Question: Using the following payoff table, use the Decision Making Under Risk Techniques and the following probabilities to determine which of the following investments the local

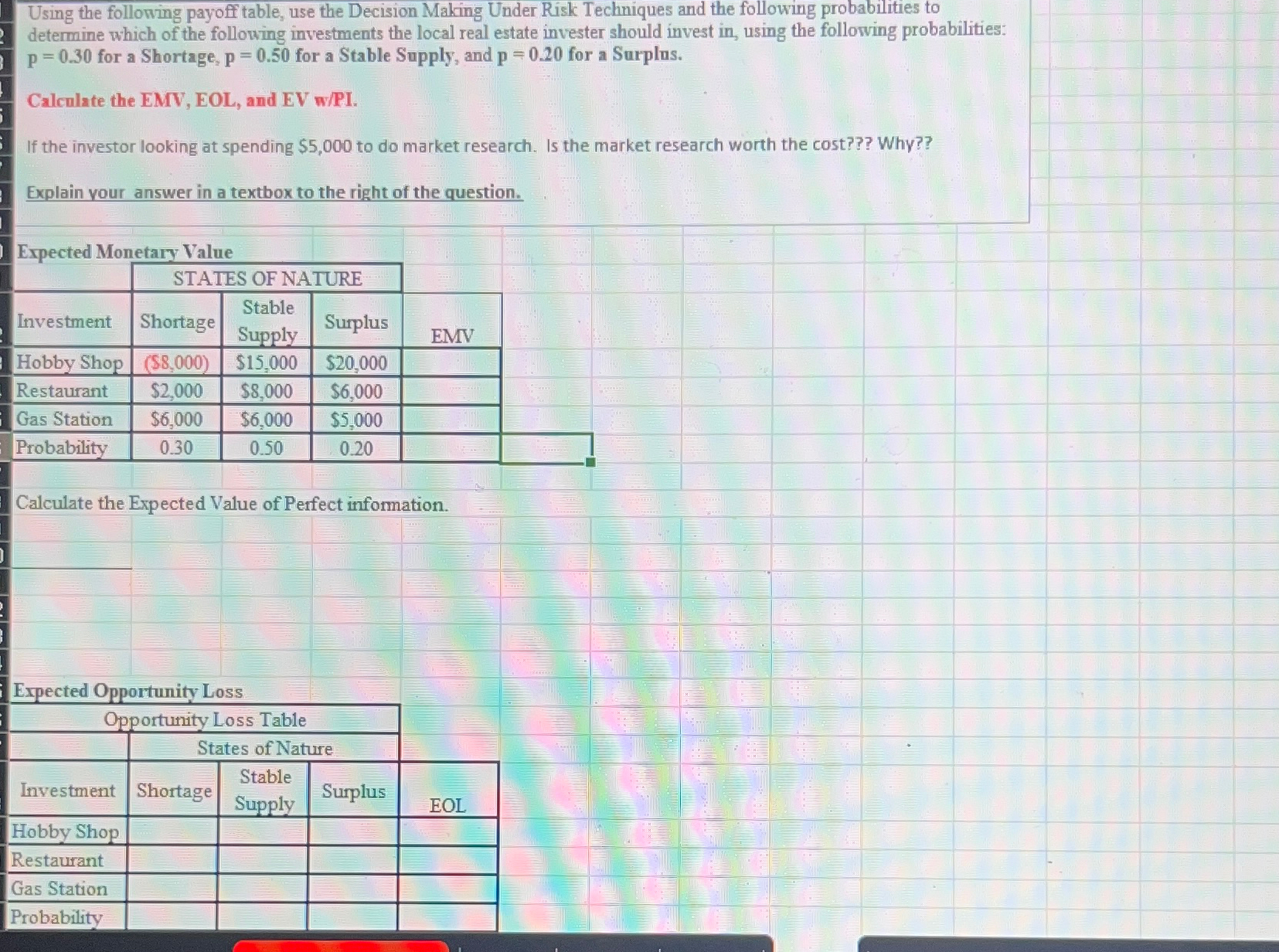

Using the following payoff table, use the Decision Making Under Risk Techniques and the following probabilities to determine which of the following investments the local real estate invester should invest in using the following probabilities: for a Shortage, for a Stable Supply, and for a Surplus.

Calculate the EMV, EOL, and EV wPI

If the investor looking at spending $ to do market research. Is the market research worth the cost??? Why??

Explain vour answer in a textbox to the right of the question.

tableExpected Mon,etary Valu,,,STAI,ES OF NAIURE,InvestmentShortage,tableStableSupplySurplus,EMV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock