Question: Using the notation: overstated (+), understated (-) or no effect (0), and the amount involved to indicate the effects of the following transactions on

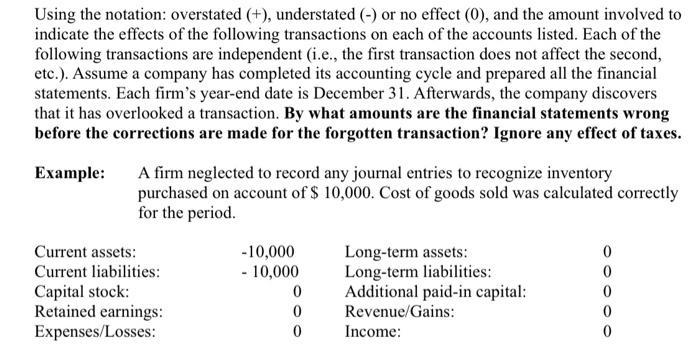

Using the notation: overstated (+), understated (-) or no effect (0), and the amount involved to indicate the effects of the following transactions on each of the accounts listed. Each of the following transactions are independent (i.e., the first transaction does not affect the second, etc.). Assume a company has completed its accounting cycle and prepared all the financial statements. Each firm's year-end date is December 31. Afterwards, the company discovers that it has overlooked a transaction. By what amounts are the financial statements wrong before the corrections are made for the forgotten transaction? Ignore any effect of taxes. Example: A firm neglected to record any journal entries to recognize inventory purchased on account of $ 10,000. Cost of goods sold was calculated correctly for the period. Current assets: Current liabilities: Capital stock: Retained earnings: Expenses/Losses: -10,000 - 10,000 0 0 0 Long-term assets: Long-term liabilities: Additional paid-in capital: Revenue/Gains: Income: 00000

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

SOLUTION 36 Assuming that stress governs 167 Td ... View full answer

Get step-by-step solutions from verified subject matter experts