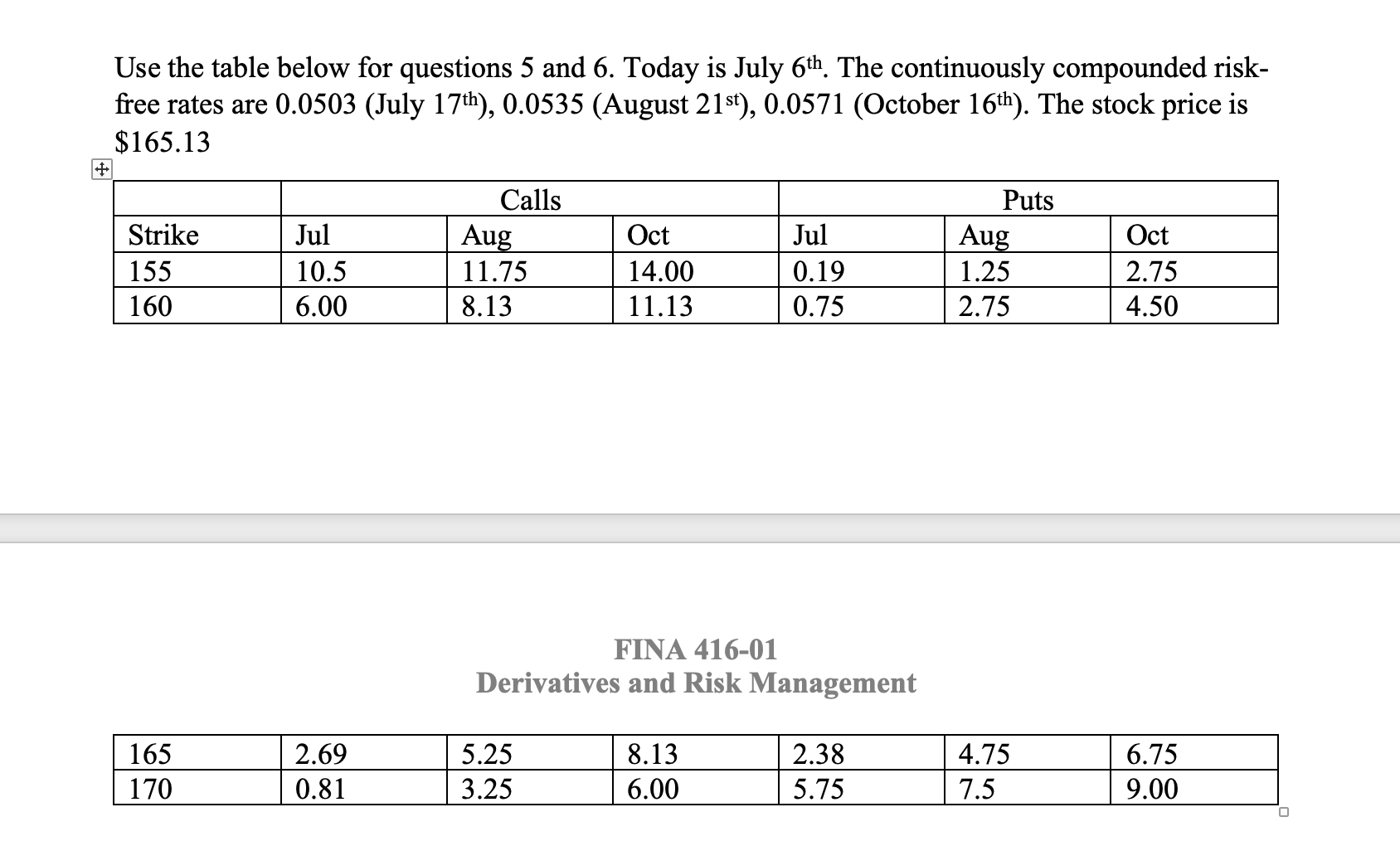

Question: Use the table below for questions 5 and 6 . Today is July 6th. The continuously compounded riskfree rates are 0.0503 (July 17th),0.0535 (August 21st),0.0571

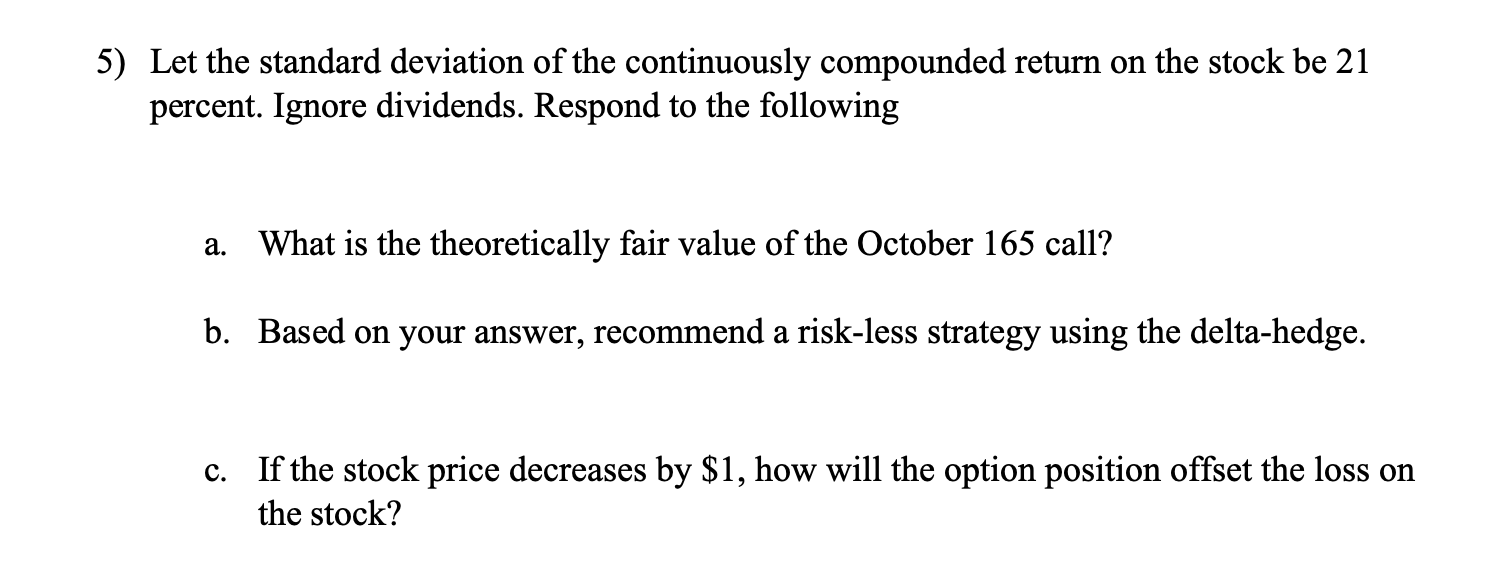

Use the table below for questions 5 and 6 . Today is July 6th. The continuously compounded riskfree rates are 0.0503 (July 17th),0.0535 (August 21st),0.0571 (October 16th). The stock price is $165.13 FINA 416-01 Derivatives and Risk Management Let the standard deviation of the continuously compounded return on the stock be 21 percent. Ignore dividends. Respond to the following a. What is the theoretically fair value of the October 165 call? b. Based on your answer, recommend a risk-less strategy using the delta-hedge. c. If the stock price decreases by $1, how will the option position offset the loss on the stock? Use the table below for questions 5 and 6 . Today is July 6th. The continuously compounded riskfree rates are 0.0503 (July 17th),0.0535 (August 21st),0.0571 (October 16th). The stock price is $165.13 FINA 416-01 Derivatives and Risk Management Let the standard deviation of the continuously compounded return on the stock be 21 percent. Ignore dividends. Respond to the following a. What is the theoretically fair value of the October 165 call? b. Based on your answer, recommend a risk-less strategy using the delta-hedge. c. If the stock price decreases by $1, how will the option position offset the loss on the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts