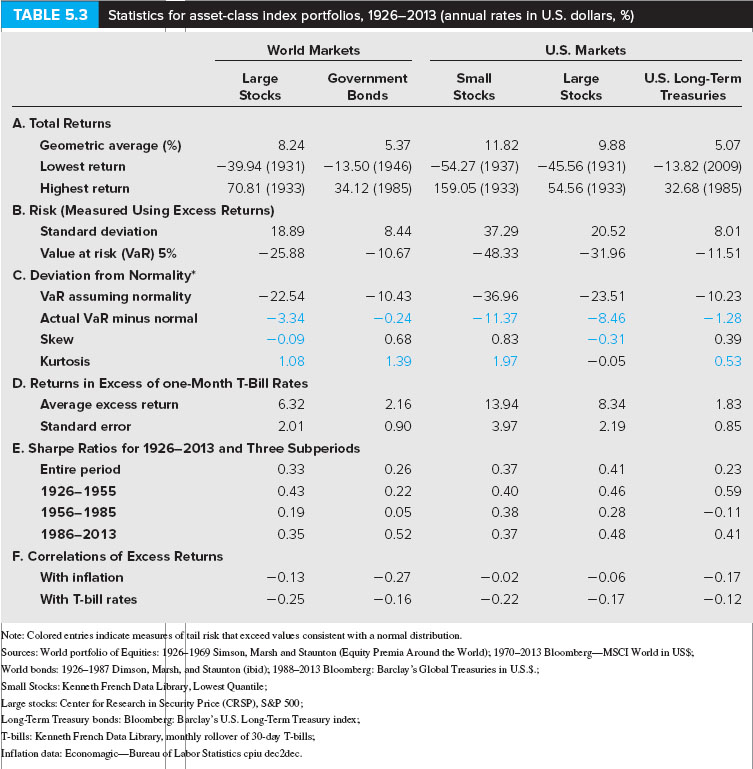

Question: Using Table 5.3 as your guide, what is your estimate of the expected annual HPR on the S&P 500 stock portfolio if the current risk-free

Using Table 5.3 as your guide, what is your estimate of the expected annual HPR on the S&P 500 stock portfolio if the current risk-free interest rate is 5%? (Round your answer to 2 decimal places.) (note that it is 1926-2013)

Expected annual HPR ________ %

TABLE 5.3 Statistics for asset-class index portfolios, 1926-2013 (annual rates in U.S. dollars, World Markets U.S. Markets Small U.S. Long-Term Large Government Large Stocks Bonds Stocks Stocks Treasuries A. Total Returns Geometric average (%0 8.24 Lowest return 39.94 (1931) 13.82 (2009 Highest return 70.81 (1933) B. Risk (Measured Using Excess Returns) Standard deviation 18.89 8.44 37.29 20.52 8.01 Value at risk IVaR) 59% 25.88 10.67 48.33 31.96 11.51 C. Deviation from Normality VaR assuming normality 22.54 10.43 36.96 23.51 10.23 3.34 0.24 Actual VaR minus normal 11.37 8.46 1.28 Skew 0.68 0.83 0.31 0.39 0.09 Kurtosis 1.08 1.39 1.97 0.05 0.53 D. Returns in Excess ofone-Month Bill Rates Average excess return 6.32 2.16 13.94 8.34 1.83 Standard error 2.01 3.97 2.19 0.85 0.90 E. Sharpe Ratios for 1926-2013 and Three Subperiods Entire period 0.33 0.26 0.37 0.41 0.23 1926-1955 0.43 0.22 0.40 0.46 0.59 1956-1985 0.19 0.05 0.38 0.28 0.11 1986-2013 0.35 0.52 0.37 0.48 0.41 F. Correlations of Excess Return With inflation 0.13 0.27 0.02 0.06 0.17 With bill rates 0.25 0.16 0.22 0.17 0.12 Note: Colored entries indicate measures of tail risk that exceed values consistent with a nomal distribution. Sources: World portfolio of Equities: 1926 1969 Simson. Marsh and Staunton Equity Premia Around the World). 1970-2013 Bloomberg MSCI World in US$. World bonds: 1926-1987 Dimson, Marsh, and Staunton (ibid). 1988-2013 Bloomberg: Barclay's Global Treasuries in US mall Stocks: Kenneth French Data Libr Lowest Quantile Large stocks: Center for Research in Security Price (CRSP), S&P 500 Long Term Treasury bonds: Bloombe Barclay's US. Long-Term Treasury index bills: Kenneth French Data Library. monthly rollover of 30-day Tbills. nflation data: Economagic Bureau of Labor Statistics cpiu dec2dec

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts