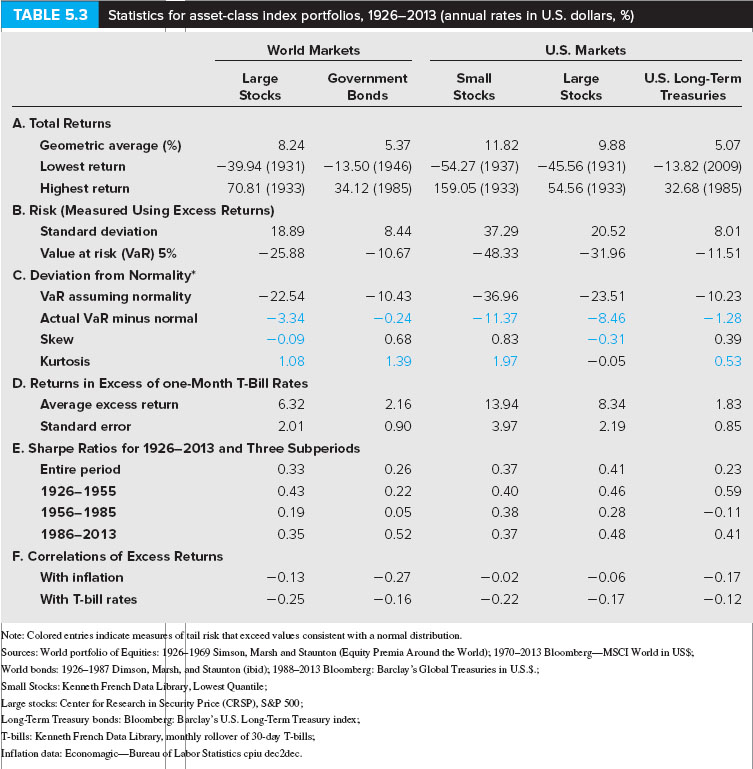

Question: Using Table 5.3 as your guide, what is your estimate of the expected annual HPR on the S&P 500 stock portfolio if the current risk-free

Using Table 5.3 as your guide, what is your estimate of the expected annual HPR on the S&P 500 stock portfolio if the current risk-free interest rate is 5.2%? (Round your answer to 2 decimal places.)

Expected annual HPR %

U.S. Long-Term Treasuries 5.07 -13.82 (2009) 32.68 (1985) 8.01 -11.51 TABLE 5.3 Statistics for asset-class index portfolios, 19262013 (annual rates in U.S. dollars, %) World Markets U.S. Markets Large Government Small Large Stocks Bonds Stocks Stocks A. Total Returns Geometric average (%) 8.24 5.37 11.82 9.88 Lowest return - 39.94 (1931) -13.50 (1946) -54.27 (1937) -45.56 (1931) Highest return 70.81 (1933) 34.12 (1985) 159.05 (1933) 54.56 (1933) B. Risk (Measured Using Excess Returns) Standard deviation 18.89 8.44 37.29 20.52 Value at risk (VaR) 5% -25.88 - 10.67 -48.33 -31.96 C. Deviation from Normality* VaR assuming normality -22.54 - 10.43 - 36.96 -23.51 Actual VaR minus normal -3.34 -0.24 - 11.37 -8.46 Skew -0.09 0.68 0.83 -0.31 Kurtosis 1.08 1.39 1.97 -0.05 D. Returns in Excess of one-Month T-Bill Rates Average excess return 6.32 2.16 13.94 8.34 Standard error 2.01 0.90 3.97 2.19 E. Sharpe Ratios for 19262013 and Three Subperiods Entire period 0.33 0.26 0.37 0.41 1926-1955 0.43 0.22 0.40 0.46 1956-1985 0.19 0.05 0.38 0.28 1986-2013 0.35 0.52 0.37 0.48 F. Correlations of Excess Returns With inflation -0.13 -0.27 -0.02 -0.06 With T-bill rates -0.25 -0.16 -0.22 -0.17 10.23 - 1.28 0.39 0.53 1.83 0.85 0.23 0.59 -0.11 0.41 -0.17 -0.12 Note: Colored entries indicate measures of tail risk that exceed values consistent with a nomal distribution. Sources: World portfolio of Equities: 19261969 Simson, Marsh and Staunton (Equity Premia Around the World): 1970-2013 BloombergMSCI World in US$. World bonds: 19261987 Dimson, Marsh, and Staunton (ibid), 19882013 Bloomberg: Barclay's Global Treasuries in U.S.S. Small Stocks: Kenneth French Data Library, Lowest Quantile; Large stocks: Center for Research in Security Price (CRSP), S&P 500; Long-Term Treasury bonds: Bloomberg: Barclay's U.S. Long-Term Treasury index: T-bills: Kenneth French Data Library. monthly rollover of 30-day T-bills, Inflation data: EconomagicBureau of Labor Statistics cpiu dec2dec

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts