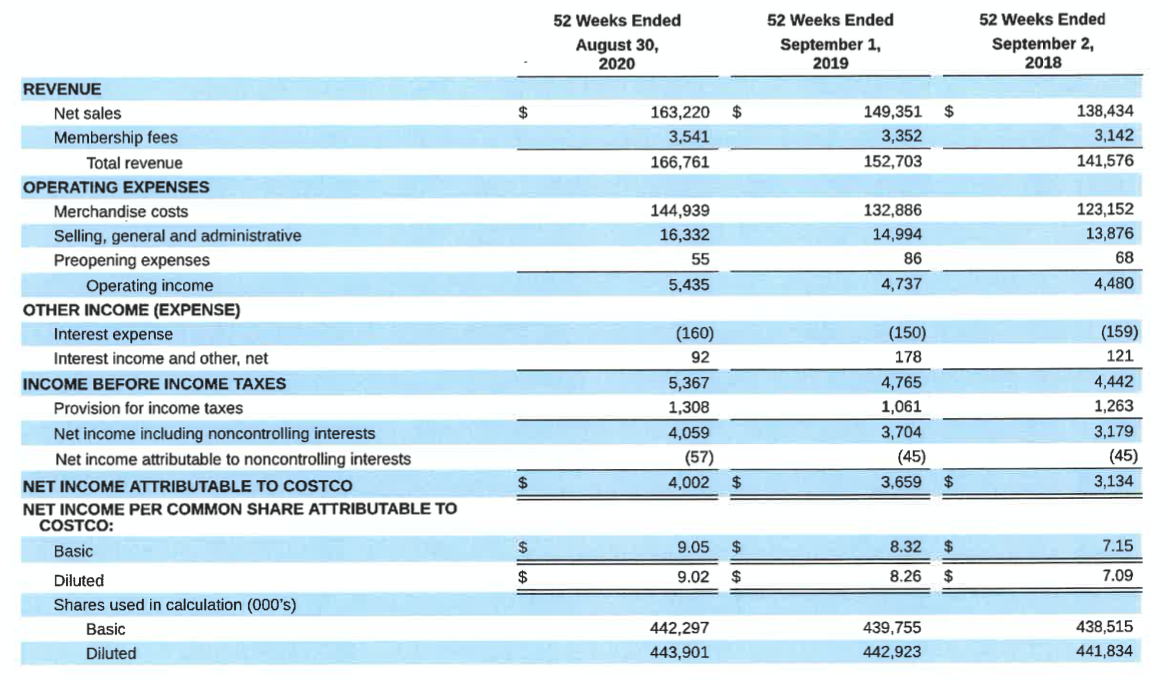

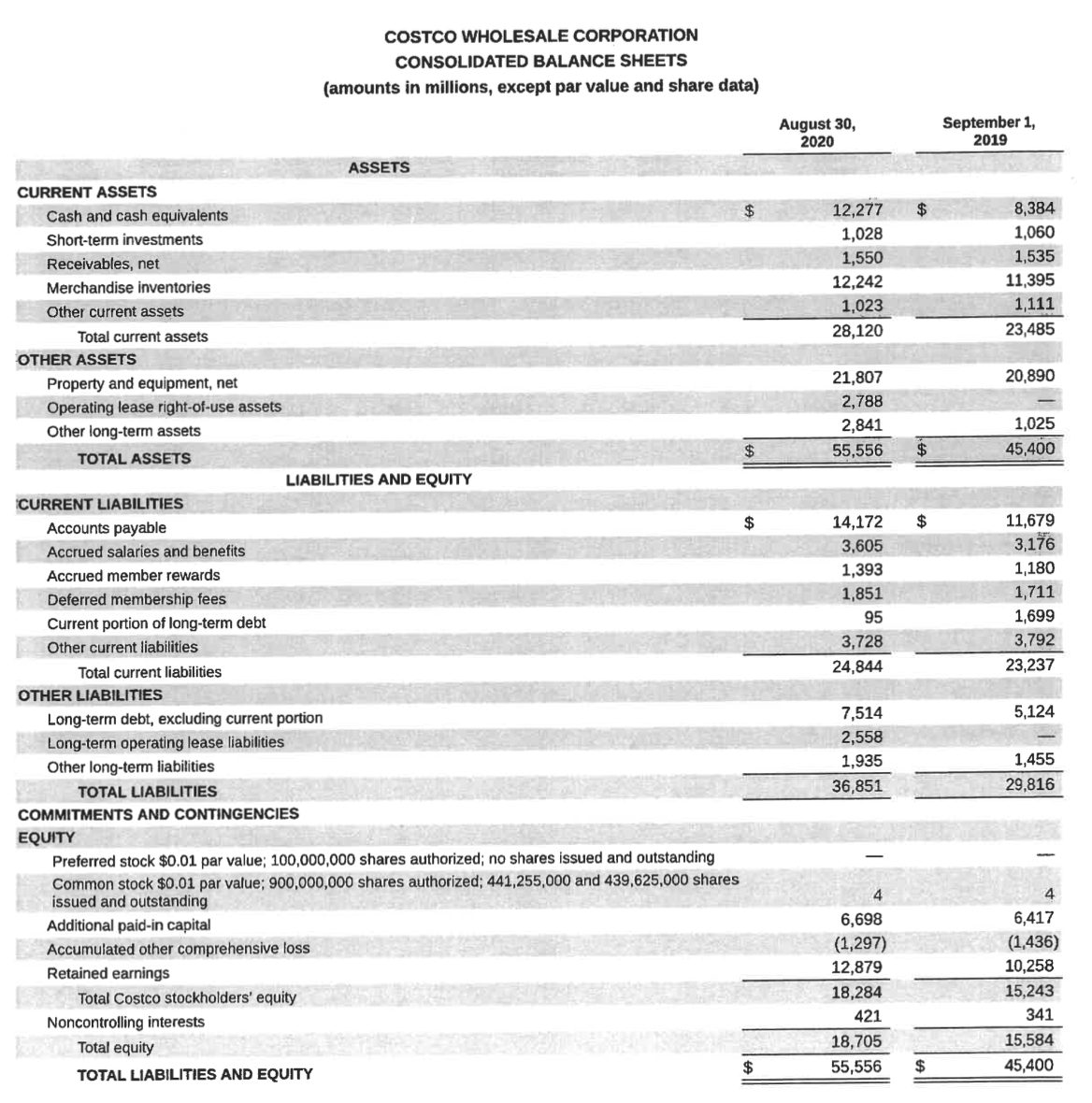

Question: Using the information for Costco, complete the table below (use 4 decimals). Use Net Income including noncontrolling interests and Total equity. 2020___2019__ % Change Net

Using the information for Costco, complete the table below (use 4 decimals). Use Net Income including noncontrolling interests and Total equity.

2020___2019__% Change

Net Profit Margin______________________

Total Asset Turnover______________________

Equity Multiplier______________________

Return on Stockholders' Equity______________________

Use your ratios, and their percentage changes, to explain the change in Costco's ROE over the two-year period.Discuss the impact that each ratio had on the change in the return on stockholders' equity.Which ratio impacted the ROE change the most?You don't need to explain why the ratios changed, only how their changes affected ROE.Did you like what caused the change in ROE? Explain.

52 Weeks Ended August 30, 2020 52 Weeks Ended September 1, 2019 52 Weeks Ended September 2, 2018 REVENUE Net sales Membership fees Total revenue 163,220 $ 149,351 $ 3,541 3,352 166,761 152,703 138,434 3,142 141,576 OPERATING EXPENSES Merchandise costs 144,939 132,886 Selling, general and administrative 16,332 14,994 123,152 13,876 Preopening expenses 55 86 68 Operating income OTHER INCOME (EXPENSE) Interest expense Interest income and other, net INCOME BEFORE INCOME TAXES Provision for income taxes 5,435 4,737 4,480 (160) (150) (159) 92 178 121 5,367 4,765 4,442 1,308 1,061 1,263 Net income including noncontrolling interests 4,059 3,704 3,179 Net income attributable to noncontrolling interests (57) (45) (45) NET INCOME ATTRIBUTABLE TO COSTCO $ 4,002 $ 3,659 $ 3,134 NET INCOME PER COMMON SHARE ATTRIBUTABLE TO COSTCO: Basic $ 9.05 $ 8.32 $ 7.15 Diluted $ 9.02 $ 8.26 $ 7.09 Shares used in calculation (000's) Basic Diluted 442,297 443,901 439,755 442,923 438,515 441,834

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts