond yields shift up by 1.00%. Additionally, the spread between US Government bonds and investment grade bonds widens by 1.0% and the corporate credit spread between investment grade and high yield bonds widens by 2.0%. Assuming these changes in the yield curve are instantaneous, the price of Bond D (after the Federal Reserve raises rates and the corporate credit spreads widen) is now closest to: a) $8754 b) $8,500 $8,207 d) $7,245 e) $5,593 9. The Federal Reserve raises interest rates so that Bond A's YTM is now 3.5%. The spread between US Government bonds and investment grade bonds widens by 1.0% and the corporate credit spread between investment grade and high yield bonds widens by 2.0%. Assuming these changes in the yield curve are instantaneous, the YTM of Bond E (after the Federal Reserve raises rates and the corporate credit spreads widen) is closest to: a) 7.0% b) 8.0% c 10.5% d) 11.5% e) 13.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts