Question: Use the information below to help answer questions 1-2 Excels solver was used to create the Minimum Variance Frontier (MVF) Portfolios 1-6 are all on

Use the information below to help answer questions 1-2

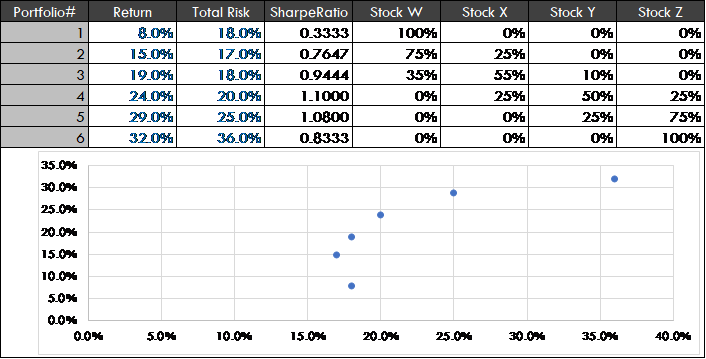

- Excels solver was used to create the Minimum Variance Frontier (MVF)

- Portfolios 1-6 are all on the MVF

- Portfolios 1-6 were created by weighting Stock W, Stock X, Stock Y, Stock Z

- Portfolios 2-6 are corner portfolios

- The risk free rate is 2%

- All return and risk figures are annualized

- (Asset Allocation) Which of the following statements is (are) most likely FALSE?

- When creating this efficient frontier above, it was assumed the portfolio manager cannot short stocks

- When finding the optimal portfolio, maximize the portfolios return using Excels solver

- The optimal portfolios Sharpe Ratio is 1.20

- I

- II

- III

- II & III

- None of the statements

- This question is worth 2 points! (Asset Allocation) Your clients current portfolio is $6,250 Stock W and $3,750 Stock Z. To achieve your clients retirement goals, you must increase the return of the existing portfolio by 3.0%. Using the weights in the corner portfolios, which of the following actions (I-IV) would be required

- Sell $6,250 Stock W

- Sell $1,750 Stock Z

- Buy $4,000 Stock X

- Buy $4,000 Stock Y

- I

- II

- III

- IV

- I, II, III, IV

The question is not cut of the slide

Portfolio# SharpeRatio Stock W Stock X Stock Y Stock Z Return 8.0% 15.0% 19.0% 24.0% 29.0% 32.0% Total Risk 18.0% 17.0% 18.0% 20.0% 25.0% 36.0% 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% 00% 5.0% 100% 15.0% 20.0% 25.0% 0.0% 35.0% 40.0% Portfolio# SharpeRatio Stock W Stock X Stock Y Stock Z Return 8.0% 15.0% 19.0% 24.0% 29.0% 32.0% Total Risk 18.0% 17.0% 18.0% 20.0% 25.0% 36.0% 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% 00% 5.0% 100% 15.0% 20.0% 25.0% 0.0% 35.0% 40.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts