Question: Using Insight Box 12-1, discuss consumer tips for getting the most from you auto insurance dollars. You may also want to refer to the Lesson

Using Insight Box 12-1, discuss consumer tips for getting the most from you auto insurance dollars. You may also want to refer to the Lesson 12 - Automobile Insurance Q & A Handout with additional information.

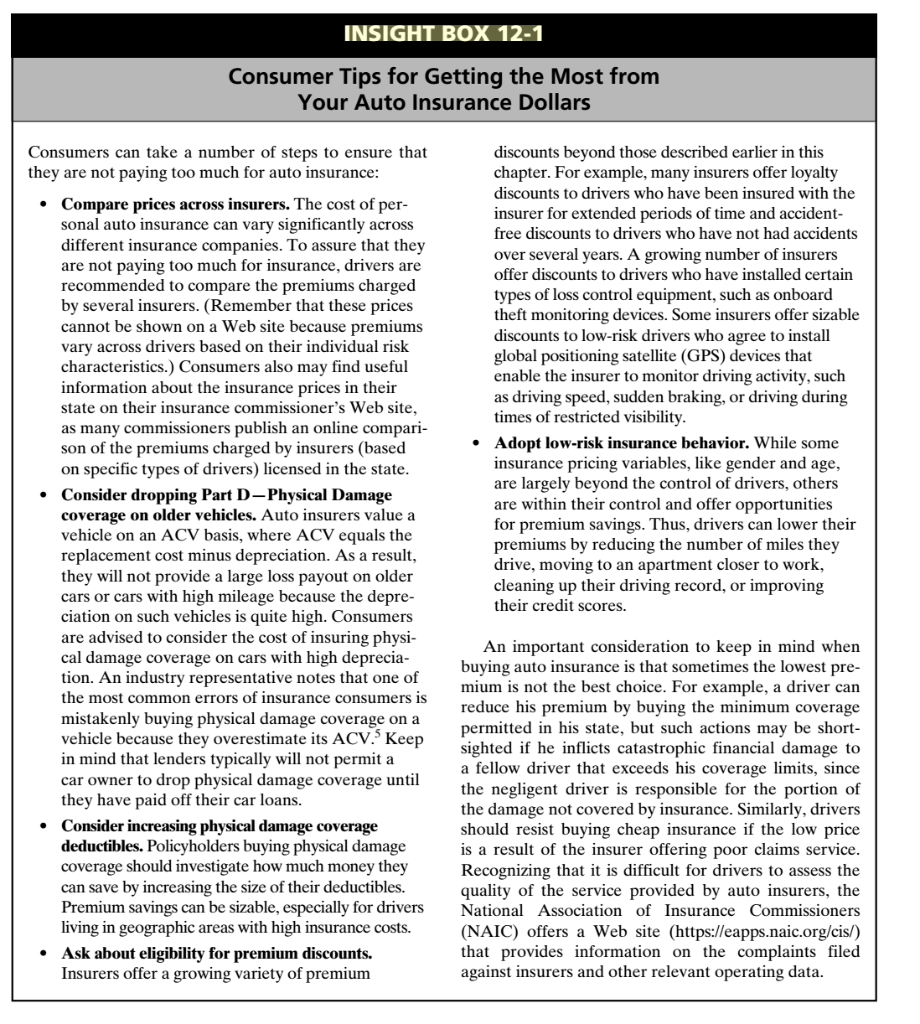

INSIGHT BOX 12-1 Consumer Tips for Getting the Most from Your Auto Insurance Dollars Consumers can take a number of steps to ensure that they are not paying too much for auto insurance: Compare prices across insurers. The cost of per- sonal auto insurance can vary significantly across different insurance companies. To assure that they are not paying too much for insurance, drivers are recommended to compare the premiums charged by several insurers. (Remember that these prices cannot be shown on a Web site because premiums vary across drivers based on their individual risk characteristics.) Consumers also may find useful information about the insurance prices in their state on their insurance commissioner's Web site, as many commissioners publish an online compari- son of the premiums charged by insurers (based on specific types of drivers) licensed in the state. Consider dropping Part D-Physical Damage coverage on older vehicles. Auto insurers value a vehicle on an ACV basis, where ACV equals the replacement cost minus depreciation. As a result, they will not provide a large loss payout on older cars or cars with high mileage because the depre- ciation on such vehicles is quite high. Consumers are advised to consider the cost of insuring physi- cal damage coverage on cars with high deprecia- tion. An industry representative notes that one of the most common errors of insurance consumers is mistakenly buying physical damage coverage on a vehicle because they overestimate its ACV. Keep in mind that lenders typically will not permit a car owner to drop physical damage coverage until they have paid off their car loans. Consider increasing physical damage coverage deductibles. Policyholders buying physical damage coverage should investigate how much money they can save by increasing the size of their deductibles. Premium savings can be sizable, especially for drivers living in geographic areas with high insurance costs. Ask about eligibility for premium discounts. Insurers offer a growing variety of premium discounts beyond those described earlier in this chapter. For example, many insurers offer loyalty discounts to drivers who have been insured with the insurer for extended periods of time and accident- free discounts to drivers who have not had accidents over several years. A growing number of insurers offer discounts to drivers who have installed certain types of loss control equipment, such as onboard theft monitoring devices. Some insurers offer sizable discounts to low-risk drivers who agree to install global positioning satellite (GPS) devices that enable the insurer to monitor driving activity, such as driving speed, sudden braking, or driving during times of restricted visibility. Adopt low-risk insurance behavior. While some insurance pricing variables, like gender and age, are largely beyond the control of drivers, others are within their control and offer opportunities for premium savings. Thus, drivers can lower their premiums by reducing the number of miles they drive, moving to an apartment closer to work, cleaning up their driving record, or improving their credit scores. An important consideration to keep in mind when buying auto insurance is that sometimes the lowest pre- mium is not the best choice. For example, a driver can reduce his premium by buying the minimum coverage permitted in his state, but such actions may be short- sighted if he inflicts catastrophic financial damage to a fellow driver that exceeds his coverage limits, since the negligent driver is responsible for the portion of the damage not covered by insurance. Similarly, drivers should resist buying cheap insurance if the low price is a result of the insurer offering poor claims service. Recognizing that it is difficult for drivers to assess the quality of the service provided by auto insurers, the National Association of Insurance Commissioners (NAIC) offers a Web site (https://eapps.naic.org/cis/) that provides information on the complaints filed against insurers and other relevant operating dataStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts