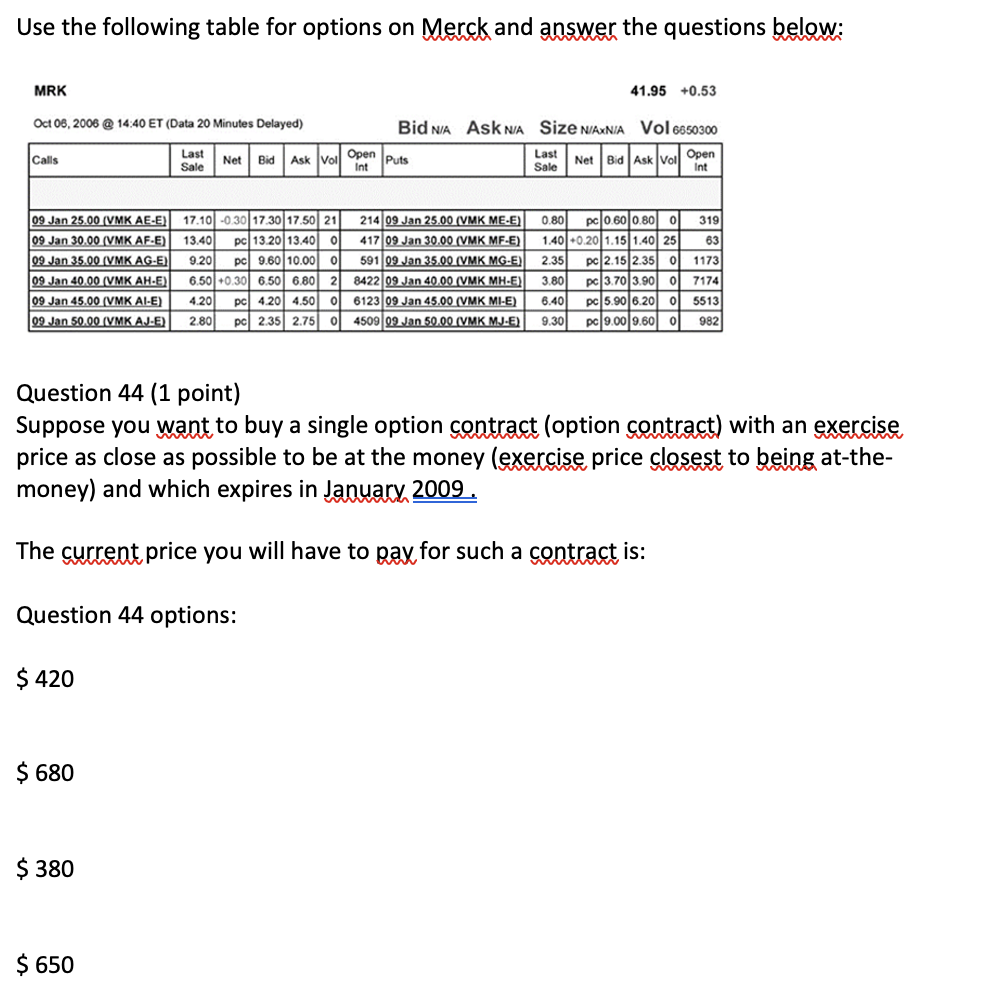

Question: Use the following table for options on Merck and answer the questions below: MRK 41.95 +0.53 Oct 06, 2006 @ 14:40 ET (Data 20 Minutes

Use the following table for options on Merck and answer the questions below: MRK 41.95 +0.53 Oct 06, 2006 @ 14:40 ET (Data 20 Minutes Delayed) Bid NA ASK NA Size N/AXNIA Vol 6650300 Last Calls Net Bid Ask Vol Open Sale Last Puts Int Sale Net Bid Askvoll Open Int 13.40 09 Jan 25,00 (VMK AE-E) 09 Jan 30.00 (VMK AF-E) 09 Jan 35.00 (VMK AG-E 09 Jan 40.00 (VMK AH-E) 09 Jan 45.00 (VMK AI-E) 09 Jan 50.00 (VMK AJ-E) 17.10 -0 30 17:30 17.50 21 PC 13.20 13.40 o 9.20 pc 9.60 10.00 ol 6.50 +0.30 6.50 6.80 2 4.20 pcl 4.20 4.50 0 2.80 pc 2.35 2.75 0 214 09 Jan 25,00 (VMK ME-E) 417 09 Jan 30.00 (VMK MF-E) 591 09 Jan 35.00 (VMK MG-E) 8422 09 Jan 40,00 VMK MH-E) 6123 09 Jan 45.00 (VMK MI-E) 4509 09 Jan 50,00 (VMK MJ-E) 0.80 PC 0.60 0.80 0 319 1.40 -0.201.151.40 25 63 2.35 pc 2.15 2.35 0 1173 3.80 pc 3.70 3.90 07174 6.40 pc 5.90 6.20 ol 5513 9.30 pc 9.00 9.60 01 982 Question 44 (1 point) Suppose you want to buy a single option contract (option contract) with an exercise price as close as possible to be at the money (exercise price closest to being at-the- money) and which expires in January 2009. The current price you will have to pay for such a contract is: Question 44 options: $ 420 $ 680 $ 380 $ 650 Question 45 (1 point) The open interest for a put option in January 2009 as close as possible in order to be at the money is: (The open interest for a Januarx 2009 put option that is closest to being at-the-money is) Options for question 45: 7174 319 982 8422 Question 46 (1 point) How many January 2009 put options are in the money? (How many of the January 2009 put options are in-the-money?) Options for question 46: 1 3 2 4 Question 47 (1 point) How many January 2009 call options are in the money? (How many of the January 2009 call options are in-the-money?) Options for question 47: 3 4 2 1 Question 48 (1 point) You have decided to purchase 10 call option contracts on Merck in January 2009 at an exercise price of $ 45 per share. How much will this transaction cost you? (You have decided to buy 10 January 2009 call options on Merck with an exercise price of $ 45 per share. How much will this transaction cost you?) Options for question 48: 4500 3450 2950 2050 Question 49 (1 point) You have decided to purchase 10 call option contracts on Merck in January 2009 at an exercise price of $ 45 per share. How will this transaction be? (You have decided to buy 10 January 2009 call options on Merck with an exercise price of $ 45 per share.) Options for question 49: out-of-the-money more information is needed. in the money at-the-money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts