Question: Using the task description and the annual review activity diagram attached below (familiar from Assignment 1) as the key material set, create the business analysis

Using the task description and the annual review activity diagram attached below (familiar from Assignment 1) as the key material set, create the business analysis artifacts listed below for the roles of Customer and MMBI representative in the mortgage loan application process. Assume that MMBI wants as the minimum level to automate the existing business process (essentially get rid of paper-based elements of the process and capture data regarding all key activities of the process). You are also welcome to make modifications to the process and suggest user goal table entries and user stories based on the modified processplease just make sure that you describe how you are planning to change the process. Here are the required artifacts: 1) A table that includes the following elements: a. A person (organizational role) or an external system interacting with the organizational system of interest b. The high-level goal for the persons (see above) or external systems interaction with the system c. The purpose of the persons or the external systems interaction with the system 2) Based on the table in #1, a set of user stories written in the format As , I want to so that 3) High-level wireframes or mock-ups for any two of the user stories specified in #2 above a. For more guidance regarding wireframing, see the Blackboard site (Course Documents > Other Readings > Wireframing) 4) Initial navigation paths between the wireframes, as appropriate. In your responses, carefully consider the effectiveness of the user stories and UI model you create as a mechanism with which you communicate your understanding of the requirements to business professionals and learn more about their perspective on the annual review process.

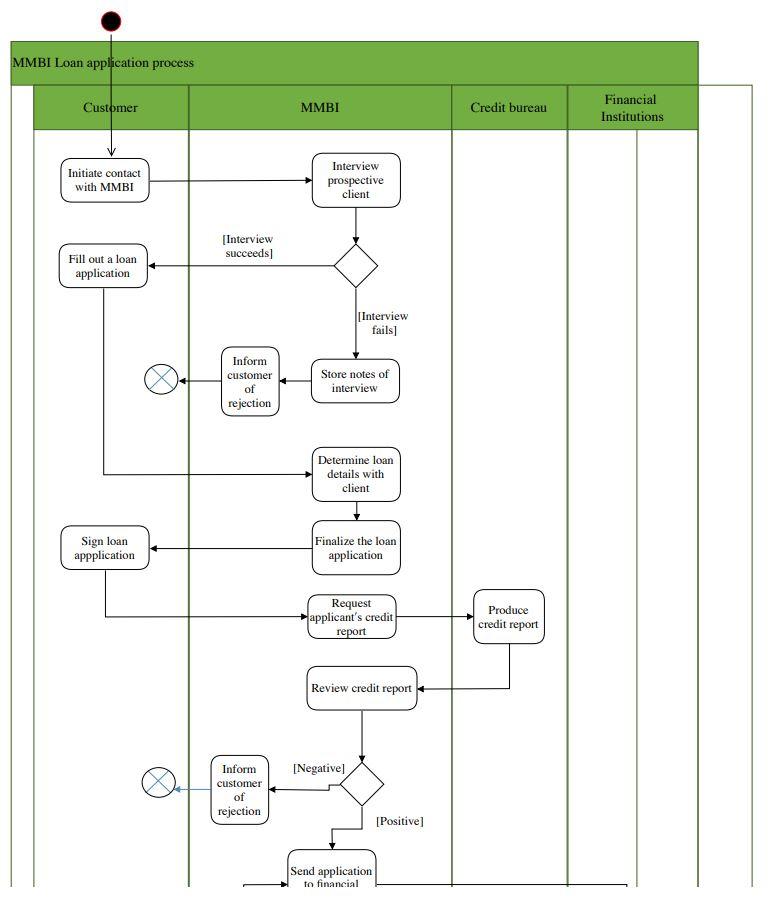

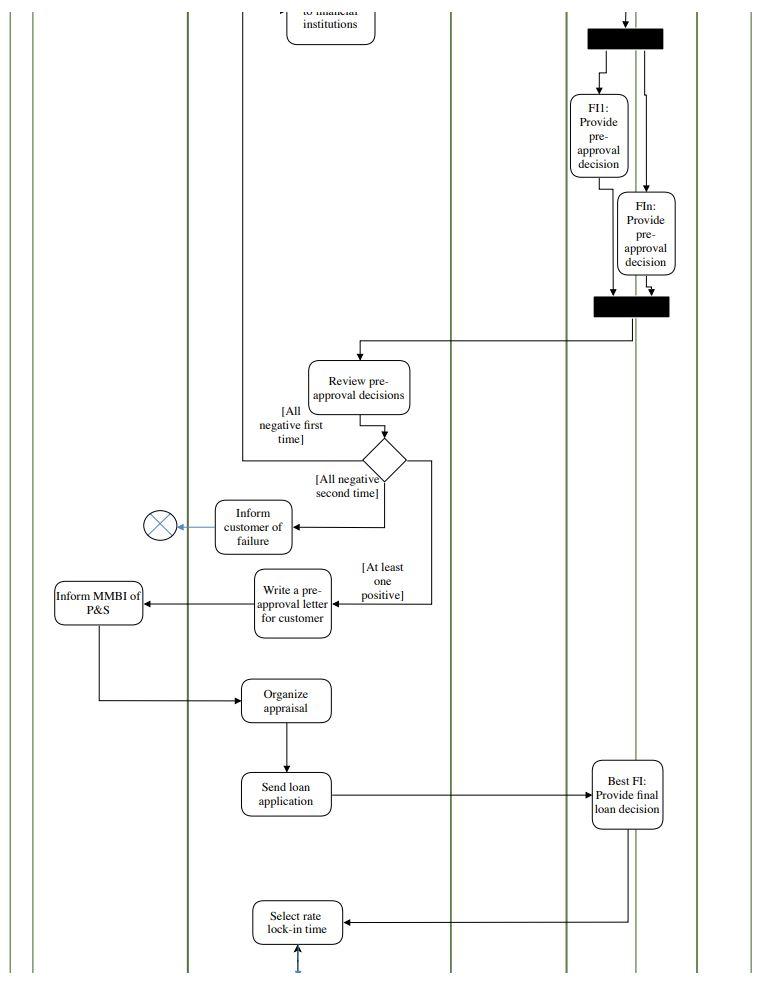

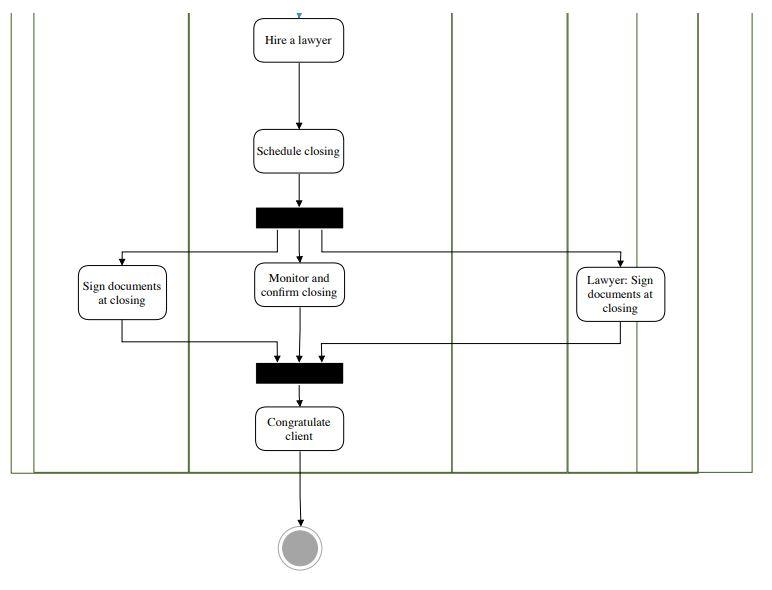

Master Mortgage Broker, Inc. (MMBI) Master Mortgage Broker, Inc. (MMBI) is small mortgage brokerage with a loyal clientele that is expanding mostly based on the recommendations existing customers make to potential new customers. MMBI's main service is to match banks and other mortgage lenders with homebuyers, and it gets its income from commissions paid by lenders. Particularly during time periods when interest rates are going down, MMBI creates a lot of business from refinancing, and therefore, it is essential that MMBI maintains very good records about its customers and all the services that have been provided to them in the past. When individual consumers start to consider buying a house, one of the first tasks for them in the process is to get pre-approved for a loan so that they know how much they can afford and demonstrate to a potential seller that they will be able to complete the purchase. In practice, all prospective clients who use MMBI's services contact MMBI the first time in order to get preapproved. At that time, an MMBI representative meets with the prospective client and interviews them about their financial situation and their home purchase goals. Based on the initial evaluation, the MMBI representative decides whether or not it is feasible for the client to pursue applying for a mortgage through MMBI. If the client is rejected at the initial interview, MMBI still captures the clients contact information and stores notes about the interview. If the answer after the initial interview is positive, the client fills out a loan application for pre-approval. In addition to the contact information, it includes the applicant's employer, current salary, other income (including source), credit card debts and auto and other consumer loans (lender and amount), and the client's liquid assets (amount, type of investment, financial institution). MMBI and the prospective client also agree on the number of discount points and who is responsible for the closing costs. The application data is stored by MMBI and printed out on a standard loan application, which the prospective client electronically. Immediately after the interview, MMBI asks for a credit report for the prospective client. If the result is sufficiently good, the application is sent to two or three financial institutions. After a few days, the financial institutions give their responses, which are stored by MMBI and relayed to the customer. If none of the original responses is positive, MMBI tries another set of financial institutions, and if none of them are positive, either, MMBI interrupts the process and tells the prospective client that MMBI was not able to get a pre-approval for them. If at least one of the answers was positive, MMBI writes a pre-approval certification letter for the client. When the client has found a house that they want to buy, had the house inspected, and signed a purchase and sale agreement with the seller, the client contacts MMBI and tells them to start the actual loan application process. At that time, MMBI orders an independent appraisal for the property and once the property has been appraised with an acceptable value, sends the loan application to the financial institution that is currently offering the best mortgage terms. The financial institution normally responds quickly (because of the pre-approval), and MMBI and the client decide when to lock in to a particular interest rate. Once the interest rate has been locked in, MMBI hires a lawyer whose task is to represent the lender at the closing. The closing is scheduled between the lender's lawyer, the seller, and the buyer (MMBI's client), at which point MMBI's only role is to monitor the work by the lender's lawyer and the lender to make sure that everything is ready for the closing. After the closing, MMBI sends a note of congratulations to the client. As indicated earlier, refinancing is another major source of income for MMBI, but that process is outside the scope of this assignment.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts