Question: Using the table created in the previous problem above, plot the opportunity set of risky assets in Excel. Then vary the correlation between stocks and

Using the table created in the previous problem above, plot the opportunity set of risky assets in Excel.

Then vary the correlation between stocks and bonds from + 1 to -1 and describe the changes in shape of the efficient frontier as you do so.

Upload the Excel file that contains the table & graph.

Make sure to include in the Excel file submission, a description of the efficient frontier's shape as you vary the correlation.

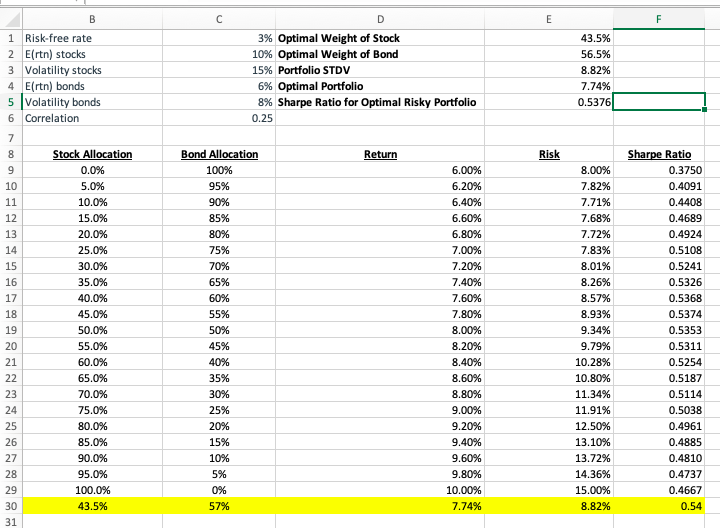

B D E F 1 Risk-free rate 43.5% 3% Optimal Weight of Stock 10% Optimal Weight of Bond 56.5% 15% Portfolio STDV 8.82% 2 Ertn) stocks 3 Volatility stocks 4 Ertn) bonds 5 Volatility bonds 6 Correlation 7.74% 6% Optimal Portfolio 8% Sharpe Ratio for Optimal Risky Portfolio 0.25 0.5376 7 00 Stock Allocation Return Risk Sharpe Ratio Bond Allocation 100% 9 0.0% 6.00% 8.00% 0.3750 10 5.0% 95% 6.20% 7.82% 0.4091 11 10.0% 90% 6.40% 7.71% 0.4408 12 15.0% 85% 6.60% 7.68% 0.4689 13 20.0% 80% 6.80% 7.72% 0.4924 14 25.0% 75% 7.00% 7.83% 0.5108 15 30.0% 70% 7.20% 8.01% 0.5241 16 35.0% 65% 7.40% 8.26% 0.5326 17 40.0% 60% 7.60% 0.5368 8.57% 8.93% 18 45.0% 55% 7.80% 0.5374 19 50.0% 50% 8.00% 9.34% 0.5353 20 55.0% 45% 8.20% 9.79% 0.5311 21 60.0% 40% 8.40% 10.28% 0.5254 22 65.0% 35% 8.60% 10.80% 0.5187 23 70.0% 30% 8.80% 11.34% 0.5114 24 75.0% 25% 9.00% 11.91% 0.5038 25 80.0% 20% 9.20% 12.50% 0.4961 26 85.0% 15% 9.40% 13.10% 0.4885 27 90.0% 10% 9.60% 13.72% 0.4810 28 95.0% 5% 9.80% 14.36% 0.4737 29 100.0% 0% 10.00% 15.00% 0.4667 30 43.5% 57% 7.74% 8.82% 0.54 31 B D E F 1 Risk-free rate 43.5% 3% Optimal Weight of Stock 10% Optimal Weight of Bond 56.5% 15% Portfolio STDV 8.82% 2 Ertn) stocks 3 Volatility stocks 4 Ertn) bonds 5 Volatility bonds 6 Correlation 7.74% 6% Optimal Portfolio 8% Sharpe Ratio for Optimal Risky Portfolio 0.25 0.5376 7 00 Stock Allocation Return Risk Sharpe Ratio Bond Allocation 100% 9 0.0% 6.00% 8.00% 0.3750 10 5.0% 95% 6.20% 7.82% 0.4091 11 10.0% 90% 6.40% 7.71% 0.4408 12 15.0% 85% 6.60% 7.68% 0.4689 13 20.0% 80% 6.80% 7.72% 0.4924 14 25.0% 75% 7.00% 7.83% 0.5108 15 30.0% 70% 7.20% 8.01% 0.5241 16 35.0% 65% 7.40% 8.26% 0.5326 17 40.0% 60% 7.60% 0.5368 8.57% 8.93% 18 45.0% 55% 7.80% 0.5374 19 50.0% 50% 8.00% 9.34% 0.5353 20 55.0% 45% 8.20% 9.79% 0.5311 21 60.0% 40% 8.40% 10.28% 0.5254 22 65.0% 35% 8.60% 10.80% 0.5187 23 70.0% 30% 8.80% 11.34% 0.5114 24 75.0% 25% 9.00% 11.91% 0.5038 25 80.0% 20% 9.20% 12.50% 0.4961 26 85.0% 15% 9.40% 13.10% 0.4885 27 90.0% 10% 9.60% 13.72% 0.4810 28 95.0% 5% 9.80% 14.36% 0.4737 29 100.0% 0% 10.00% 15.00% 0.4667 30 43.5% 57% 7.74% 8.82% 0.54 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts