Question: Using the data from Chapter 1 for Large Stocks and Long-term U.S. Government bonds, calculate: 1) The expected return assuming that the past returns represent

Using the data from Chapter 1 for Large Stocks and Long-term U.S. Government bonds, calculate: 1) The expected return assuming that the past returns represent the expected future returns 2) Calculate the standard deviation of each portfolio 3) Calculate the expected return for a portfolio weight 50% in each security 4) Calculate the standard deviation of the portfolio from a combination of the two assets 5) Calculate the minimum variance portfolio for a combination of the two assets 6) Plot the efficient frontier including the minimum variance portfolio

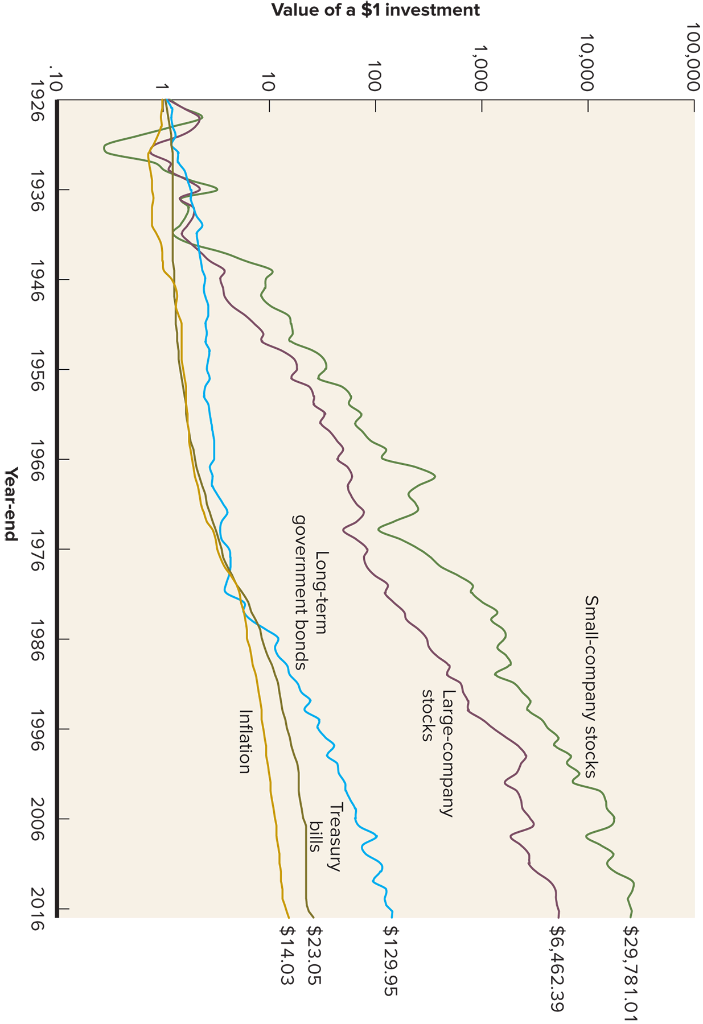

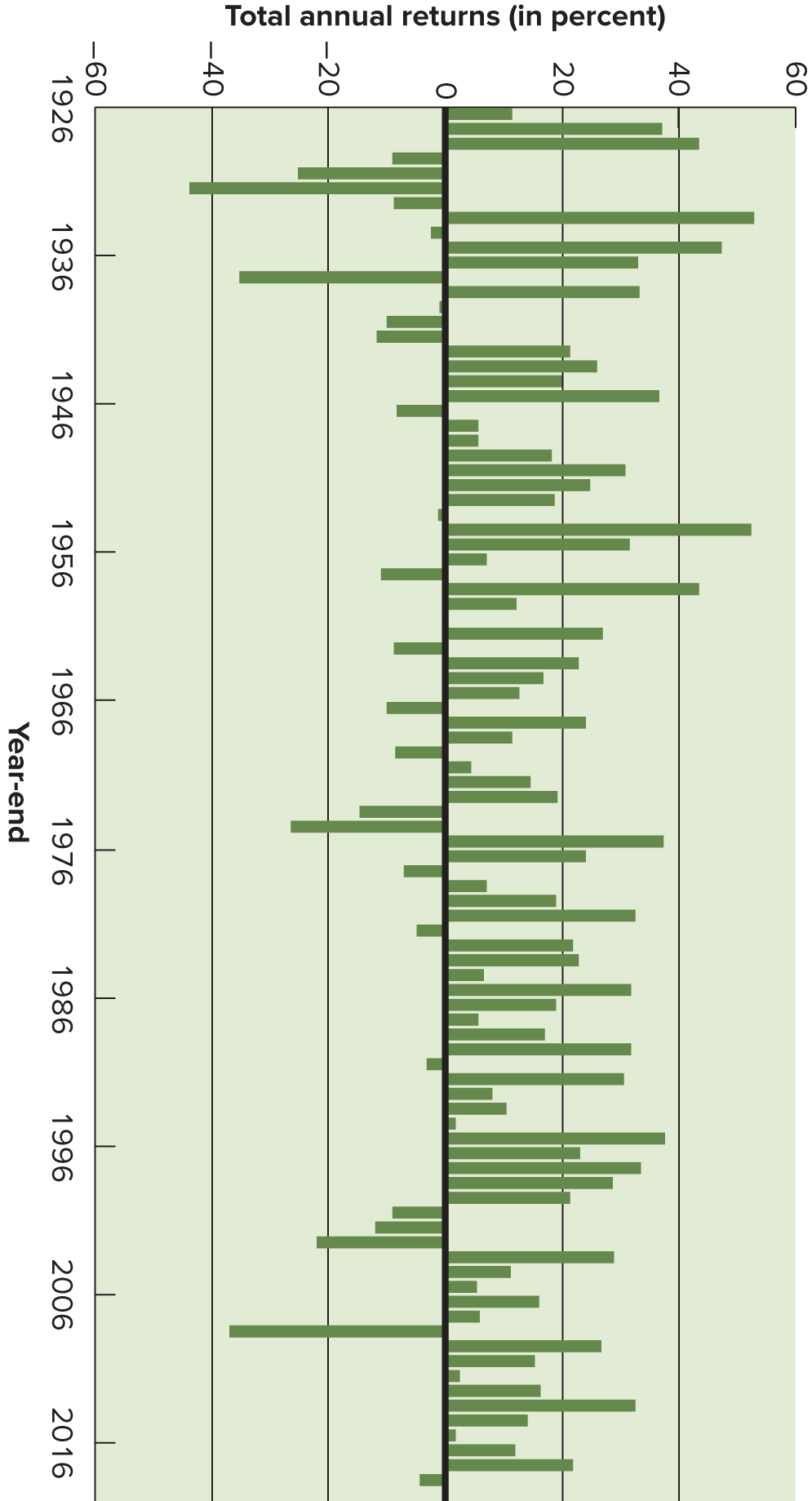

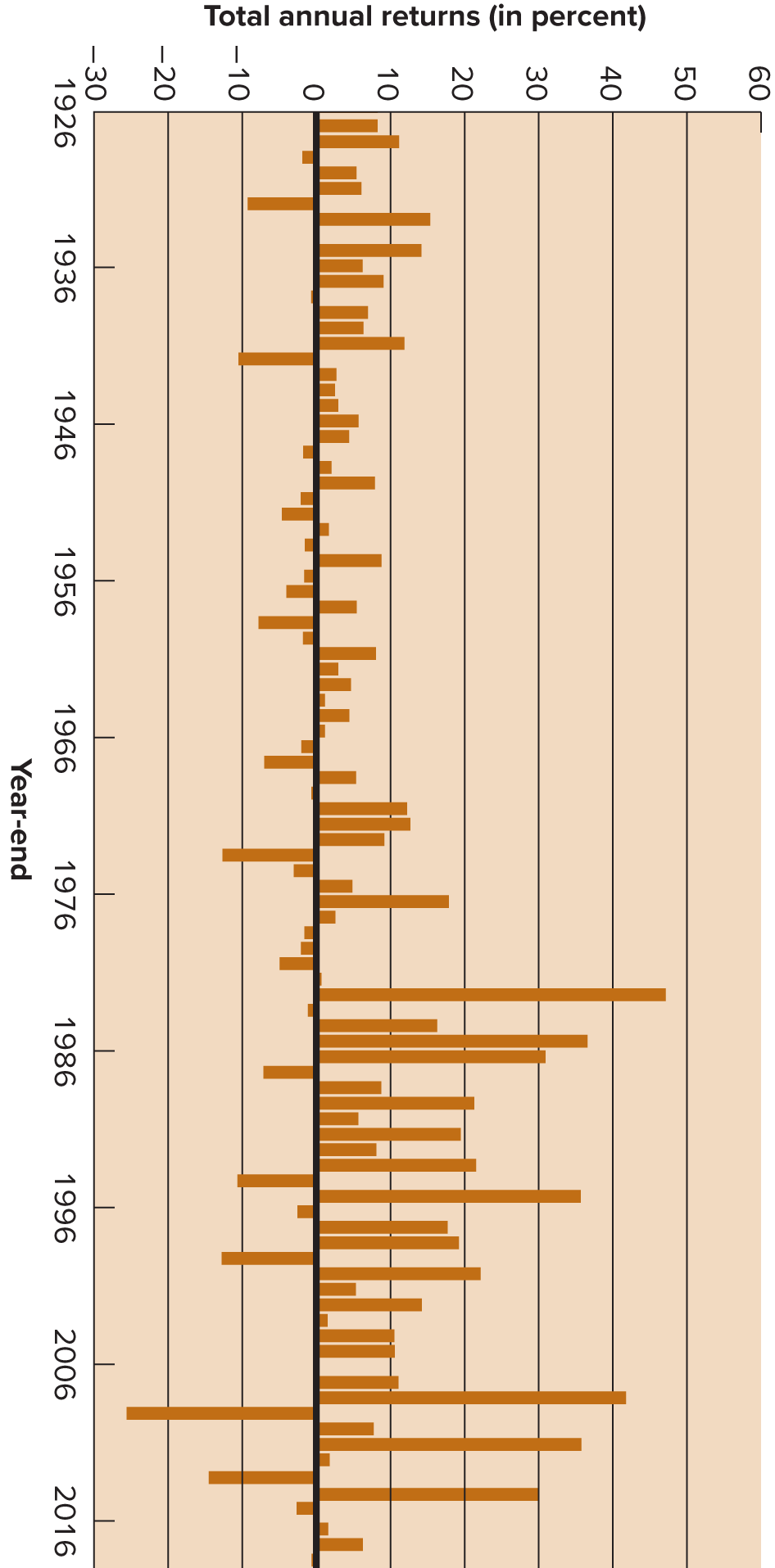

Value of a $1 investment 100,000 10,000- 1,000- 100 10- .10 MAY 1936 1926 1946 1956 1966 Small-company stocks Long-term government bonds 1976 Year-end 1986 Large-company stocks Inflation 1996 Treasury bills 2006 $29,781.01 $6,462.39 $129.95 $23.05 $14.03 2016 Total annual returns (in percent) 60 40 20 -20 -40 -60 1926 1936 1946 1956 th 1966 I k 1976 1986 2006 2016 Year-end 1996 Total annual returns (in percent) 60 50 40 30 20 10 -10 -20 -30 1926 1936 1946 1956 1966 1976 Year-end 1986 1996 2006 2016 Value of a $1 investment 100,000 10,000- 1,000- 100 10- .10 MAY 1936 1926 1946 1956 1966 Small-company stocks Long-term government bonds 1976 Year-end 1986 Large-company stocks Inflation 1996 Treasury bills 2006 $29,781.01 $6,462.39 $129.95 $23.05 $14.03 2016 Total annual returns (in percent) 60 40 20 -20 -40 -60 1926 1936 1946 1956 th 1966 I k 1976 1986 2006 2016 Year-end 1996 Total annual returns (in percent) 60 50 40 30 20 10 -10 -20 -30 1926 1936 1946 1956 1966 1976 Year-end 1986 1996 2006 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts