Question: use the pages below to thoroughly answer the question 5. Describe how the five forces can be used to deter- mine the average expected profitability

use the pages below to thoroughly answer the question

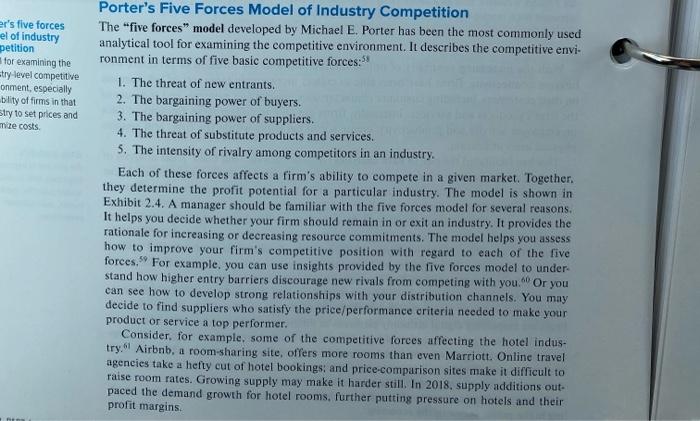

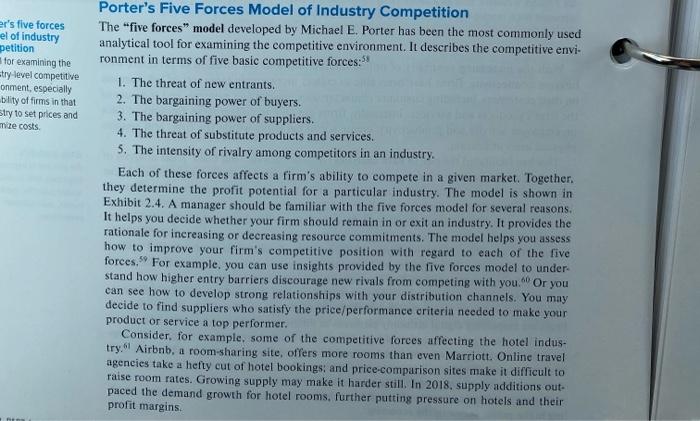

5. Describe how the five forces can be used to deter- mine the average expected profitability in an industry. er's five forces el of industry petition for examining the try level competitive onment, especially ability of firms in that Stry to set prices and mize costs Porter's Five Forces Model of Industry Competition The "five forces" model developed by Michael E. Porter has been the most commonly used analytical tool for examining the competitive environment. It describes the competitive envi- ronment in terms of five basic competitive forces: 1. The threat of new entrants. 2. The bargaining power of buyers. 3. The bargaining power of suppliers. 4. The threat of substitute products and services. 5. The intensity of rivalry among competitors in an industry. Each of these forces affects a firm's ability to compete in a given market. Together. they determine the profit potential for a particular industry. The model is shown in Exhibit 2.4. A manager should be familiar with the five forces model for several reasons. It helps you decide whether your firm should remain in or exit an industry. It provides the rationale for increasing or decreasing resource commitments. The model helps you assess how to improve your firm's competitive position with regard to each of the five forces. For example, you can use insights provided by the five forces model to under 59 stand how higher entry barriers discourage new rivals from competing with you. can see how to develop strong relationships with your distribution channels. You may decide to find suppliers who satisfy the price/performance criteria needed to make your product or service a top performer. Consider, for example, some of the competitive forces affecting the hotel indus- try. Airbnb, a room-sharing site, offers more rooms than even Marriott. Online travel agencies take a hefty cut of hotel bookings: and price.comparison sites make it difficult to raise room rates. Growing supply may make it harder still. In 2018, supply additions out- paced the demand growth for hotel rooms, further putting pressure on hotels and their profit margins Or you EXHIBIT 2.4 Porter's Five Forces Model of industry Competition POTENTI. ENTRANTS Burgaining power of suppliers Threat of Substitute products of services Bargaining power INDUSTRY of buyers COMPETITORS BUYERS Rivalry anong Eesting Firms SUPPLIERS Threat of now erants SUBSTITUTES Source Porter, M. E. 2008. The five competitive ones that has Special Centennial Honu Ree TX 78-9). The Threat of New Entrants The threat of new entrants refers to the possibility that the threat of new entrants profits of established firms in the industry may be eroded by new competitors. The extent the possibility that of the threat depends on existing barriers to entry and the combined reactions from existing pots of establishers competitors. If entry barriers are high and/or the newcomer can anticipate a sharp retalia is the industy cay to coded by bew tion from established competitors the threat of entry is low These circumstances discour co age new competitors. There are six major sources of entry barriers. Economies of Scale Economies of scale refers to spreading the costs of production over the economies of scale mumber of units produced. The cost of a product per unit declines as the absolute volume Dincoln per period increases. This deters entry by forcing the entrant to come in at a large scale and mabile upute risk strong reaction from existing firms or come in at a small scale and accept a cost disad vantage. Both are undesirable options. Product Differation when existing competitors have strong brand identification and customer loyalty product differentiation creates a barrier to entry by forcing entrants to product spend heavily to overcome existing customer loyalties differentiation he degree owhid the song and Capital Requirements The need to invest large financial resources to compete creates a kvart barrier to entry, especially the capital is required for risky or unrecoverable up front adver tising or research and development (R&D) Switchine Con A burrier 10 entry is created by the existence of one time costs that the cost buyer faces when switching from one supplier's product or service to another - yetlerce de Distributi Chark The new entrant's need to secure diuinbution for inspired hingan uct can create a barrier to entry OPTER 2 ANALYZING THE EXTERNAL ENVIRONMENT OF THE 1 124 These examples are not meant to trivialize the strategic groups concept." Classifying an industry into strategic groups involves judgment. If it is useful as an analytical tool. we must exercise caution in deciding what dimensions to use to map these firms. Dimensions include breadth of product and geographic scope, price/quality, degree of vertical integration, type of distribution (eg, dealers, mass merchandisers, private label), and so on. Dimensions should also be selected to reflect the variety of strategie combinations in an industry. For example, if all firms in an industry have roughly the same level of product differentiation (or R&D intensity), this would not be a good dimension to select What value is the strategic groups concept as an analytical tool? First, strategle groupings help a firm identify barriers to mobility that protect a group from attacks by other groups. Mobility barriers are factors that deter the movement of firms from one strategic position to another. For example, in the chainsaw industry, the major barriers protecting the high- quality/dealer-oriented group are technology, brand image, and an established network of servicing dealers. The second value of strategic grouping is that it helps a firm Identify groups whose com petitive prisition may be marginal or lenious. We may anticipate that these competitors may exit the industry or try to move into another group. In recent years in the retail department store industry, firms such as JC Penney and Sears have experienced extremely difficult times because they were stuck in the middle, neither an aggressive discount player like Walmart nor a prestigious upscale player like Neiman Marcus Third, strategic groupings help chart the future directions of firms strategies. Arrows emanating from each strategic group can represent the direction in which the group (or a firm within the group) seems to be moving. If all strategic groups are moving in a similar direction, this could indicate a high degree of future volatility and intensity of competi- tion. In the automobile industry, for example, the competition in the minivan and sport utility segments has intensified in recent years as many firms have entered those product segments, Fourth, strategic groups are helpful in thinking through the implications of each industry trend for the strategic group as a whole. Is the trend decreasing the viability of a group? If so, in what direction should the strategic group move? Is the trend increasing or decreasing entry barriers? Will the trend decrease the ability of one group to separate itself from other groups? Such analysis can help in making predictions about industry evolution. A sharp increase in interest rates, for example, tends to have less impact on providers of higher priced goods (e... Porsches) than on providers of lower-priced goods (eg.. Chevrolet Cobalt), whose customer base is much more price-sensitive Exhibit 2.7 provides a strategic grouping of the worldwide automobile industry. The 91 firms in each group are representative: not all firms are included in the mapping. We have identified five strategic groups. In the top left-hand corner are high-end luxury automak ers that focus on a very narrow product market. Most of the cars produced by the mem. bers of this group cost well over $100,000. Some cost over twice that amount. The 2017 Ferrari California T starts at $210.843, and the 2017 Lamborghini Huracan will set you back $210,000 (in case you were wondering how to spend your employment signing bonus). Players in this market have a very exclusive clientele and face little rivalry from other strategic groups. Close to the bottom left-hand corner is a strategie group that has low-price/quality attributes and targets a narrow market. These players. Hyundai and Kia. limit competition from other strategic groups by pricing their products very low. The third group (near the middle) consists of firms such as Mercedes and BMW that are high in product pricing quality and average in their product line breadth. The fourth group (at the far right) consists of firms with a broad range of products and multiple price points. These firms have entries that compete at both the lower end of the market (e.s. the Ford Focus) and the higher end (e... Chevrolet Corvette) CHAPTER 2 ANALYZING THE EXTERNAL ENVIRONMENT OF THE FIRM 61

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock