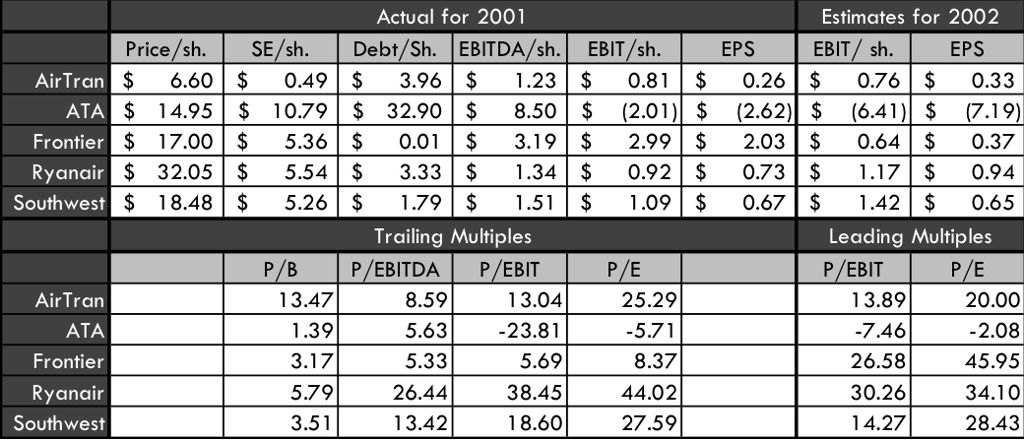

Question: Using only the information provided in the table, you decide to value JetBlues IPO using either a P/EBIT or P/E multiple. Based on this decision,

Using only the information provided in the table, you decide to value JetBlues IPO using either a P/EBIT or P/E multiple. Based on this decision, which comparable company would you be most likely excludefrom your analysis?

A. AirTran, because it is valued at a discount to Frontier, Ryanair, and Southwest on a leading multiple basis

B. ATA, because it would produce an irrational share price for JetBlue

C. Frontier, because it is an airline major, not a low cost provider

D. Rynair, because it is bigger and more established than JetBlue

E.Southwest, because it is a low cost provider, not an airline major

Actual for 2001 Estimates for 2002 EBIT/sh.EPS $0.76 $ 0.33 Price/sh. SE/sh.Debt/Sh. EBITDA/sh. EBIT/sh. EPS 6.60 0.49 $3.96 $ 1.23 $ 6.60$ AirTran Frontier Ryanair Southwest S 14.95 $ 10.79 $ 32.90 $ 8.50 2.01) $ (2.62) $ (6.4 .19) $ 17.005.360.0$ 3.19$ 2.9 2.03 0.64 0.37 $ 32.05 5.543.33$ 1.34$ 0.92$ 0.73$ 1.170.94 $ 18.48 | $ 5.26 | $ 1.79 | $ 1.51|$ 1,09 | $ 0.67 | $ 1.42 |$ o.65 Trailing Multiples P/B P/EBITDA P/EBIT Leading Multiples P EBIT PIE PIE 8.591 AirTran ATA Frontier Ryanair Southwest 13.47 13.0425.29 3.8920.00 2.08 45.95 30.2634.10 28.43 1.395-5.71 7.46 26.58 5.63 -23.81 3.17 5.33 5.69 8.37 579 26.44 38.4544.0 3.51 13.4218.6027.59 14.27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts