Question: Using the data in the Chase addendum provided and assuming a 3 year planning period. Calculate the Segment Level CLV you can expect for each

Using the data in the Chase addendum provided and assuming a 3 year planning period.

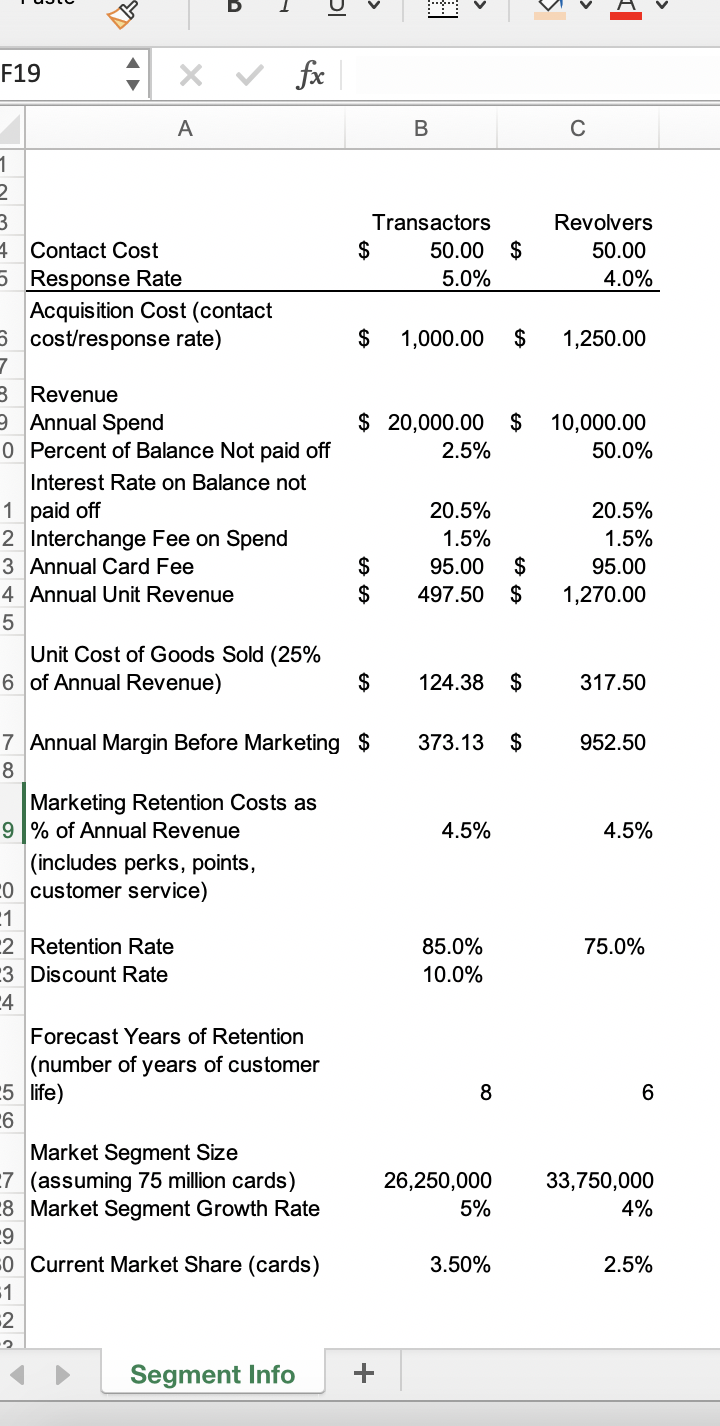

Calculate the Segment Level CLV you can expect for each segment if you keep the investments to acquire and retain customers constant at the same % they are in the current period (Year 1). Assume a 3 year planning period for your calculation.

\"\"\"\"\" 6 D 2 V 'i' V Vi V a A F19 Y fx A B C l 2 3 Transactors Revolvers 4 Contact Cost $ 50.00 $ 50.00 5 Res nse Rate 5.0% 4.0% Acquisition Cost (contact 5 costlresponse rate) $ 1,000.00 $ 1,250.00 7 3 Revenue 3 Annual Spend $ 20,000.00 $ 10,000.00 0 Percent of Balance Not paid off 2.5% 50.0% Interest Rate on Balance not 1 paid off 20.5% 20.5% 2 Interchange Fee on Spend 1.5% 1.5% 3 Annual Card Fee $ 95.00 $ 95.00 4 Annual Unit Revenue $ 497.50 $ 1,270.00 5 Unit Cost of Goods Sold (25% 6 of Annual Revenue) $ 124.38 $ 317.50 7 Annual Margin Before Marketing $ 373.13 $ 952.50 8 Marketing Retention Costs as 9 % of Annual Revenue 4.5% 4.5% (includes perks, points, :0 customer service) {1 E2 Retention Rate 85.0% 75.0% :3 Discount Rate 10.0% {4 Forecast Years of Retention (number of years of customer {5 life) 8 6 I6 Market Segment Size {7 (assuming 75 million cards) 26,250,000 33,750,000 38 Market Segment Growth Rate 5% 4% {9 '0 Current Market Share (cards) 3.50% 2.5% i1 2 I: { D Segment Info +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts