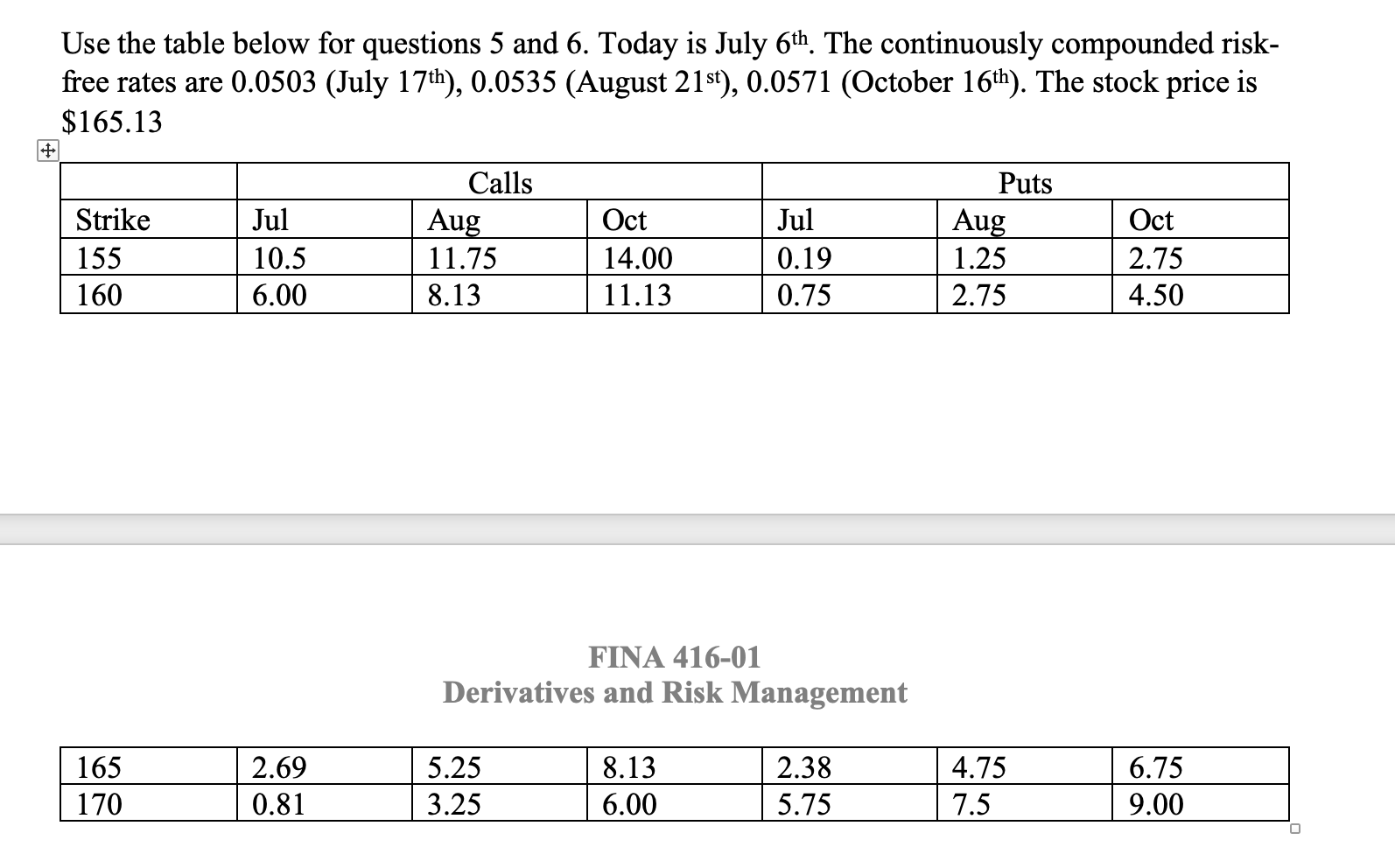

Question: Use the table below for questions 5 and 6 . Today is July 6th. The continuously compounded riskfree rates are 0.0503 (July 17 7th),0.0535 (August

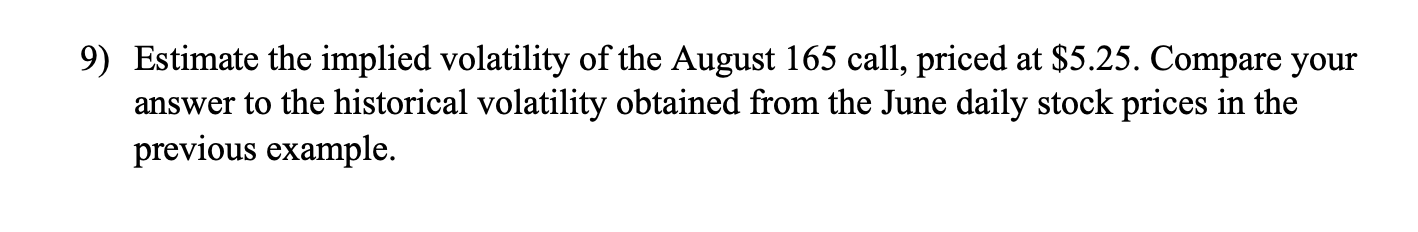

Use the table below for questions 5 and 6 . Today is July 6th. The continuously compounded riskfree rates are 0.0503 (July 17 7th),0.0535 (August 21st),0.0571( October 16th). The stock price is $165.13 FINA 416-01 Derivatives and Risk Management Estimate the implied volatility of the August 165 call, priced at $5.25. Compare your answer to the historical volatility obtained from the June daily stock prices in the previous example. Use the table below for questions 5 and 6 . Today is July 6th. The continuously compounded riskfree rates are 0.0503 (July 17 7th),0.0535 (August 21st),0.0571( October 16th). The stock price is $165.13 FINA 416-01 Derivatives and Risk Management Estimate the implied volatility of the August 165 call, priced at $5.25. Compare your answer to the historical volatility obtained from the June daily stock prices in the previous example

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts