Question: Utilise Excel pleaseQuestion 5 ( a ) The current market price of a three - month European put option on a non - dividend paying

Utilise Excel pleaseQuestion

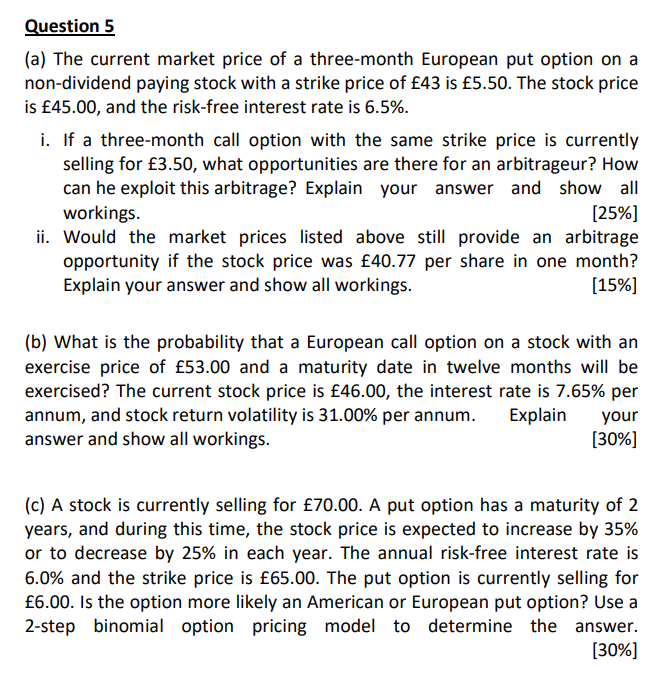

a The current market price of a threemonth European put option on a

nondividend paying stock with a strike price of is The stock price

is and the riskfree interest rate is

i If a threemonth call option with the same strike price is currently

selling for what opportunities are there for an arbitrageur? How

can he exploit this arbitrage? Explain your answer and show all

workings.

ii Would the market prices listed above still provide an arbitrage

opportunity if the stock price was per share in one month?

Explain your answer and show all workings.

b What is the probability that a European call option on a stock with an

exercise price of and a maturity date in twelve months will be

exercised? The current stock price is the interest rate is per

annum, and stock return volatility is per annum. Explain your

answer and show all workings.

c A stock is currently selling for A put option has a maturity of

years, and during this time, the stock price is expected to increase by

or to decrease by in each year. The annual riskfree interest rate is

and the strike price is The put option is currently selling for

Is the option more likely an American or European put option? Use a

step binomial option pricing model to determine the answer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock