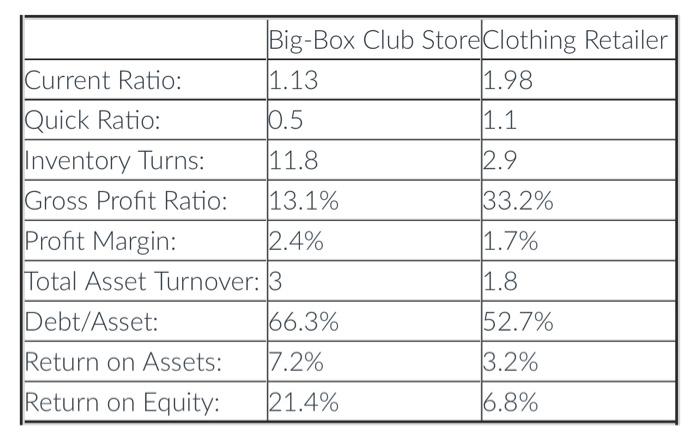

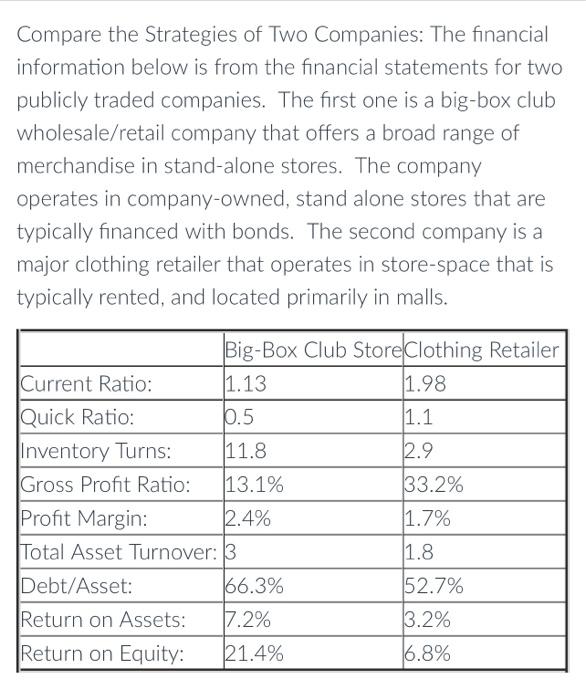

Question: use this to solve the problem Use this table to answer the 3 questions please begin{tabular}{|l|l|l|} hline & Big-Box Club Store & Clothing Retailer

use this to solve the problem

use this to solve the problem

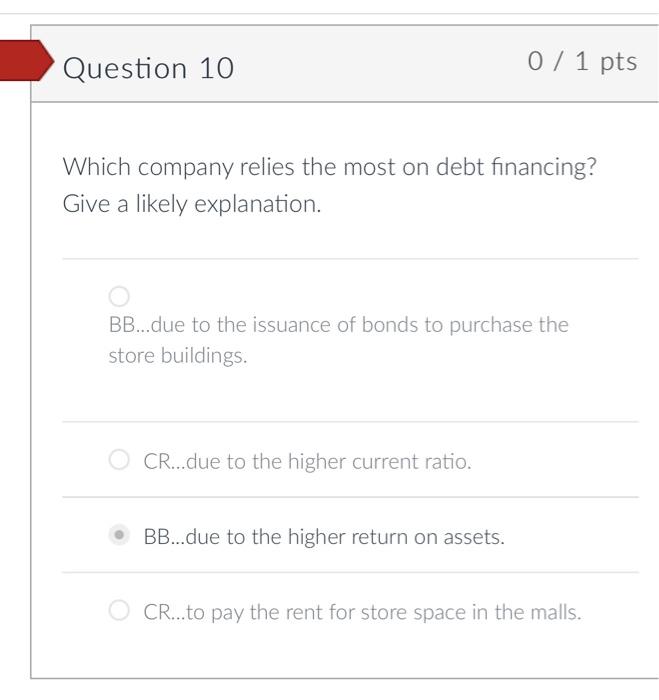

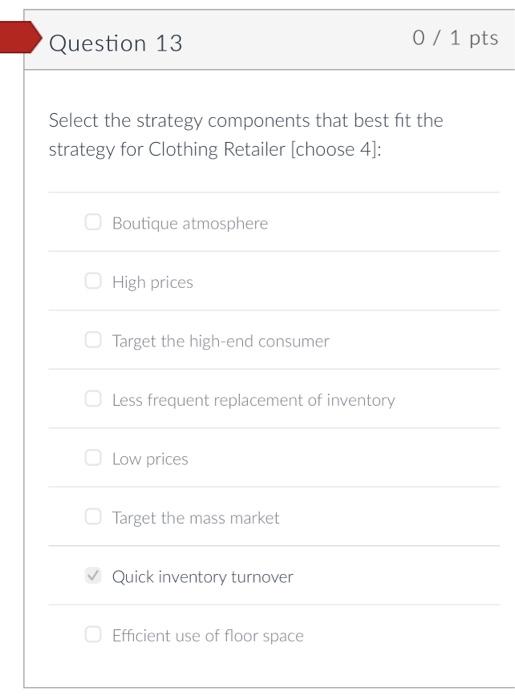

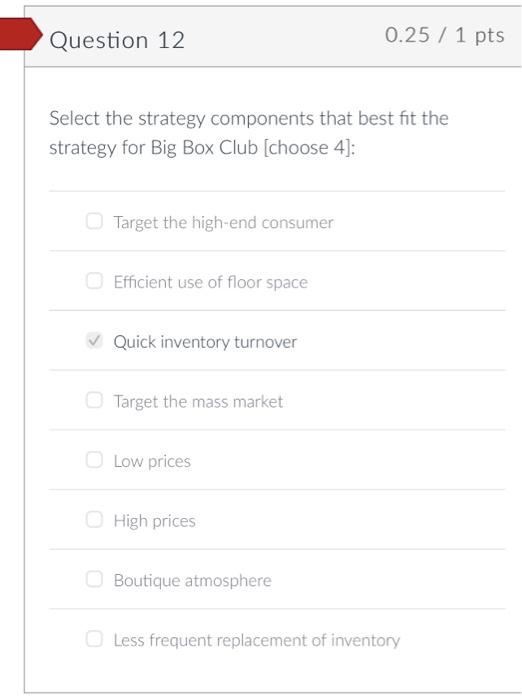

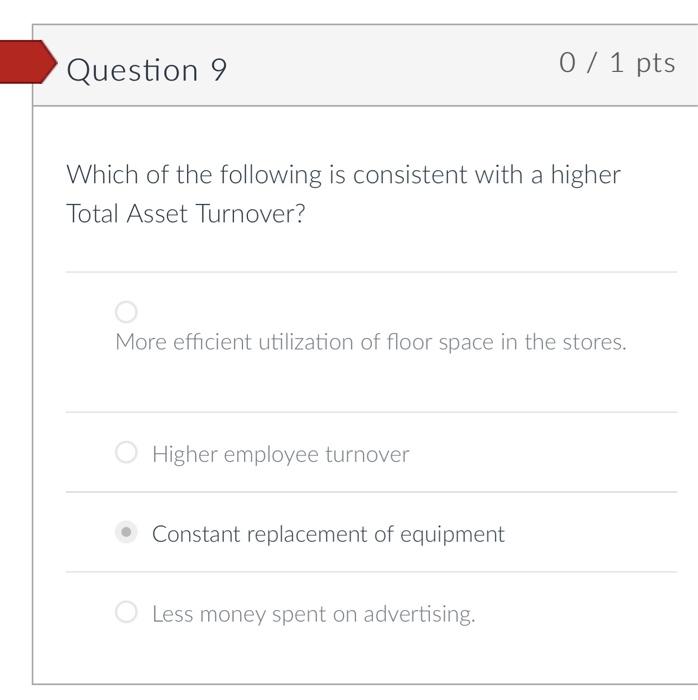

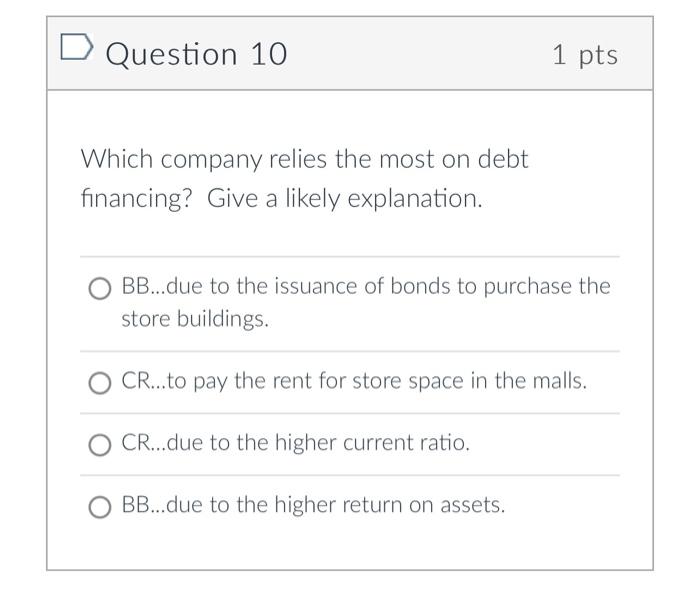

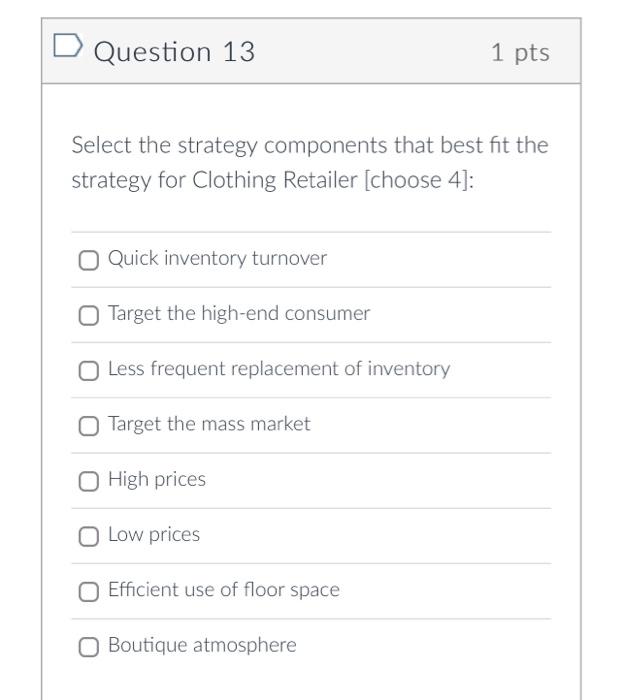

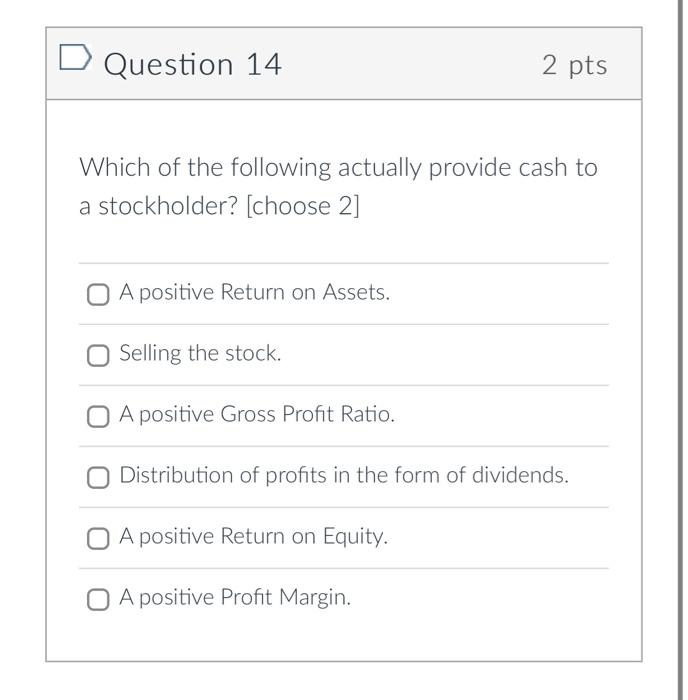

\begin{tabular}{|l|l|l|} \hline & Big-Box Club Store & Clothing Retailer \\ \hline Current Ratio: & 1.13 & 1.98 \\ \hline Quick Ratio: & 0.5 & 1.1 \\ \hline Inventory Turns: & 11.8 & 2.9 \\ \hline Gross Profit Ratio: & 13.1% & 33.2% \\ \hline Profit Margin: & 2.4% & 1.7% \\ \hline Total Asset Turnover: & 3 & 1.8 \\ \hline Debt/Asset: & 66.3% & 52.7% \\ \hline Return on Assets: & 7.2% & 3.2% \\ \hline Return on Equity: & 21.4% & 6.8% \\ \hline \end{tabular} Which company relies the most on debt financing? Give a likely explanation. BB...due to the issuance of bonds to purchase the store buildings. CR...due to the higher current ratio. BB...due to the higher return on assets. CR...to pay the rent for store space in the malls. Select the strategy components that best fit the strategy for Clothing Retailer [choose 4]: Boutique atmosphere High prices Target the high-end consumer Less frequent replacement of inventory Low prices Target the mass market Quick inventory turnover Efficient use of floor space Select the strategy components that best fit the strategy for Big Box Club [choose 4]: Target the high-end consumer Efficient use of floor space Quick inventory turnover Target the mass market Low prices High prices Boutique atmosphere Less frequent replacement of inventory Which of the following is consistent with a higher Total Asset Turnover? More efficient utilization of floor space in the stores. Higher employee turnover Constant replacement of equipment Less money spent on advertising. Compare the Strategies of Two Companies: The financial information below is from the financial statements for two publicly traded companies. The first one is a big-box club wholesale/retail company that offers a broad range of merchandise in stand-alone stores. The company operates in company-owned, stand alone stores that are typically financed with bonds. The second company is a major clothing retailer that operates in store-space that is typically rented, and located primarily in malls. Which company relies the most on debt financing? Give a likely explanation. BB...due to the issuance of bonds to purchase the store buildings. CR...to pay the rent for store space in the malls. CR...due to the higher current ratio. BB...due to the higher return on assets. Question 13 1 pts Select the strategy components that best fit the strategy for Clothing Retailer [choose 4]: Quick inventory turnover Target the high-end consumer Less frequent replacement of inventory Target the mass market High prices Low prices Efficient use of floor space Boutique atmosphere Question 14 2 pts Which of the following actually provide cash to a stockholder? [choose 2] A positive Return on Assets. Selling the stock. A positive Gross Profit Ratio. Distribution of profits in the form of dividends. A positive Return on Equity. A positive Profit Margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts