Question: Using the tax table in Exhibit 3-5, determine the amount of taxes for the following situations: a. A head of household with taxable income of

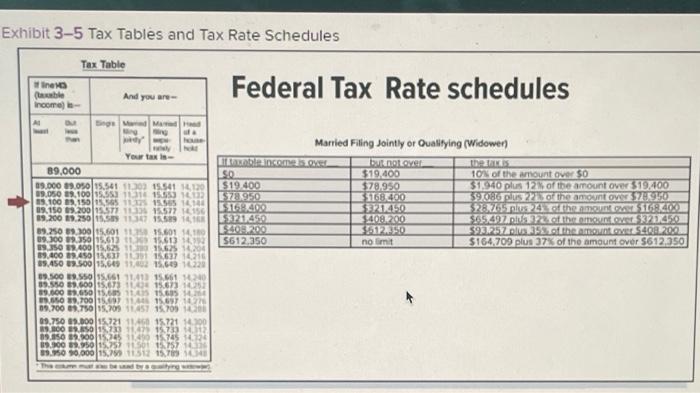

Using the tax table in Exhibit 3-5, determine the amount of taxes for the following situations: a. A head of household with taxable income of $89,525. Tax amount b. A single person with taxable income of $89,001. Tax amount c. A married person filing a separate return with taxable income of $89,365. Tax amount Exhibit 3-5 Tax Tables and Tax Rate Schedules Tax Table ine (table Income Federal Tax Rate schedules And you are AL ng MM Married Filling Jointly or Qualifying (Widowen TO gover 5.0 $19,400 10 of the amount over 50 $19.400 $79.950 $1940 plus 12% of the amount over $19.400 5701950 $168.400 3970s of the amount oveZEKTO IS1409 21450 222524 Chomut SRO S71450 $408.200 365497.pus 12. of the amount over $3321452 184000 39225252famount over $408.2002 5612.350 no limit $164.709 plus 37% of the amount over $612350 w Your taxis- 89,000 09.000 09.050 15.541 103 15.541 1110 19.050 1.1001153 11 15.55310112 ES 100 150 95 115.565 141 19.150 09.2001 ST 11577 156 19.200 19.250 1147 159 16 89.250 9.000 15.601 141 09.300.350.613 15.613 12 0.350.40015625 1015625 16204 39.400 1.43015631 11 15.637 14216 39.450 1.500 15.0 11.2 15.6-19 16220 09.500 9.9.66 11411 15.661 240 89.550 89.000 15.671 115.673 1053 89.000 9.650 5.60 110 15.605 H . 89.700 11415691 09.700 9.750 15,709 11457 15.705 100 09.750 0.0001221 114 1221 14.00 BOOSO 15 733 17 15.733 05.050 8900115245 1140 15745414 19.300 89.950115257 11501 15,757 19.950 90.000 15.7511512 15.790

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts