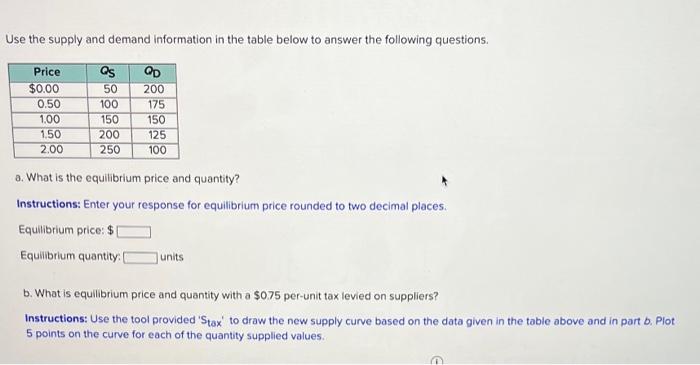

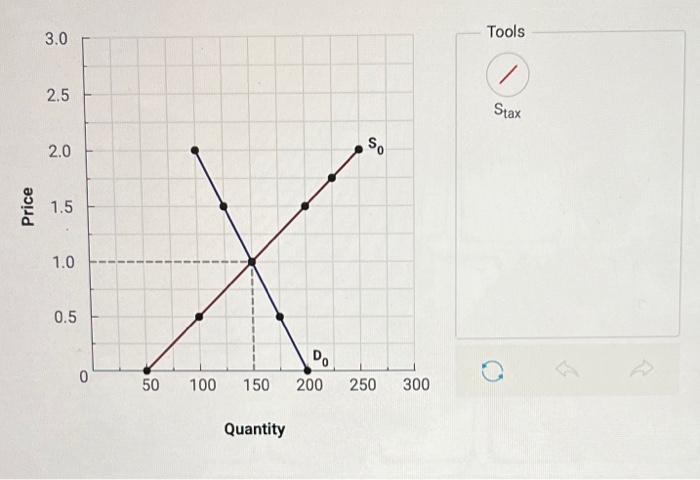

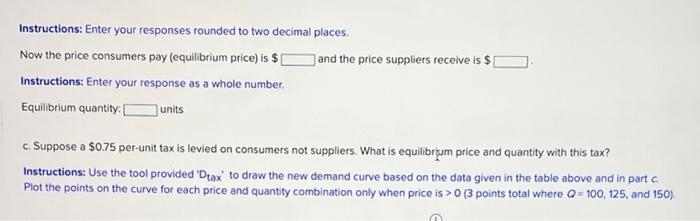

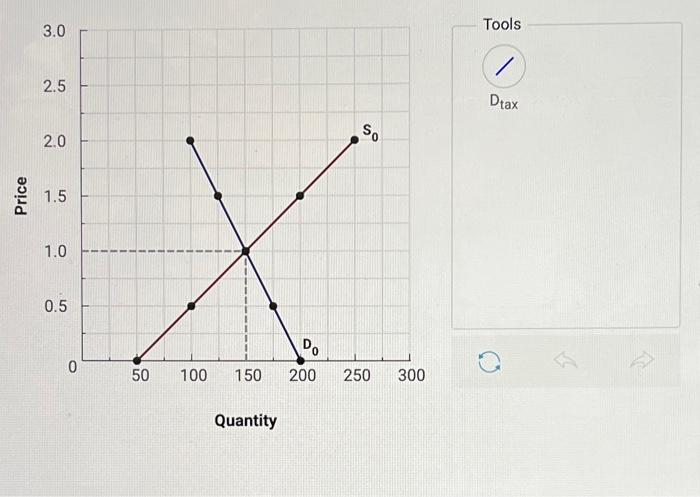

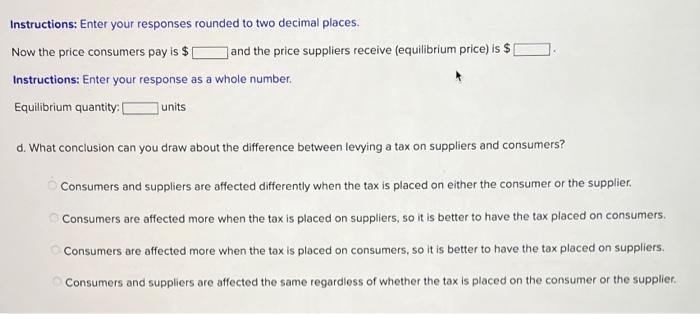

Question: Use the supply and demand information in the table below to answer the following questions, Price $0.00 0.50 1.00 1.50 2.00 as 50 100 150

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock