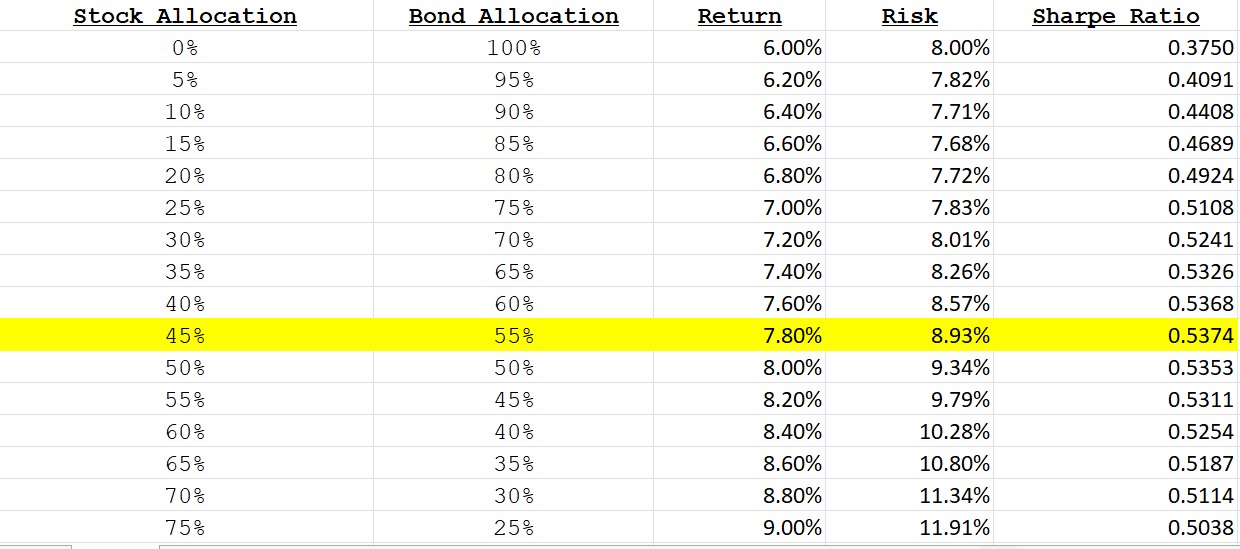

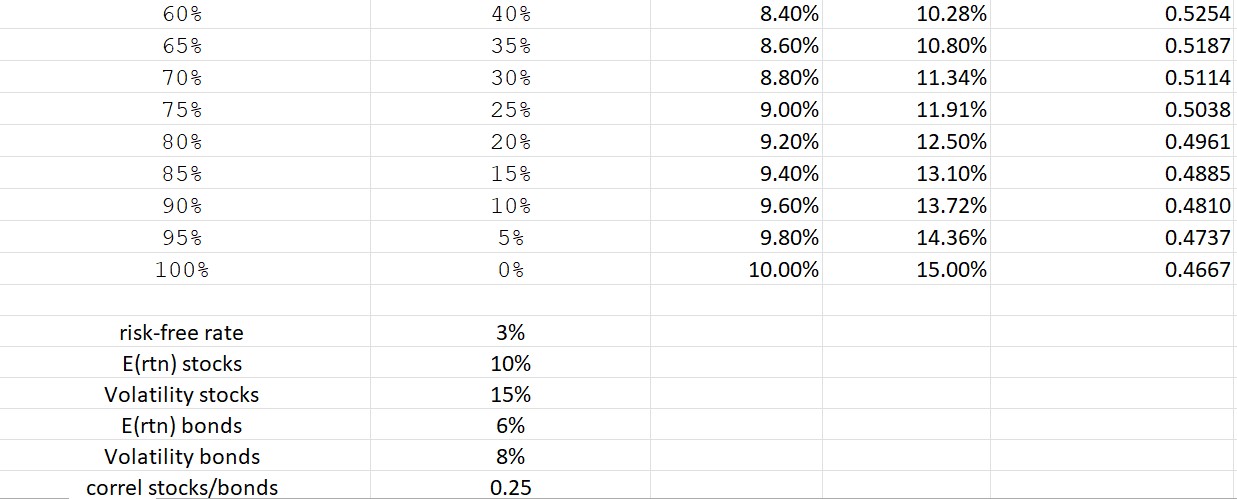

Question: Using the table created in the previous problem above, plot the opportunity set of risky assets in Excel. Then vary the correlation between stocks and

Using the table created in the previous problem above, plot the opportunity set of risky assets in Excel.

Then vary the correlation between stocks and bonds from + 1 to -1 and describe the changes in shape of the efficient frontier as you do so.

Upload the Excel file that contains the table & graph.

Make sure to include in the Excel file submission, a description of theefficient frontier's shape as you vary the correlation.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts