Question: Using ILAS method Question 1 Dan Razzle and Zeus have been in business together as picture framers and art restorers since 2015. Their clients include

Using ILAS method

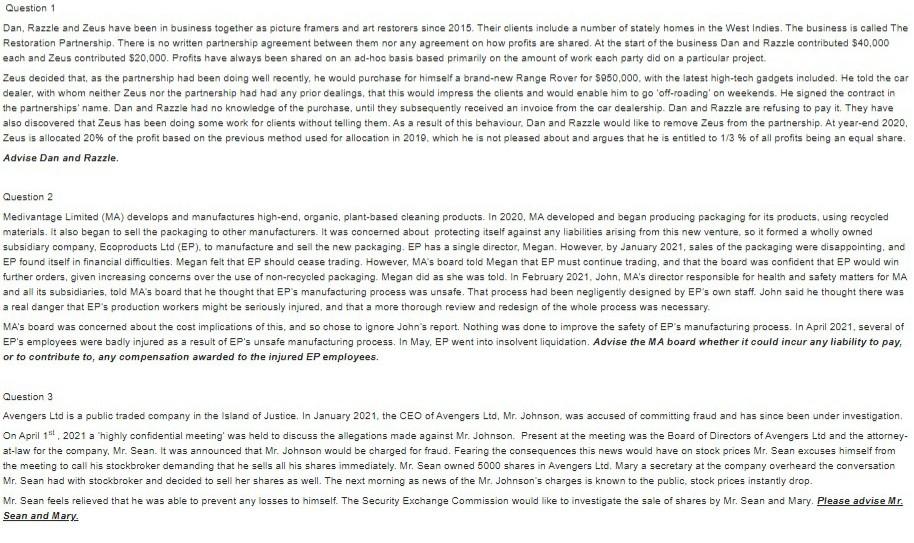

Question 1 Dan Razzle and Zeus have been in business together as picture framers and art restorers since 2015. Their clients include a number of stately homes in the West Indies. The business is called The Restoration Partnership. There is no written partnership agreement between them nor any agreement on how profits are shared. At the start of the business Dan and Razzle contributed $40,000 each and Zeus contributed $20,000. Profits have always been shared on an ad-hoc basis based primarily on the amount of work each party did on a particular project. Zeus decided that, as the partnership had been doing well recently, he would purchase for himself a brand-new Range Rover for $950,000, with the latest high-tech gadgets included. He told the car dealer, with whom neither Zeus nor the partnership had had any prior dealings, that this would impress the clients and would enable him to go off-roading' on weekends. He signed the contract in the partnerships' name. Dan and Razzle had no knowledge of the purchase, until they subsequently received an invoice from the car dealership. Dan and Razzle are refusing to pay it. They have also discovered that Zeus has been doing some work for clients without telling them. As a result of this behaviour. Dan and Razzle would like to remove Zeus from the partnership. At year-end 2020, Zeus is allocated 20% of the profit based on the previous method used for allocation in 2019, which he is not pleased about and argues that he is entitled to 1/3 % of all profits being an equal share. Advise Dan and Razzle. Question 2 Medivantage Limited (MA) develops and manufactures high-end, organic, plant-based cleaning products. In 2020, MA developed and began producing packaging for its products, using recycled materials. It also began to sell the packaging to other manufacturers. It was concerned about protecting itself against any liabilities arising from this new venture, so it formed a wholly owned subsidiary company, Ecoproducts Ltd (EP). to manufacture and sell the new packaging EP has a single director, Megan. However. by January 2021, sales of the packaging were disappointing, and EP found itself in financial difficulties, Megan felt that EP should cease trading. However, MA's board told Megan that EP must continue trading, and that the board was confident that EP would win further orders, given increasing concerns over the use of non-recycled packaging. Megan did as she was told. In February 2021, John, MA's director responsible for health and safety matters for MA and all its subsidiaries, told MA's board that he thought that EP's manufacturing process was unsafe. That process had been negligently designed by EP's own staff. John said he thought there was a real danger that EP's production workers might be seriously injured, and that a more thorough review and redesign of the whole process was necessary MA's board was concerned about the cost implications of this, and so chose to ignore John's report. Nothing was done to improve the safety of EP's manufacturing process. In April 2021. several of EP's employees were badly injured as a result of EP's unsafe manufacturing process. In May, EP went into insolvent liquidation Advise the MA board whether it could incur any liability to pay, or to contribute to any compensation awarded to the injured EP employees. Question 3 Avengers Ltd is a public traded company in the island of Justice. In January 2021. the CEO of Avengers Ltd, Mr. Johnson, was accused of committing fraud and has since been under investigation, On April 16, 2021 a highly confidential meeting was held to discuss the allegations made against Mr. Johnson Present at the meeting was the Board of Directors of Avengers Ltd and the attorney- at-law for the company. Mr. Sean. It was announced that Mr. Johnson would be charged for fraud. Fearing the consequences this news would have on stock prices Mr. Sean excuses himself from the meeting to call his stockbroker demanding that he sells all his shares immediately. Mr. Sean owned 5000 shares in Avengers Ltd, Mary a secretary at the company overheard the conversation Mr. Sean had with stockbroker and decided to sell her shares as well. The next morning as news of the Mr. Johnson's charges is known to the public, stock prices instantly drop. Mr. Sean feels relieved that he was able to prevent any losses to himself. The Security Exchange Commission would like to investigate the sale of shares by Mr. Sean and Mary. Please advise Mr. Sean and Mary Question 1 Dan Razzle and Zeus have been in business together as picture framers and art restorers since 2015. Their clients include a number of stately homes in the West Indies. The business is called The Restoration Partnership. There is no written partnership agreement between them nor any agreement on how profits are shared. At the start of the business Dan and Razzle contributed $40,000 each and Zeus contributed $20,000. Profits have always been shared on an ad-hoc basis based primarily on the amount of work each party did on a particular project. Zeus decided that, as the partnership had been doing well recently, he would purchase for himself a brand-new Range Rover for $950,000, with the latest high-tech gadgets included. He told the car dealer, with whom neither Zeus nor the partnership had had any prior dealings, that this would impress the clients and would enable him to go off-roading' on weekends. He signed the contract in the partnerships' name. Dan and Razzle had no knowledge of the purchase, until they subsequently received an invoice from the car dealership. Dan and Razzle are refusing to pay it. They have also discovered that Zeus has been doing some work for clients without telling them. As a result of this behaviour. Dan and Razzle would like to remove Zeus from the partnership. At year-end 2020, Zeus is allocated 20% of the profit based on the previous method used for allocation in 2019, which he is not pleased about and argues that he is entitled to 1/3 % of all profits being an equal share. Advise Dan and Razzle. Question 2 Medivantage Limited (MA) develops and manufactures high-end, organic, plant-based cleaning products. In 2020, MA developed and began producing packaging for its products, using recycled materials. It also began to sell the packaging to other manufacturers. It was concerned about protecting itself against any liabilities arising from this new venture, so it formed a wholly owned subsidiary company, Ecoproducts Ltd (EP). to manufacture and sell the new packaging EP has a single director, Megan. However. by January 2021, sales of the packaging were disappointing, and EP found itself in financial difficulties, Megan felt that EP should cease trading. However, MA's board told Megan that EP must continue trading, and that the board was confident that EP would win further orders, given increasing concerns over the use of non-recycled packaging. Megan did as she was told. In February 2021, John, MA's director responsible for health and safety matters for MA and all its subsidiaries, told MA's board that he thought that EP's manufacturing process was unsafe. That process had been negligently designed by EP's own staff. John said he thought there was a real danger that EP's production workers might be seriously injured, and that a more thorough review and redesign of the whole process was necessary MA's board was concerned about the cost implications of this, and so chose to ignore John's report. Nothing was done to improve the safety of EP's manufacturing process. In April 2021. several of EP's employees were badly injured as a result of EP's unsafe manufacturing process. In May, EP went into insolvent liquidation Advise the MA board whether it could incur any liability to pay, or to contribute to any compensation awarded to the injured EP employees. Question 3 Avengers Ltd is a public traded company in the island of Justice. In January 2021. the CEO of Avengers Ltd, Mr. Johnson, was accused of committing fraud and has since been under investigation, On April 16, 2021 a highly confidential meeting was held to discuss the allegations made against Mr. Johnson Present at the meeting was the Board of Directors of Avengers Ltd and the attorney- at-law for the company. Mr. Sean. It was announced that Mr. Johnson would be charged for fraud. Fearing the consequences this news would have on stock prices Mr. Sean excuses himself from the meeting to call his stockbroker demanding that he sells all his shares immediately. Mr. Sean owned 5000 shares in Avengers Ltd, Mary a secretary at the company overheard the conversation Mr. Sean had with stockbroker and decided to sell her shares as well. The next morning as news of the Mr. Johnson's charges is known to the public, stock prices instantly drop. Mr. Sean feels relieved that he was able to prevent any losses to himself. The Security Exchange Commission would like to investigate the sale of shares by Mr. Sean and Mary. Please advise Mr. Sean and Mary

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock