Question: v Y A S Merge & Center - $ - % , con Clipboard Font Form Alignment Number P26 : 7 for AT BOLD F

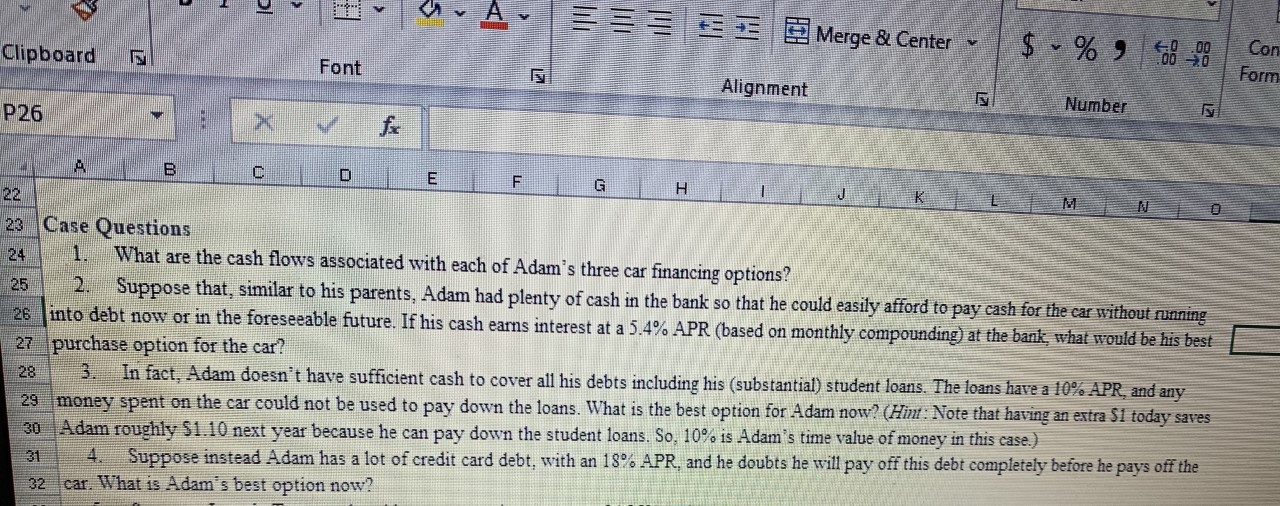

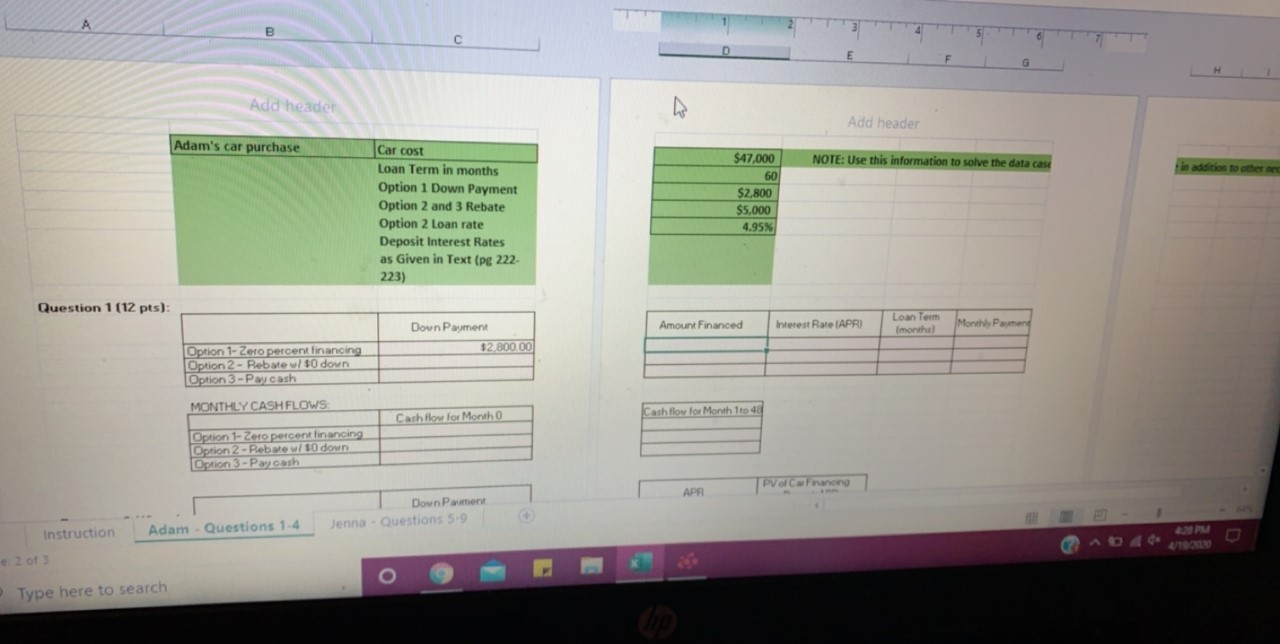

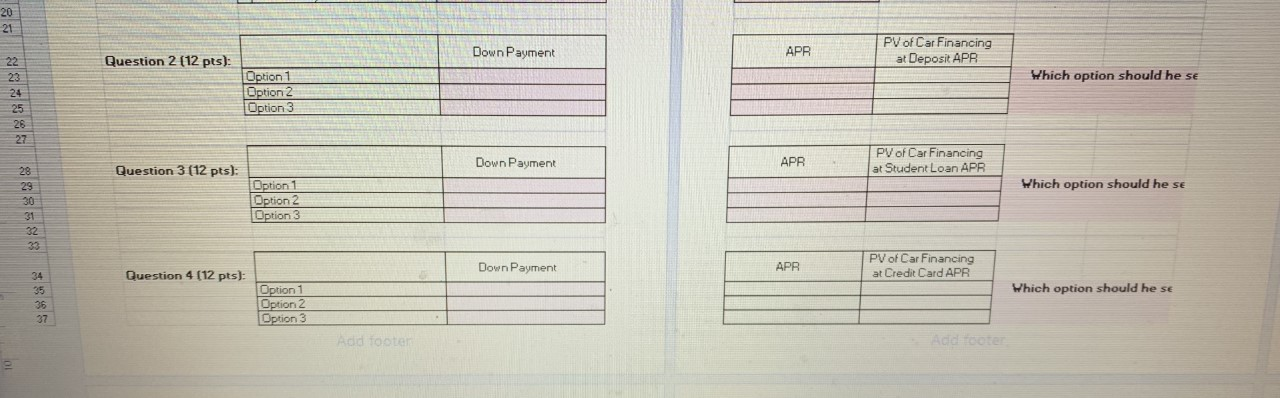

v Y A S Merge & Center - $ - % , con Clipboard Font Form Alignment Number P26 : 7 for AT BOLD F G 22 23 Case Questions 24 1. What are the cash flows associated with each of Adam's three car financing options? 25 2. Suppose that, similar to his parents, Adam had plenty of cash in the bank so that he could easily afford to pay cash for the car without running 26 into debt now or in the foreseeable future. If his cash earns interest at a 5.4% APR (based on monthly compounding) at the bank, what would be his best 27 purchase option for the car? 28 3. In fact, Adam doesn't have sufficient cash to cover all his debts including his (substantial) student loans. The loans have a 10% APR, and any 29 money spent on the car could not be used to pay down the loans. What is the best option for Adam now? (Hint: Note that having an extra Si today saves 30 Adam roughly $1.10 next year because he can pay down the student loans. So, 10% is Adam's time value of money in this case.) 31 4. Suppose instead Adam has a lot of credit card debt, with an 18% APR, and he doubts he will pay off this debt completely before he pays off the 32 car. What is Adam's best option now? Add head Add header Adam's car purchase NOTE: Use this information to solve the data case in addition to other med Car cost Loan Term in months Option 1 Down Payment Option 2 and 3 Rebate Option 2 Loan rate Deposit Interest Rates as Given in Text (Pg 222- 223) $47,000 60 $2,800 $5,000 4.95% Question 1 (12 pts): Amount Financed Interest Rate (APR) Loan Term imonthel Monthly Payment Down Payment 12 800.00) Option 1- Zero percent financing Option 2 - Rebate w/ 80 down Option 3 -Pay cash MONTHLY CASHFLOWS: Cash flow for Month to 48 Cash flow for Month Option 1- Zero percent financing Option 2 - Rebel 10 down Option 3 - Pay cash PV of Conanong APR Down Pawet Jenna - Questions 5.9 instruction Adam - Questions 1-4 Type here to search 28 Down Payment APR Question 2 (12 pts): PV of Car Financing at Deposit APR Which option should he se Option 1 Option 2 Option 3 Down Payment APR PV of Car Financing at Student Loan APR Question 3 (12 pts): Which option should he se Eption Option 2 Option 3 9888 88988 Down Payment APR PV of Car Financing at Credit Card APR Question 4 (12 pts): Which option should he se Option 1 Option 2 Option 3 : Add footer Add tooted v Y A S Merge & Center - $ - % , con Clipboard Font Form Alignment Number P26 : 7 for AT BOLD F G 22 23 Case Questions 24 1. What are the cash flows associated with each of Adam's three car financing options? 25 2. Suppose that, similar to his parents, Adam had plenty of cash in the bank so that he could easily afford to pay cash for the car without running 26 into debt now or in the foreseeable future. If his cash earns interest at a 5.4% APR (based on monthly compounding) at the bank, what would be his best 27 purchase option for the car? 28 3. In fact, Adam doesn't have sufficient cash to cover all his debts including his (substantial) student loans. The loans have a 10% APR, and any 29 money spent on the car could not be used to pay down the loans. What is the best option for Adam now? (Hint: Note that having an extra Si today saves 30 Adam roughly $1.10 next year because he can pay down the student loans. So, 10% is Adam's time value of money in this case.) 31 4. Suppose instead Adam has a lot of credit card debt, with an 18% APR, and he doubts he will pay off this debt completely before he pays off the 32 car. What is Adam's best option now? Add head Add header Adam's car purchase NOTE: Use this information to solve the data case in addition to other med Car cost Loan Term in months Option 1 Down Payment Option 2 and 3 Rebate Option 2 Loan rate Deposit Interest Rates as Given in Text (Pg 222- 223) $47,000 60 $2,800 $5,000 4.95% Question 1 (12 pts): Amount Financed Interest Rate (APR) Loan Term imonthel Monthly Payment Down Payment 12 800.00) Option 1- Zero percent financing Option 2 - Rebate w/ 80 down Option 3 -Pay cash MONTHLY CASHFLOWS: Cash flow for Month to 48 Cash flow for Month Option 1- Zero percent financing Option 2 - Rebel 10 down Option 3 - Pay cash PV of Conanong APR Down Pawet Jenna - Questions 5.9 instruction Adam - Questions 1-4 Type here to search 28 Down Payment APR Question 2 (12 pts): PV of Car Financing at Deposit APR Which option should he se Option 1 Option 2 Option 3 Down Payment APR PV of Car Financing at Student Loan APR Question 3 (12 pts): Which option should he se Eption Option 2 Option 3 9888 88988 Down Payment APR PV of Car Financing at Credit Card APR Question 4 (12 pts): Which option should he se Option 1 Option 2 Option 3 : Add footer Add tooted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts