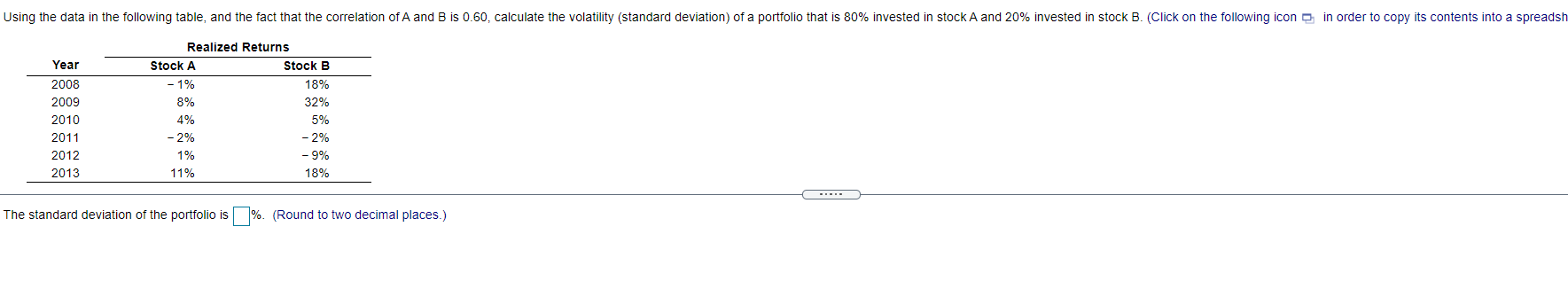

Question: Using the data in the following table, and the fact that the correlation of A and B is 0.60, calculate the volatility (standard deviation) of

Using the data in the following table, and the fact that the correlation of A and B is

0.60,

calculate the volatility (standard deviation) of a portfolio that is

80%

invested in stock A and

20%

invested in stock B. (Click on the following icon

in order to copy its contents into a spreadsheet.)

| Realized Returns | ||||

| Year | Stock A | Stock B | ||

| 2008 | 1% | 18% | ||

| 2009 | 8% | 32% | ||

| 2010 | 4% | 5% | ||

| 2011 | 2% | 2% | ||

| 2012 | 1% | 9% | ||

| 2013 | 11% | 18% | ||

The standard deviation of the portfolio is

enter your response here%.

(Round to two decimal places.)

Using the data in the following table, and the fact that the correlation of A and B is 0.60, calculate the volatility (standard deviation) of a portfolio that is 80% invested in stock A and 20% invested in stock B. (Click on the following icon in order to copy its contents into a spreadsh Year 2008 2009 2010 2011 2012 2013 Realized Returns Stock A Stock B - 1% 18% 8% 32% 4% 5% -2% - 2% 1% -9% 11% 18% The standard deviation of the portfolio is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts