Question: Question 2 Question text Stock As expected dividend for next year is :- a. $0.378 b. $0.360 c. $0.432 d. $0.534 Clear my choice Question

Question 2

Question text

Question 3

Question text

Question 4

Question text

Question 5

Question text

Question 6

Question text

Question 7

Question text

Question 8

Question text

Question 9

Question text

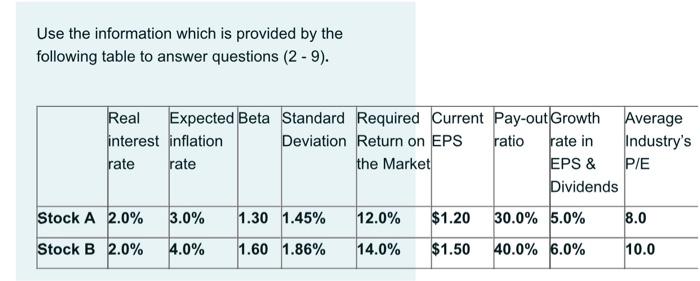

Use the information which is provided by the following table to answer questions (2 - 9). Real Expected Beta Standard Required Current Pay-out Growth Average interest inflation Deviation Return on EPS ratio rate in Industry's rate rate the Market EPS & PIE Dividends Stock A 2.0% 3.0% 1.30 1.45% 12.0% $1.20 30.0% 5.0% 8.0 Stock B 2.0% 4.0% 1.60 1.86% 14.0% $1.50 40.0% 6.0% 10.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts