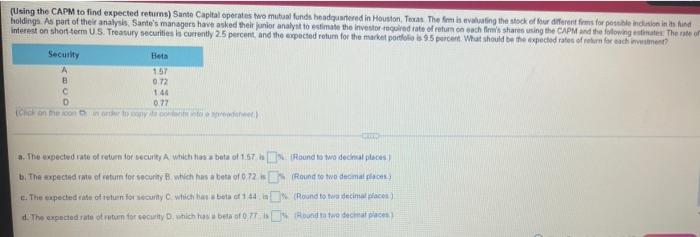

Question: (Using the CAPM to find expected returns) Sante Capital operates a mutual funds headquartered in Houston Texas The fem is evaluating the stock of four

(Using the CAPM to find expected returns) Sante Capital operates a mutual funds headquartered in Houston Texas The fem is evaluating the stock of four diferent firms for possible indusion in to find holdings. As part of their analysis, Sante's managers have asked the nor analyst to estimate the investor required rate of return on each few's shares using the CAPM and the following estimate the rate of Interest on shon term US. Treasury securities is currently 2.5 percent, and the expected return for the market portfolio 95 percent What should be the expected rates of return for each wenn Security Heta 157 072 144 D 077 Con economy a. The expected rate of return for security A which has a bota of 1.67 Round to two decimal places b. The expected rate of watum for securiny B which has a beta of 0 72 E (Round to two decimal plants c. The expected to return for security C, which habets of 144 (Round to two decimal places di The expected rate of return for security which has beta of 0 77. Round no two decal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts