Question: Use the NPV method to determine whether Smith Products should invest in the following projects: - Project A: Costs ( $ 295,000 ) and offers

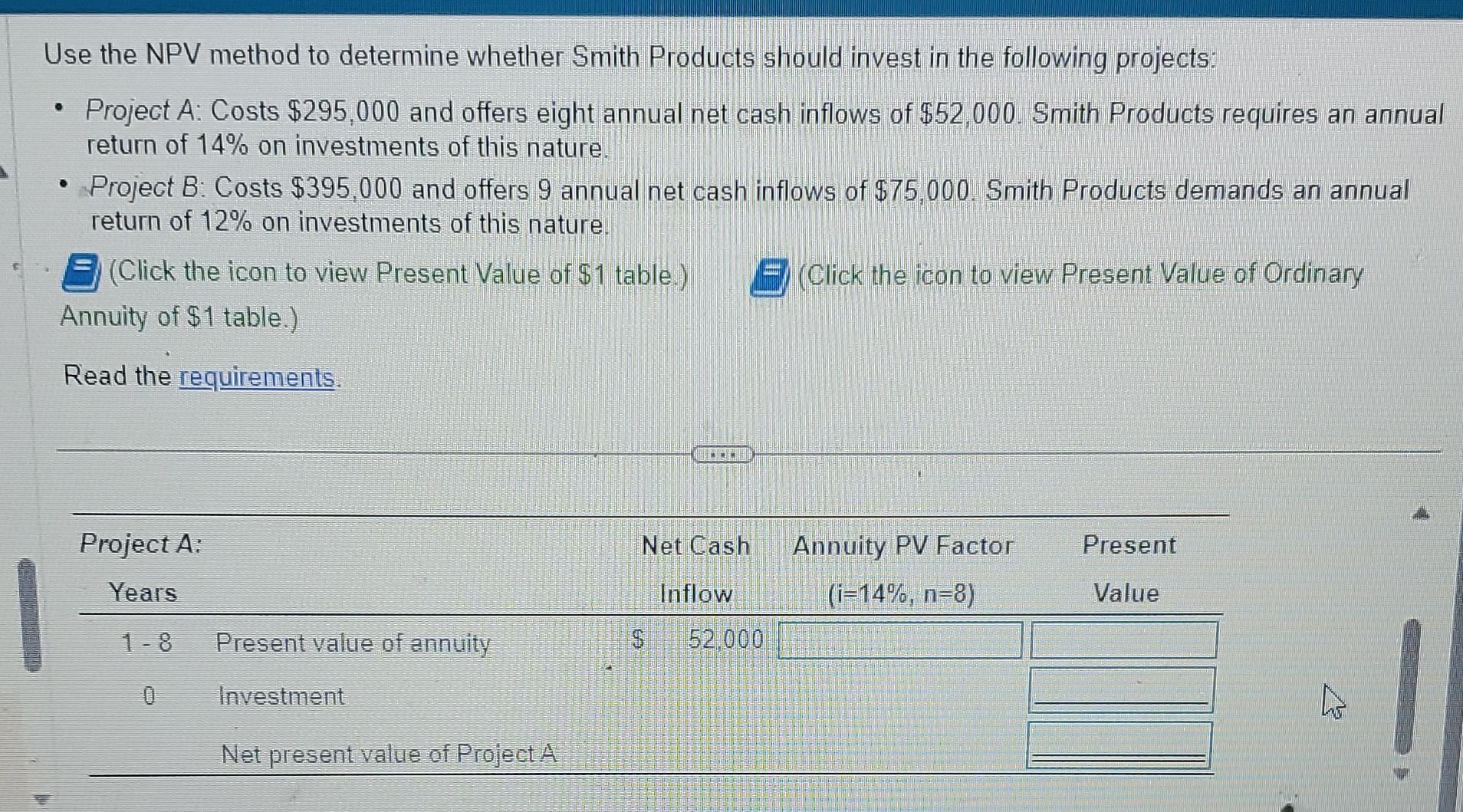

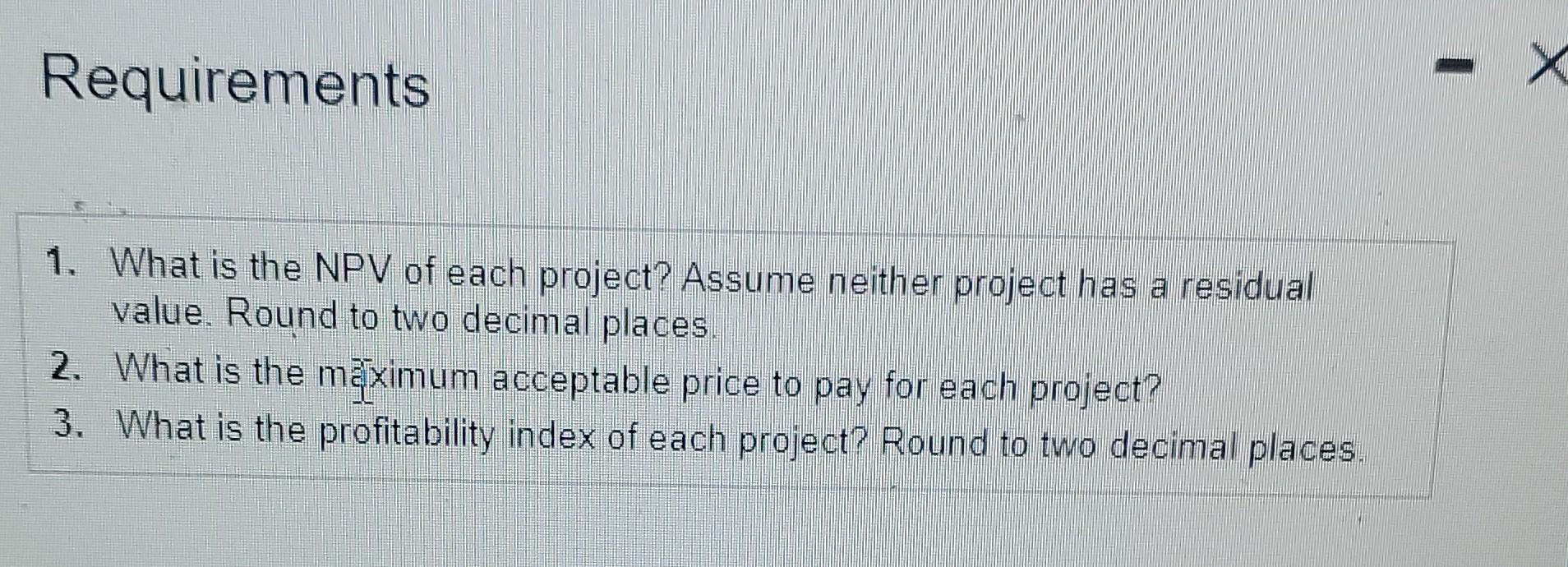

Use the NPV method to determine whether Smith Products should invest in the following projects: - Project A: Costs \\( \\$ 295,000 \\) and offers eight annual net cash inflows of \\( \\$ 52,000 \\). Smith Products requires an annual return of \14 on investments of this nature. - Project B: Costs \\( \\$ 395,000 \\) and offers 9 annual net cash inflows of \\( \\$ 75,000 \\). Smith Products demands an annual return of \12 on investments of this nature. (Click the icon to view Present Value of \\( \\$ 1 \\) table.) (Click the icon to view Present Value of Ordinary Annuity of \\( \\$ 1 \\) table.) Read the requirements. Requirements 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. 2. What is the man acimum acceptable price to pay for each project? 3. What is the profitability index of each project? Round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts