Question: Use the information below to help answer questions 22 Excel's solver was used to create the Minimum Variance Frontier (MVF) for Stock X, Stock Y,

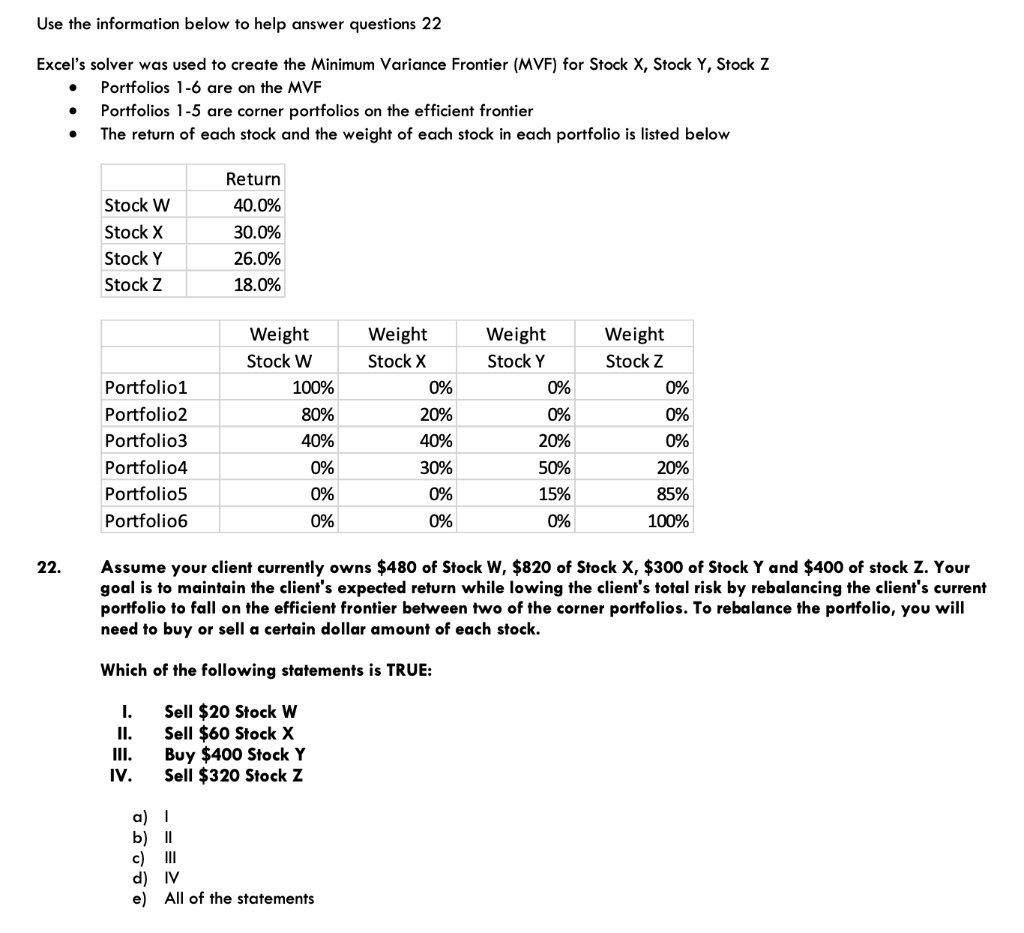

Use the information below to help answer questions 22 Excel's solver was used to create the Minimum Variance Frontier (MVF) for Stock X, Stock Y, Stock Z Portfolios 1-6 are on the MVF Portfolios 1-5 are corner portfolios on the efficient frontier The return of each stock and the weight of each stock in each portfolio is listed below Stock W Stock X Stock Y Stock Z Return 40.0% 30.0% 26.0% 18.0% Weight Stock Y 0% 0% Weight Stock W 100% 80% 40% 0% 0% 0% Weight Stock X 0% 20% 40% 30% Portfolio1 Portfolio 2 Portfolio 3 Portfolio 4 Portfolio5 Portfolio 6 Weight Stock Z 0% 0% 0% 20% 85% 100% 20% 0% 0% 50% 15% 0% 22. Assume your client currently owns $480 of Stock W, $820 of Stock X, $300 of Stock Y and $400 of stock Z. Your goal is to maintain the client's expected return while lowing the client's total risk by rebalancing the client's current portfolio to fall on the efficient frontier between two of the corner portfolios. To rebalance the portfolio, you will need to buy or sell a certain dollar amount of each stock. Which of the following statements is TRUE: I. II. Sell $20 Stock W Sell $60 Stock X Buy $400 Stock Y Sell $320 Stock Z IV. b) 11 III d) IV e) All of the statements Use the information below to help answer questions 22 Excel's solver was used to create the Minimum Variance Frontier (MVF) for Stock X, Stock Y, Stock Z Portfolios 1-6 are on the MVF Portfolios 1-5 are corner portfolios on the efficient frontier The return of each stock and the weight of each stock in each portfolio is listed below Stock W Stock X Stock Y Stock Z Return 40.0% 30.0% 26.0% 18.0% Weight Stock Y 0% 0% Weight Stock W 100% 80% 40% 0% 0% 0% Weight Stock X 0% 20% 40% 30% Portfolio1 Portfolio 2 Portfolio 3 Portfolio 4 Portfolio5 Portfolio 6 Weight Stock Z 0% 0% 0% 20% 85% 100% 20% 0% 0% 50% 15% 0% 22. Assume your client currently owns $480 of Stock W, $820 of Stock X, $300 of Stock Y and $400 of stock Z. Your goal is to maintain the client's expected return while lowing the client's total risk by rebalancing the client's current portfolio to fall on the efficient frontier between two of the corner portfolios. To rebalance the portfolio, you will need to buy or sell a certain dollar amount of each stock. Which of the following statements is TRUE: I. II. Sell $20 Stock W Sell $60 Stock X Buy $400 Stock Y Sell $320 Stock Z IV. b) 11 III d) IV e) All of the statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts