Question: Value the real option using the Black-Scholes model: Your company has the opportunity to invest in a project which will cost $2,900 million. With the

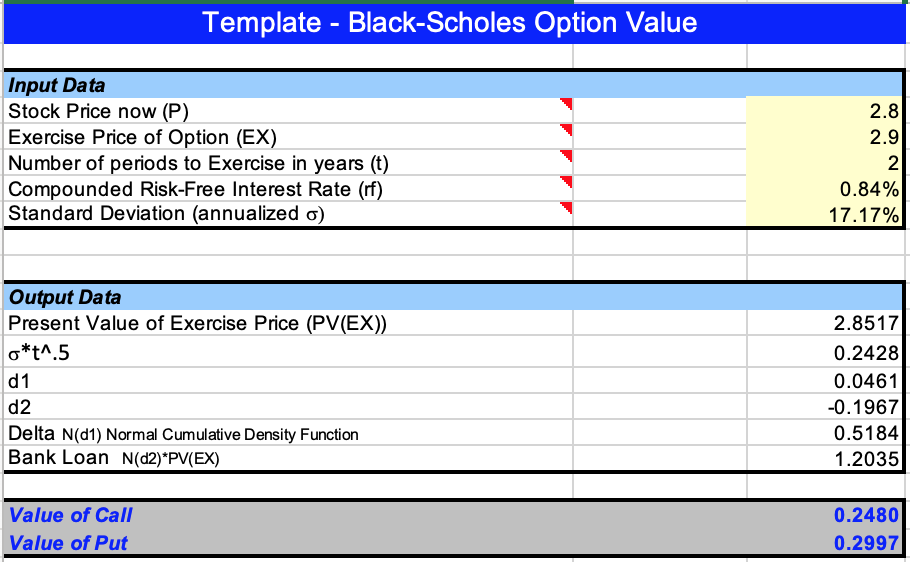

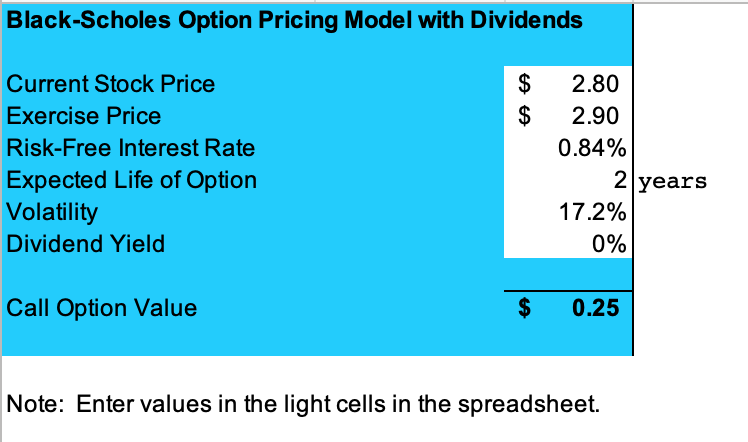

Value the real option using the Black-Scholes model: Your company has the opportunity to invest in a project which will cost $2,900 million. With the current political risk in the global economy, this project currently requires a very high discount rate and has a PV of future cash flows of $2,800 million. This project has a life of 15 years and the company has an opportunity to delay commencement for the next two years, so they can avoid a global recession. The project's cash flows volatility is the same as the volatility of company's returns, and the current risk-free rate is the same as you have applied previously. How much is this project worth without the real option? How much is this option worth?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts