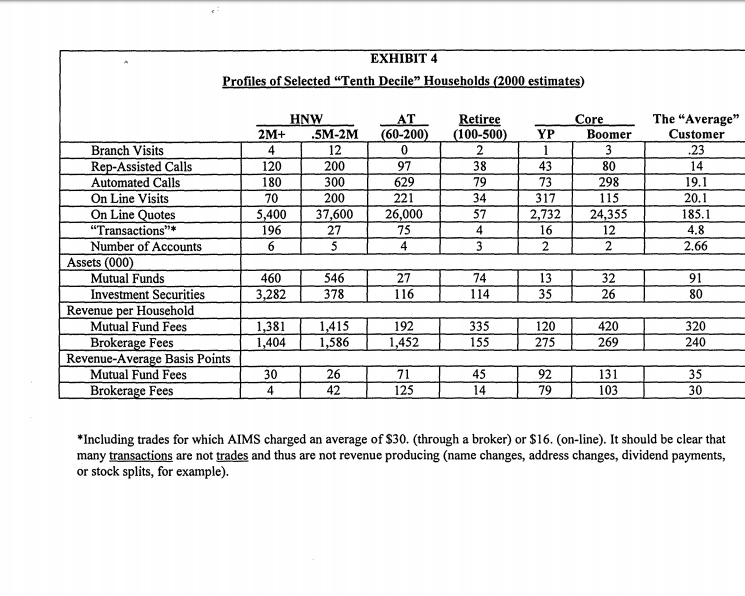

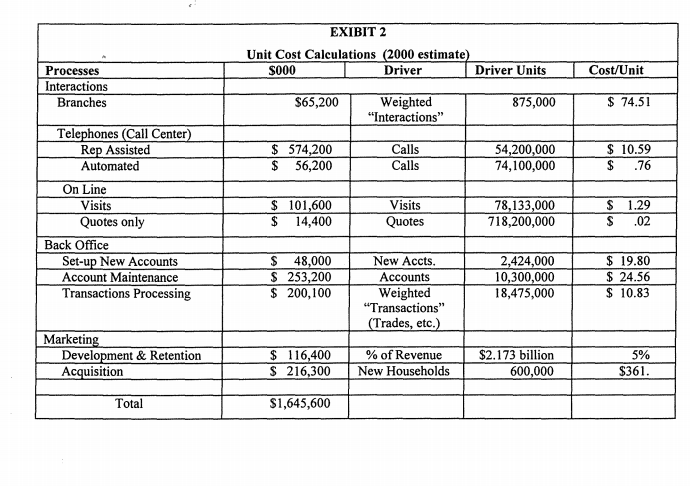

Question: . Using ABC analysis, and the information in Exhibits 2 and 4, calculate the loss per household for the six customer profiles per Exhibit 4.

.

.

Using ABC analysis, and the information in Exhibits 2 and 4, calculate the loss per household for the six customer profiles per Exhibit 4. Round your calculations to the nearest dollar.

EXHIBIT 4 Profiles of Selected "Tenth Decile Households (2000 estimates) The The "Average" Customer .23 43 14 HNW _AT_ Retiree Core 2M+ 5M-2M (60-200) (100-500) YP Boomer 4 12 0 120 200 97 38 80 300 629 79 73 298 200 221 34 317 115 5,400 37,600 26,000 57 2,732 24,355 196 27 75 16 12 6 5 14 13 12 1 2 180 70 19.1 20.1 185.1 4.8 2.66 Branch Visits Rep-Assisted Calls Automated Calls On Line Visits On Line Quotes "Transactions"* Number of Accounts Assets (000) Mutual Funds Investment Securities Revenue per Household Mutual Fund Fees Brokerage Fees Revenue-Average Basis Points Mutual Fund Fees Brokerage Fees 460 3,282 546 378 27 116 74 114 13 35 32 26 | | | | | 91 80 1 1,381 1,4151 1,4041,586 192 1 1,452 335 155 120 | 2751 420 269 | 320 2 40 11 71 30 4 26 42T 125 45T 14 92T 79T 131 103 *Including trades for which AIMS charged an average of $30. (through a broker) or $16. (on-line). It should be clear that many transactions are not trades and thus are not revenue producing (name changes, address changes, dividend payments, or stock splits, for example). EXIBIT 2 Unit Cost Calculations (2000 estimate) Driver Driver Units S000 Cost/Unit Processes Interactions Branches $65,200 Weighted "Interactions" 875,000 $ 74.51 $ 574,200 $ 56,200 Calls Calls 54,200,000 74,100,000 $ 10.59 $ .76 Telephones (Call Center) Rep Assisted Automated On Line Visits Quotes only Back Office Set-up New Accounts Account Maintenance Transactions Processing $ 101,600 $ 14,400 Visits Quotes 78,133,000 718,200,000 $ $ 1.29 .02 $ 48,000 $ 253,200 $ 200,100 New Accts. Accounts Weighted "Transactions" (Trades, etc.) 2,424,000 10,300,000 18,475,000 $ 19.80 $ 24.56 $ 10.83 Marketing Development & Retention Acquisition $ 116,400 $ 216,300 % of Revenue New Households $2.173 billion 600,000 5% $361. Total $1,645,600 EXHIBIT 4 Profiles of Selected "Tenth Decile Households (2000 estimates) The The "Average" Customer .23 43 14 HNW _AT_ Retiree Core 2M+ 5M-2M (60-200) (100-500) YP Boomer 4 12 0 120 200 97 38 80 300 629 79 73 298 200 221 34 317 115 5,400 37,600 26,000 57 2,732 24,355 196 27 75 16 12 6 5 14 13 12 1 2 180 70 19.1 20.1 185.1 4.8 2.66 Branch Visits Rep-Assisted Calls Automated Calls On Line Visits On Line Quotes "Transactions"* Number of Accounts Assets (000) Mutual Funds Investment Securities Revenue per Household Mutual Fund Fees Brokerage Fees Revenue-Average Basis Points Mutual Fund Fees Brokerage Fees 460 3,282 546 378 27 116 74 114 13 35 32 26 | | | | | 91 80 1 1,381 1,4151 1,4041,586 192 1 1,452 335 155 120 | 2751 420 269 | 320 2 40 11 71 30 4 26 42T 125 45T 14 92T 79T 131 103 *Including trades for which AIMS charged an average of $30. (through a broker) or $16. (on-line). It should be clear that many transactions are not trades and thus are not revenue producing (name changes, address changes, dividend payments, or stock splits, for example). EXIBIT 2 Unit Cost Calculations (2000 estimate) Driver Driver Units S000 Cost/Unit Processes Interactions Branches $65,200 Weighted "Interactions" 875,000 $ 74.51 $ 574,200 $ 56,200 Calls Calls 54,200,000 74,100,000 $ 10.59 $ .76 Telephones (Call Center) Rep Assisted Automated On Line Visits Quotes only Back Office Set-up New Accounts Account Maintenance Transactions Processing $ 101,600 $ 14,400 Visits Quotes 78,133,000 718,200,000 $ $ 1.29 .02 $ 48,000 $ 253,200 $ 200,100 New Accts. Accounts Weighted "Transactions" (Trades, etc.) 2,424,000 10,300,000 18,475,000 $ 19.80 $ 24.56 $ 10.83 Marketing Development & Retention Acquisition $ 116,400 $ 216,300 % of Revenue New Households $2.173 billion 600,000 5% $361. Total $1,645,600Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts