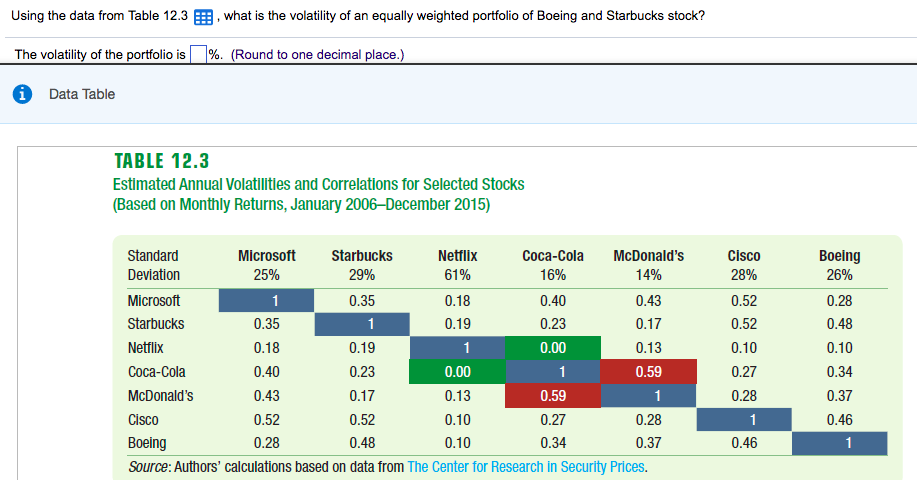

Question: Using the data from Table 12.3, what is the volatility of an equally weighted portfolio of Boeing and Starbucks stock? The volatility of the portfolio

Using the data from Table 12.3, what is the volatility of an equally weighted portfolio of Boeing and Starbucks stock? The volatility of the portfolio is %. (Round to one decimal place.) Data Table TABLE 12.3 Estimated Annual Volatilities and Correlations for Selected Stocks (Based on Monthly Returns, January 2006-December 2015) Standard Deviation Microsoft StarbuckS Netflix Coca-Cola McDonald's Cisco Boeing Source: Authors' calculations based on data from The Center for Research in Security Prices. Cisco 28% 0.52 0.52 0.10 0.27 0.28 Boeing 26% 0.28 0.48 0.10 0.34 0.37 0.46 Microsoft 25% Netflix 61% Coca-Cola McDonald's Starbucks 29% 16% 0.40 0.23 0.00 14% 0.43 0.17 0.13 0.59 0.35 0.35 0.18 0.40 0.43 0.52 0.28 0.19 0.19 0.23 0.17 0.52 0.48 0.00 0.13 0.10 0.10 0.59 0.27 0.34 0.28 0.37 0.46

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts