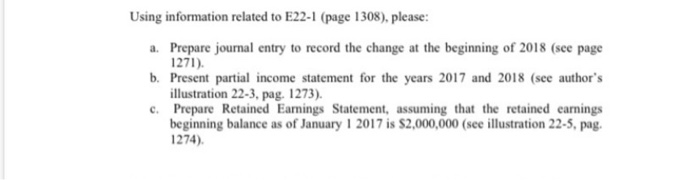

Question: Using information related to E22-1 (page 1308), please: a. Prepare journal entry to record the change at the beginning of 2018 (see page 1271) b.

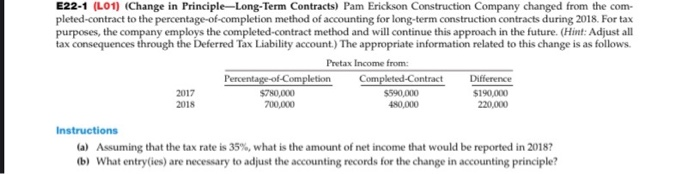

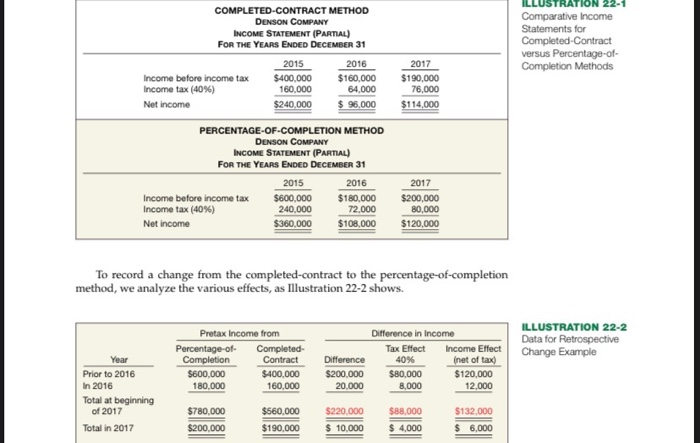

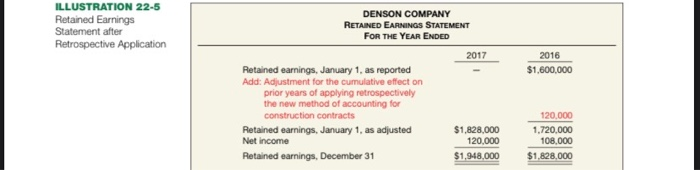

Using information related to E22-1 (page 1308), please: a. Prepare journal entry to record the change at the beginning of 2018 (see page 1271) b. Present partial income statement for the years 2017 and 2018 (see author's illustration 22-3, pag. 1273). c. Prepare Retained Earnings Statement, assuming that the retained earnings beginning balance as of January 1 2017 is $2,000,000 (see illustration 22-5. pag. 1274) E22-1 (L01) (Change in Principle-Long-Term Contracts) Pam Erickson Construction Company changed from the com- pleted-contract to the percentage-of-completion method of accounting for long-term construction contracts during 2018. For tax purposes, the company employs the completed-contract method and will continue this approach in the future. (Hint: Adjust all tax consequences through the Deferred Tax Liability account.) The appropriate information related to this change is as follows. Pretax Income from: Percentage-of-Completion Completed-Contract Difference 2017 $780,000 $590,000 $190,000 2018 700,000 480,000 220,000 Instructions (a) Assuming that the tax rate is 35%, what is the amount of net income that would be reported in 2018? (b) What entry (ies) are necessary to adjust the accounting records for the change in accounting principle? COMPLETED-CONTRACT METHOD DENSON COMPANY INCOME STATEMENT (PARTIAL) FOR THE YEARS ENDED DECEMBER 31 ILLUSTRATION 22-1 Comparative Income Statements for Completed-Contract versus Percentage-of- Completion Methods 2017 $190,000 Income before income tax Income tax (40%) Net income 2015 $400,000 160,000 $240.000 2016 $160.000 64.000 $ 96.000 76,000 $114,000 PERCENTAGE-OF-COMPLETION METHOD DENSON COMPANY INCOME STATEMENT (PARTIAL) FOR THE YEARS ENDED DECEMBER 31 Income before income tax Income tax (40%) Net income 2015 $600,000 240,000 $360,000 2016 $180,000 72.000 $100.000 2017 $200,000 80,000 $120.000 To record a change from the completed-contract to the percentage-of-completion method, we analyze the various effects, as Illustration 22-2 shows. ILLUSTRATION 22-2 Data for Retrospective Change Example Pretax income from Percentage-of- Completed- Completion Contract $600,000 $400,000 180.000 160,000 Difference $200,000 20.000 Difference in Income Tax Effect Income Effect 40% (net of tax) $80,000 $120,000 8.000 12.000 Prior to 2016 In 2016 Total at beginning of 2017 Total in 2017 $780.000 S88.000 $132.000 $560,000 $190,000 $220,000 $ 10,000 $200,000 $ 4,000 $ 6.000 DENSON COMPANY INCOME STATEMENT (PARTIAL) FOR THE YEAR ENDED ILLUSTRATION 22-3 Comparative Information Related to Accounting Change (Percentage-of- Completion) 2017 Income before income tax Income tax (40%) Net income $200,000 80,000 $120,000 2016 As Adjusted (Note A $180,000 72,000 $108.000 ILLUSTRATION 22-5 Retained Earnings Statement after Retrospective Application DENSON COMPANY RETAINED EARNINGS STATEMENT FOR THE YEAR ENDED 2017 2016 $1,600,000 Retained earnings, January 1, as reported Add: Adjustment for the cumulative effect on prior years of applying retrospectively the new method of accounting for construction contracts Retained earnings, January 1, as adjusted Net Income Retained earnings. December 31 $1.828.000 120,000 $1,948,000 120,000 1.720,000 108.000 $1,828,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts