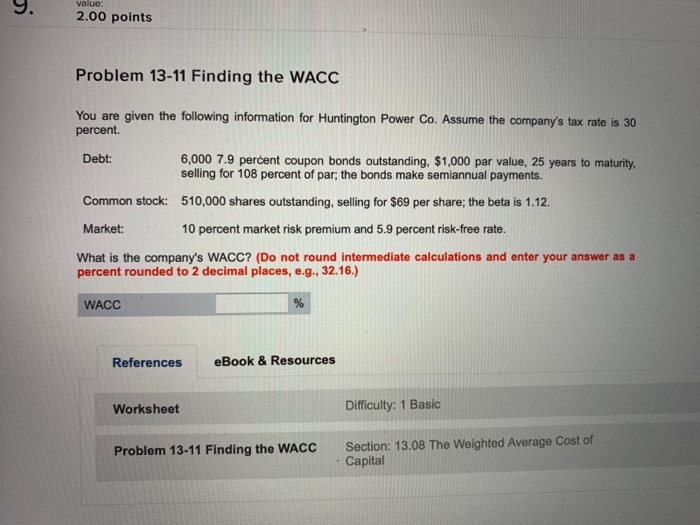

Question: value: 2.00 points Problem 13-11 Finding the WACC You are given the following information for Huntington Power Co. Assume the company's tax rate is 30

value: 2.00 points Problem 13-11 Finding the WACC You are given the following information for Huntington Power Co. Assume the company's tax rate is 30 percent. 6,000 7.9 percent coupon bonds outstanding, $1,000 par value, 25 years to maturity, selling for 108 percent of par; the bonds make semiannual payments Debt: Common stock: 510,000 shares outstanding, selling for $69 per share; the beta is 1.12 Market 10 percent market risk premium and 5.9 percent risk-free rate. What is the company's WACC? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) WACC eBook & Resources References Difficulty: 1 Basic Worksheet Section: 13.08 The Weighted Average Cost of Problem 13-11 Finding the WACC . Capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts